The trend in crypto investing is changing; Bitcoin ETFs are seeing an inflow of capital. In the last five trading days, Bitcoin ETFs pulled in $1.1B, more than double from the prior week of $515.9M, according to ETF.com data. Big players in the space, like BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC), are still leading the charge as investors move into Bitcoin against geopolitical and economic uncertainty.

This is different from the chaotic global markets after US President Donald Trump announced tariffs-first 25% on Canadian and Mexican imports, then he hit the brakes. In response, investors are increasing their allocation to Bitcoin-based products as part of a broader risk management strategy.

Bitcoin ETFs Surge as Traditional Markets React to Policy Changes

Based on available data, since January 2024, spot Bitcoin ETFs have gathered over $40.6B while Ethereum ETFs, since July 2023, have grabbed only $3.2B.

Bitcoin is still volatile, down 1.3% in the last 24 hours to $98,000 due to US economic policy uncertainty and global geopolitical tensions.

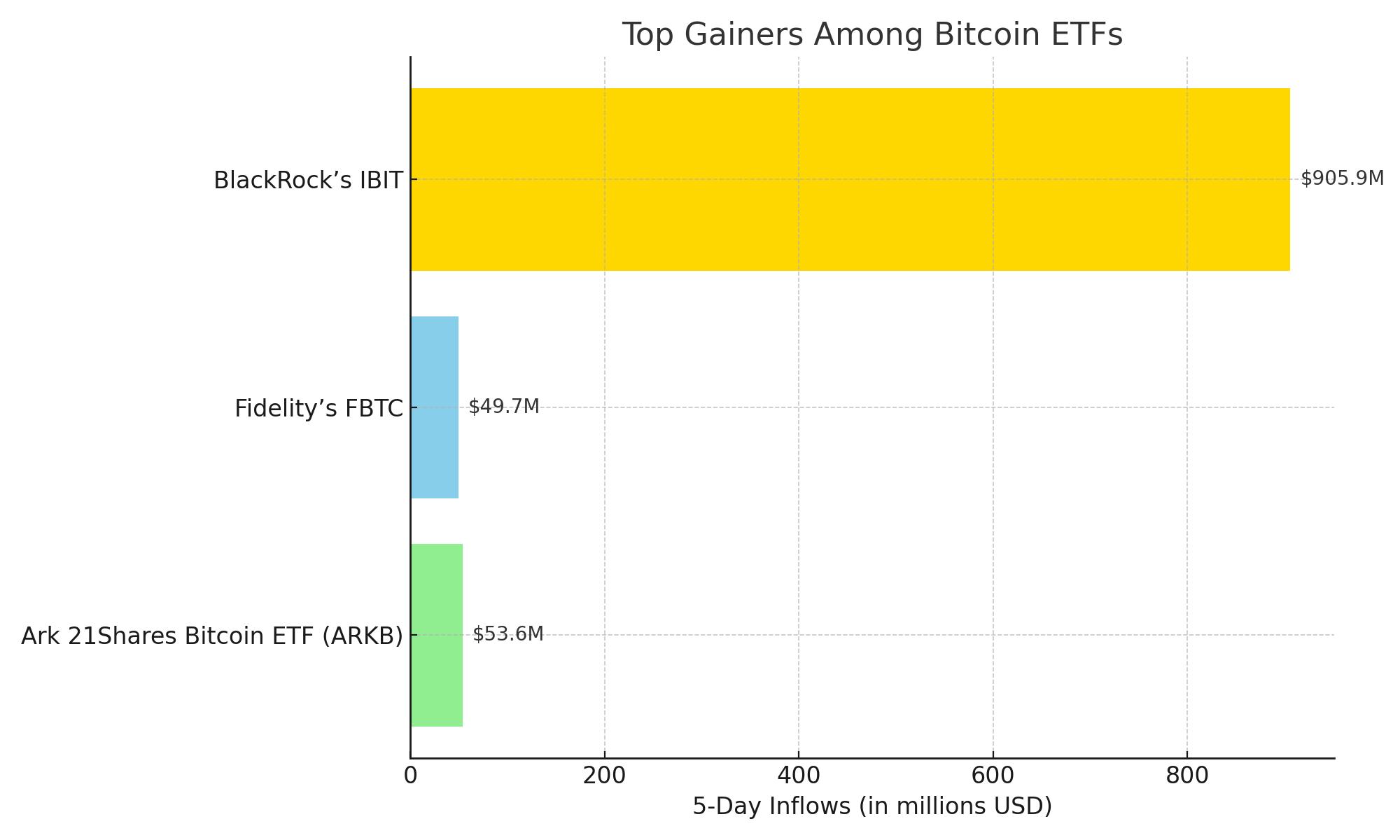

Top Gainers Among Bitcoin ETFs

| ETF | 5-Day Inflows |

| BlackRock’s IBIT | $905.9 million |

| Fidelity’s FBTC | $49.7 million |

| Ark 21Shares Bitcoin ETF (ARKB) | $53.6 million |

Despite these inflows, Bitcoin is still susceptible to regulatory changes, trade policy shifts and macroeconomic concerns.

