The rise of digital currencies has not gone unnoticed in Ghana. Over the past three years, data collected by the BoG shows a substantial increase in the number of Ghanaians engaging in cryptocurrency transactions. Whether for investment, remittances, or day-to-day transactions, it’s clear that more people in the country are embracing the digital asset wave. However, with this growing interest comes a need for regulation to ensure that the space remains safe and trustworthy.

The Bank of Ghana has recognised the potential risks associated with digital assets, including money laundering, terrorism financing, and fraud. These concerns have spurred the central bank to draft new guidelines aimed at mitigating these risks while also protecting consumers.

A New Framework for Cryptocurrency Exchanges

Central to the BoG’s proposed regulations is an eight-pillar framework that places significant emphasis on the registration and reporting requirements for cryptocurrency exchanges and other virtual asset service providers (VASPs). The framework suggests that these exchanges should be subject to stricter scrutiny, particularly concerning the monitoring and reporting of suspicious transactions.

One of the key aspects of the proposed regulations is the requirement for crypto exchanges to comply with the Financial Action Task Force’s (FATF) Travel Rule. This rule mandates that certain information must accompany transfers of digital assets to help combat money laundering and other illicit activities. Additionally, the BoG plans to work closely with other stakeholders, including commercial banks and offshore regulators, to ensure a comprehensive regulatory approach.

A representative from the Bank of Ghana stated, “The Bank would collaborate with the Securities and Exchange Commission (SEC) to develop distinct complementary regulatory frameworks that encompass various applications or use cases of digital assets.” This collaboration underscores the importance of a unified approach to regulation in the rapidly evolving digital asset space.

Public Feedback and Collaboration

In an effort to ensure that the proposed regulations are well-rounded and effective, the BoG is seeking input from a wide range of stakeholders, including industry players, experts, and the general public. This period of consultation, which is open until the end of August, allows those who are directly involved in the crypto space to voice their opinions and provide feedback on the draft guidelines.

The Bank of Ghana has made it clear that it values these inputs and will consider them carefully before moving forward with the final regulations. “The bank will consider these inputs in determining the next steps forward,” the draft proposal stated. This approach highlights the BoG’s commitment to transparency and inclusiveness in the regulatory process.

In addition to seeking feedback, the BoG is also considering the introduction of a sandbox environment for crypto exchanges. This would allow these platforms to test their systems and processes in a controlled setting before being fully licensed to operate in Ghana. Such a measure could help to iron out any potential issues before they impact consumers, further ensuring the safety and reliability of the crypto ecosystem.

Ghana’s Cultural Nod to Crypto

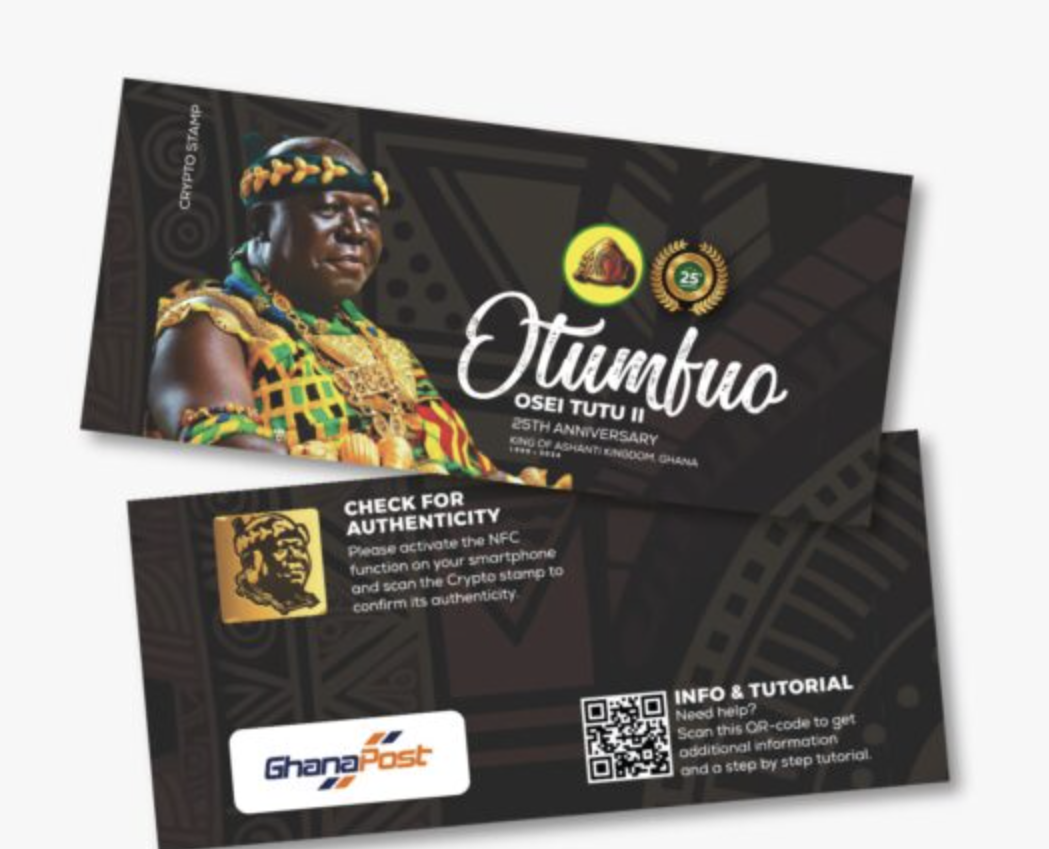

Interestingly, this move towards regulating digital assets in Ghana comes on the heels of a culturally significant event that also ties into the world of cryptocurrency. In May, Ghana Post, the country’s national postal service, launched a special collection of crypto stamps. These stamps, dubbed the “Crypto Stamp,” were created to celebrate the 25th coronation anniversary of His Majesty Otumfuo Osei Tutu II.

The limited-edition stamps, priced at 250 Ghanaian cedi (around $18) each, are more than just a collector’s item. They represent a unique blend of Ghana’s rich cultural heritage and its forward-looking approach to technology. This initiative reflects a growing recognition of the role that digital assets can play in both preserving history and driving innovation.

A New Chapter for Ghana’s Financial Landscape?

As the deadline for public feedback approaches, it is clear that Ghana is on the brink of a new chapter in its financial landscape. The proposed regulations by the Bank of Ghana signify a thoughtful and measured approach to the world of digital assets, balancing the need for innovation with the imperative of security and consumer protection.