News Stories

Third Altcoin Season Brewing? Dominance Chart Flashes Breakout Signal

This article was first published on Deythere. Altcoin season may be closer…

By

Sui Launches USDsui to Deepen DeFi and Payments

Sui has taken a meaningful step in its effort to build a…

Eric Trump Sparks Stablecoin Yield Debate as Banks Push Back

This article was first published on Deythere. Eric Trump has pushed the…

By

Bitcoin Price Rally Faces $76K Resistance as 43% of Holders Stay in Loss

This article was first published on Deythere. Bitcoin price rally is gaining…

Altcoin Market Bleeds as 38% of Tokens Hit Historic Lows, Bitcoin Dominance Rises

Altcoins currently sit near all-time lows across a sizable segment of the…

Kraken Wins Limited Fed Access to Settle U.S. Dollar Payments

This article was first published on Deythere. Kraken said its Wyoming-chartered bank,…

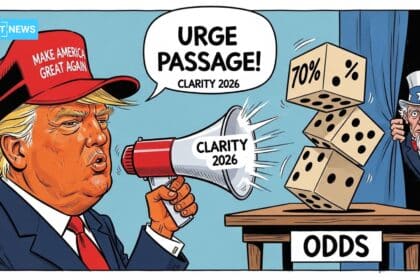

Clarity Act 2026 Odds Jump to 72% After Trump Endorsement

The odds for the Clarity Act 2026 have improved after President Donald…

Binance Targets Five New Asia Licenses Amid APAC Crypto Growth

Binance Asia licenses are becoming a focal point in the global crypto…

By

Altcoin Stress Hits Extreme Levels as 38% Near Record Lows

This article was first published on Deythere. In the parts of crypto that…

Bitcoin Stability Contrasts With Ether and Solana Declines Amid Mideast Stress

This article was first published on Deythere. Crypto market began the week on…