Grayscale Bitcoin Trust – GBTC Sees Slower Outflows

While inflows into some of the new Bitcoin ETFs were strong for much of January-February, outflows for Grayscale’s Bitcoin Trust–which became an ETF a few months ago, for instance, was $3.1M over the last 5 days, says. Meanwhile, its ETH counterpart, Grayscale Ethereum Trust (ETHE), saw $72M in outflows, so Ethereum-based products are not yet enjoying the same investor confidence as Bitcoin ETFs.

Trump Administration’s Pro-Crypto Stance

The greater acceptance of Bitcoin ETFs is aided largely by the pro-crypto affirmation from the Trump administration. The promotion of digital asset growth by the Trump administration happened through many policies advancing blockchain capacity building and Bitcoin adoption.

Reports also have it that the Securities and Exchange Commission is merging its crypto enforcement unit into what could mean non-restrictive regulations. Just recently, Trump appointed the former PayPal executive David Sacks as AI & Crypto Czar, showing his administration’s keen interest in digital assets.

This has created a good environment for Bitcoin ETFs, so investors are increasing their exposure to digital assets as part of their overall portfolios.

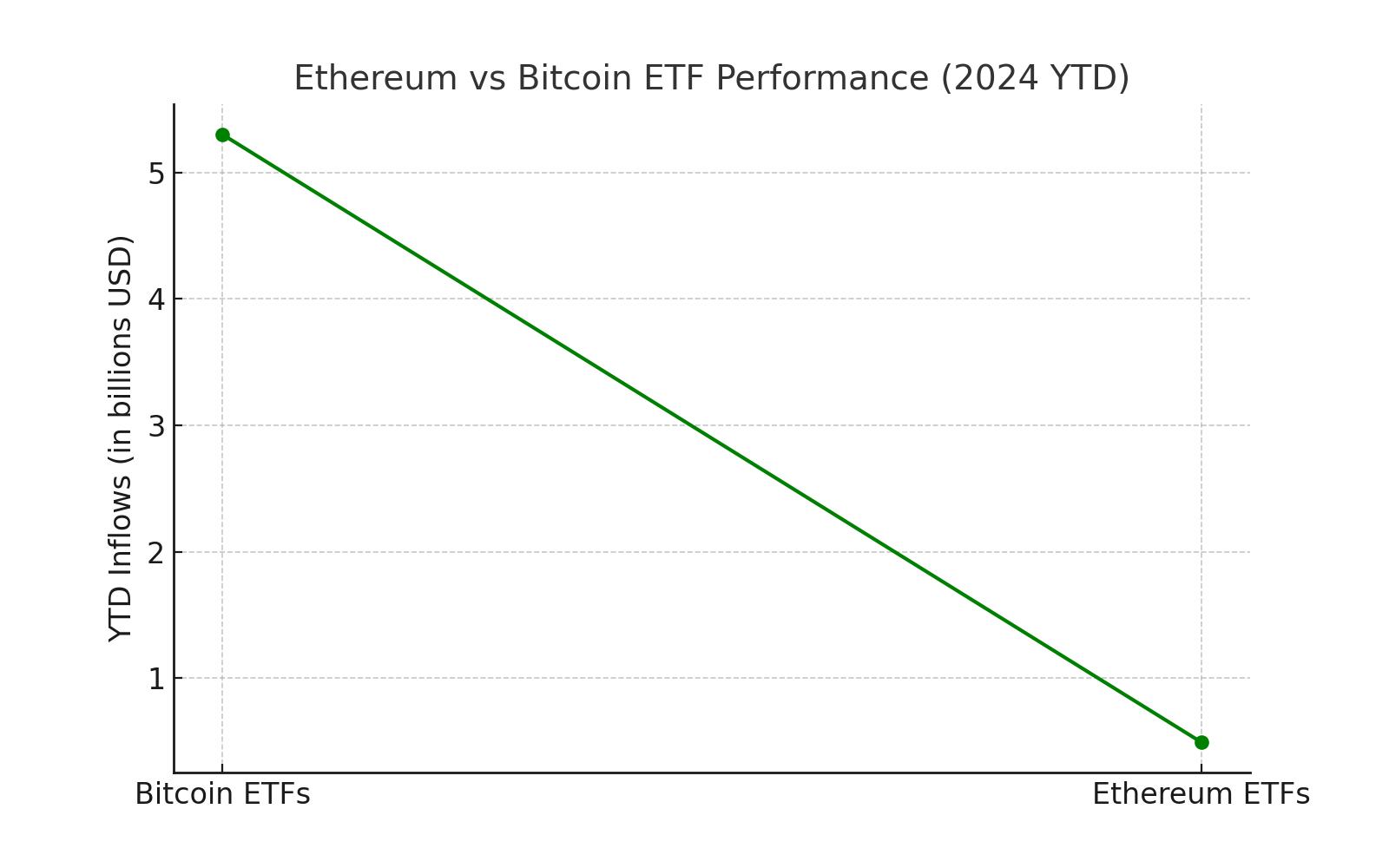

Ethereum ETFs Struggle

BTC ETFs are outpacing their Ethereum-based counterparts. While Bitcoin ETFs have gathered $5.3B YTD, Ethereum ETFs have only seen $492.9M in new assets, according to ETF.com.

Even with Ethereum’s highly volatile price lately, Ethereum-based products are not getting the same level of institutional acceptance that Bitcoin ETFs are now getting, so this is a legit avenue for institutional and retail investors.

Ethereum vs Bitcoin ETF Performance (2024 YTD)

| ETF Category | YTD Inflows |

| Bitcoin ETFs | $5.3 billion |

| Ethereum ETFs | $492.9 million |

The gap shows a broader investor preference for Bitcoin ETFs, at least, as traditional financial institutions are embracing Bitcoin as an inflation hedge.

Global Market Reaction to Bitcoin ETF

As Bitcoin ETFs keep attracting institutional money, the global markets are adjusting to the increasingly finance-integrated crypto industry. The CoinMarketCap ‘Fear & Greed Index, which measures investor sentiment, is at 38 (Fear), due to U.S. economic policies and geopolitical tensions. Traditional markets: the Nasdaq 100, S&P 500, and STOXX 600-are all red due to Trump’s tariffs, pushing investors into Bitcoin-based products.

Bitcoin is strong, shining in economic turmoil when most other assets fail to.

