In a surprise move, Binance US has sparked a significant rise in XRP, after launching a sudden promotion for the token. This development comes at a time when Ripple, the company behind XRP, has just secured a major legal victory against the U.S. Securities and Exchange Commission (SEC). The promotion, coupled with this legal triumph, has generated renewed interest in XRP, leading to increased trading activity and a surge in bullish sentiment within the market.

Binance US Highlights XRP’s Strengths

Binance US, the American branch of the global cryptocurrency exchange Binance, recently launched a promotion that focuses on XRP. The promotion provides a spotlight on some key details about the token, which have helped boost confidence among investors. According to Binance US, XRP was founded in 2012 by David Schwartz, Jed McCaleb, and Arthur Britto. The token operates on the XRP Ledger (XRPL), a decentralized blockchain powered by the XRP Ledger Consensus Protocol, which validates transactions without the need for a central authority. Additionally, Binance US highlighted the impressive scalability of the XRPL network, noting that it can process up to 1,500 transactions per second.

The sudden promotion by Binance US has quickly gained attention, leading to what many are now calling an “XRP Surge.” This surge has seen an increase in trading volumes and a renewed sense of optimism around the token, particularly among investors who were previously uncertain about XRP’s future due to ongoing regulatory challenges.

Ripple’s Legal Victory Boosts Confidence

The timing of Binance US’s promotion is particularly noteworthy, as it comes just days after Ripple’s landmark legal victory against the SEC. For years, Ripple has been embroiled in a legal battle with the SEC over allegations that XRP was being sold as an unregistered security. However, in a recent court ruling, Ripple was found to have acted within the law, leading to the resolution of the case. The court ordered Ripple to pay $125 million to settle the dispute, marking the end of a long and uncertain chapter for the company and the XRP token.

This ruling has provided much-needed clarity for XRP, which has been under a cloud of legal uncertainty since the SEC first filed its case. With the legal issue now resolved, investors are increasingly confident about XRP’s prospects. Since the court’s decision on August 7, XRP has seen a dramatic increase in value, rallying over 30% and reaching levels not seen since April. The positive momentum generated by this legal victory has been further amplified by the Binance US promotion, resulting in the current XRP Surge.

Data Points to Growing Bullish Sentiment

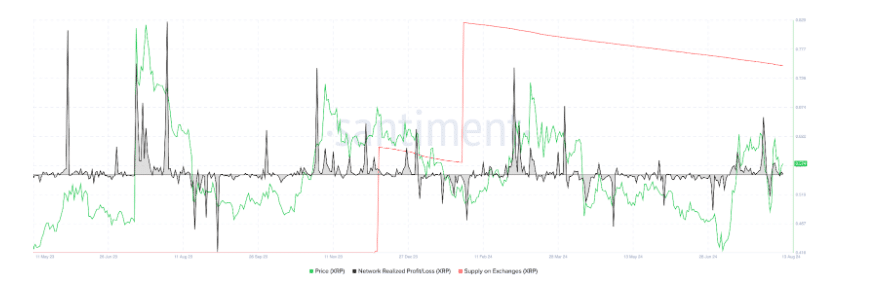

Supporting the XRP Surge, data from on-chain analytics firm Santiment reveals a clear shift in investor behavior. One of the most telling signs is the dwindling supply of XRP on exchanges. This decline suggests that investors are moving their XRP off exchanges and into long-term storage, indicating that they are holding onto the token in anticipation of further price increases. When tokens are withdrawn from exchanges, it usually signals that investors are less likely to sell, which often leads to a reduced supply and higher prices.

Additionally, Santiment’s data shows a notable increase in retail accumulation. The number of addresses holding 10,000 XRP or less has risen significantly, reflecting increased interest from smaller investors. This growth in retail accumulation is a positive sign, as it suggests broader market participation in the XRP Surge.

However, not all investors are following the same pattern. The data also reveals a decrease in the number of whale accounts—addresses holding between 1 million to 100 million XRP. This suggests that some larger investors, or “whales,” may be taking profits after the recent price surge. While the reduction in whale activity may seem concerning, it is not unusual for large holders to take profits after a significant rally. Despite this, the overall market sentiment remains bullish, with the majority of investors still expecting further gains for XRP.

Short-Term Fluctuations Amid Long-Term Optimism

Despite the strong bullish sentiment driving the XRP Surge, the token has faced some resistance in recent days. At the time of writing, XRP is trading at $0.5665, down 2% in the past 24 hours. This slight pullback could be attributed to profit-taking by some investors, particularly those who entered the market during the recent rally. It is not uncommon for assets to experience short-term fluctuations after a rapid price increase, as some investors look to lock in their gains.

However, the overall outlook for XRP remains positive. The combination of regulatory clarity from the recent court ruling and the promotional push by Binance US has created a favorable environment for the token’s continued growth. Many analysts believe that the current XRP Surge is just the beginning, with further gains likely as more investors recognize the long-term potential of XRP.

Conclusion: XRP Positioned for Continued Growth

The sudden promotion by Binance US, paired with Ripple’s recent legal victory, has created the perfect conditions for the ongoing XRP Surge. Investors are increasingly optimistic about the token’s future, and the data supports this positive sentiment. While there may be some short-term fluctuations, the long-term prospects for XRP look promising, especially as more investors become aware of the regulatory clarity and strong fundamentals supporting the token.

For readers of BIT Journal, this is a critical moment to pay attention to XRP and the broader crypto market. The recent developments surrounding XRP highlight the importance of staying informed and recognizing opportunities as they arise. As always, BIT Journal will continue to provide in-depth coverage of XRP and other major cryptocurrencies, keeping you updated on the latest trends and news in the crypto world. Stay tuned to deythere.com for more updates on XRP and other major cryptocurrencies as we continue to cover the latest news and trends in the ever-evolving world of crypto.