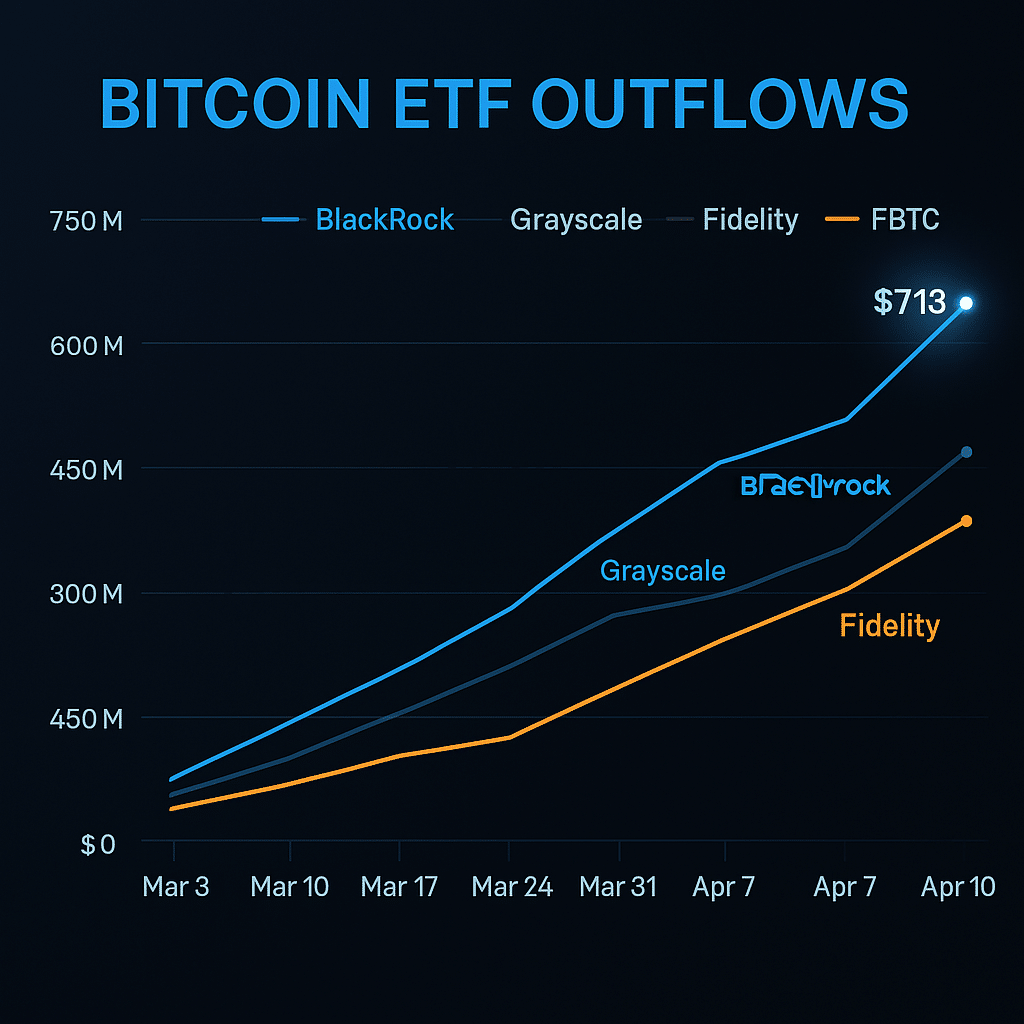

As trade tensions between the United States and China continue to escalate, a sharp wave of outflows has hit the U.S. spot Bitcoin ETFs market. Investors are increasingly retreating from risk assets amid fears of prolonged geopolitical conflict, resulting in over $713 million withdrawn from Bitcoin ETFs in just one week.

This dramatic shift in sentiment reflects growing macroeconomic anxiety, with digital asset markets once again proving vulnerable to traditional global headwinds.

Trade War Triggers ETF Exodus

On April 2, former President Donald Trump announced a sweeping 104% tariff on all Chinese imports, a move that came into effect on April 9. Beijing retaliated with a 34% tariff on U.S. goods, marking the latest chapter in an already strained economic relationship between the two superpowers.