Conclusion: Bitcoin ETFs’ Place in Modern Finance

$1.1 billion pouring in for Bitcoin ETFs in just 5 days, it’s clear institutional investors are buying Bitcoin as a hedge against economic uncertainty and inflation risks. With regulatory clarity, pro-crypto policies and more institutional acceptance of traditional finance players, Bitcoin ETFs will be important in the future of the global financial system. As global markets prepare for more volatility, the Bitcoin ETF is the vessel of choice for investment, solidifying Bitcoin’s position in the financial world as the digital store of value.

Stay updated with Deythere as we’re available around the clock, providing you with updated information about the state of the crypto world.

FAQ

1. Why is so much money going into Bitcoin ETFs?

Investors are reportedly pumping funds into the BTC ETF as a safe-haven asset to hedge against global economy uncertainty, trade tensions and inflation.

2. Bitcoin ETFs or Ethereum ETFs: Which one attracts more money?

BTC ETFs have seen $5.3B in inflows in 2024 while Ethereum ETFs have seen $492.9M, showing BTC’s dominance in institutional adoption.

3. What has Trump done for the Bitcoin ETF?

Trump’s presidency with its pro-crypto approach, reduced crypto regulatory enforcement and crypto-friendly officials has brought mass institutional participation in Bitcoin ETFs.

4. Does Inflow into ETF mean Bitcoin price will increase?

Price action is dependent on one key factor: general economic conditions, policy, regulation and market sentiment despite high liquidity provided by ETFs amid surging institutional demand.

5. Are Bitcoin ETFs safer than holding Bitcoin outright?

Bitcoin ETFs allow institutional and retail investors to get exposure to Bitcoin without the self-custody headaches or direct crypto exchange trading and are, therefore, suitable for regulated investment portfolios.

Glossary of Key Terms

Bitcoin ETF: An exchange-traded fund (ETF) that tracks the price of Bitcoin, allowing investors to get exposure to Bitcoin without directly holding the cryptocurrency.

Spot Bitcoin ETF: A Bitcoin ETF that holds actual Bitcoin and not through the use of derivatives differs from futures-based ETFs by tracking Bitcoin’s price.

Market Sentiment: An investor’s level of confidence or fear of investors in any of the financial markets.

Institutional Investors: Large corporate investors-including hedge funds, banks, and pension funds that trade massive volume

Fear & Greed Index: A type of indicator that measures market sentiment from extreme fear (bearish) to extreme greed (bullish).