In response, investors rushed to pull money out of Bitcoin ETFs. On April 8 alone, ETF outflows spiked to $326.3 million, marking one of the largest single-day withdrawals of the year. The most impacted fund was BlackRock’s iShares Bitcoin Trust (IBIT), which saw $342.6 million in total redemptions over the week.

“Investors are clearly nervous,” said Alicia Monroe, senior analyst at Chainwatch Markets. “The reemergence of US-China trade disputes adds a fresh layer of uncertainty to global markets, and Bitcoin is feeling the pressure.”

Updated Crypto Prices (as of April 14, 2025)

| Asset | Price (USD) | 24-Hour Change | 7-Day Change | Year-to-Date |

|---|---|---|---|---|

| Bitcoin (BTC) | $84,553.00 | +0.23% | -3.5% | +18.2% |

| Ethereum (ETH) | $1,631.10 | +1.21% | -4.1% | +15.7% |

BlackRock, Grayscale, and Fidelity Face the Fallout

Aside from IBIT, other major ETF players also experienced severe drawdowns. Grayscale’s GBTC lost $160.9 million, while Fidelity’s FBTC saw outflows of $74.6 million, reflecting a coordinated investor pullback across institutions.

These outflows were not isolated to Bitcoin. Ethereum-based ETFs have also been impacted, recording $29.2 million in net redemptions on April 11 — the fourth consecutive day of capital flight.

Analysts suggest that the swift retreat underscores a broader “risk-off” trend among institutional investors.

Crypto’s Sensitivity to Geopolitical Risks

Despite being marketed as alternatives to traditional financial systems, cryptocurrencies are proving just as susceptible to macroeconomic shocks.

Bitcoin’s price has dropped nearly 27% from its local highs, approaching levels last seen during the FTX collapse in 2022. Ethereum has mirrored the trend, pressured by capital outflows and a cautious investor base.

“Crypto is still a high-beta asset,” explained Monroe. “In times of political and economic uncertainty, these markets are often the first to bleed.”

Are ETFs a Double-Edged Sword?

While spot Bitcoin ETFs were once seen as the gateway to mainstream adoption, this week’s events highlight a major downside: institutional access also means institutional exits.

With ETFs now acting as large liquidity vessels, movements of this magnitude can have profound impacts on price — particularly during market turmoil.

“ETFs introduced a new dynamic,” said crypto economist Jacob Lin. “They gave credibility, but they also brought exposure to global fear cycles.”

Conclusion on Bitcoin ETFs

The recent $713 million outflow from Bitcoin ETFs has sent a clear message: the cryptocurrency market remains tightly intertwined with global politics and macroeconomic sentiment. As US-China trade tensions intensify, investors are likely to remain cautious, and ETF activity will continue to serve as a barometer of risk appetite.

Although long-term fundamentals for Bitcoin and Ethereum remain strong, short-term volatility is likely to persist. Market watchers should remain alert to further policy escalations and their ripple effects across digital assets.

FAQs

Why did Bitcoin ETFs see such large outflows?

The surge in redemptions is linked to the escalating trade war between the U.S. and China, which has created uncertainty and reduced risk appetite.

Which ETFs were most affected?

BlackRock’s IBIT, Grayscale’s GBTC, and Fidelity’s FBTC saw the highest outflows during the week of April 8.

Are Bitcoin ETFs a risk during market turbulence?

Yes. While they provide exposure and access, they also magnify price swings when large institutional players pull out funds.

What should investors watch next?

Keep an eye on policy developments between the U.S. and China, as well as ETF flow data, which signals institutional sentiment.

Glossary of Key Terms

ETF (Exchange-Traded Fund): A financial product that tracks an asset or index and is traded on stock exchanges.

Outflow: When investors withdraw capital from an asset, often due to market concerns or changes in sentiment.

Risk-Off Strategy: A market condition where investors shift funds away from volatile assets into safer ones.

Trade War: A conflict where countries impose tariffs or trade restrictions to gain economic advantage.

Bitcoin Trust: A financial instrument offering institutional exposure to Bitcoin, often traded as an ETF.