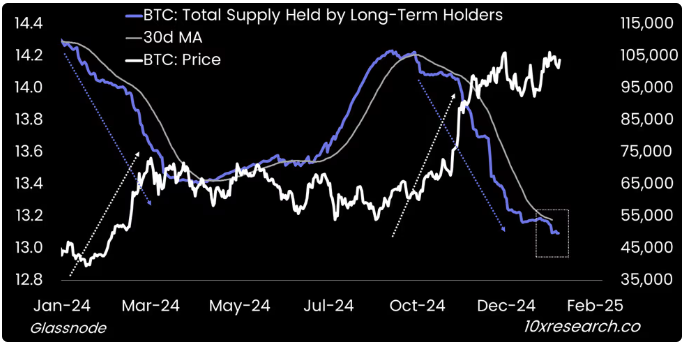

Long-term Bitcoin investors show a decrease in their holdings, which, according to analysts, could create additional price growth. The historical record indicates that substantial supply drops held by these investors bring about consistent Bitcoin market gains. During the price jump to greater than $100,000, investors pursued 1 million BTC units to meet the increased demand, which absorbed the available supply.

Bitcoin Selling Slows as Market Stability Increases

Long-term Bitcoin investors who have held their assets for more than five months are accelerating their balance declines, a pattern that signals future market price increases. Experts identify substantial asset disposals from this group of investors in both quarter one and quarter four of 2024 during Bitcoin’s market price expansion period.

The ongoing selling activity from investors holding Bitcoin more than five months puts upward pressure on prices that may ultimately lead to a rapid spike in cost.

Glassnode data shows that long-term wallets now control less than 13 million BTC from their total supply. Bitcoin witnessed a substantial transfer when short-term traders raided wallets holding 1.1 million BTC throughout its ascent to surpass $100,000. The market data shows that users actively want to purchase all supply on hand, irrespective of the current prices reaching new peaks.

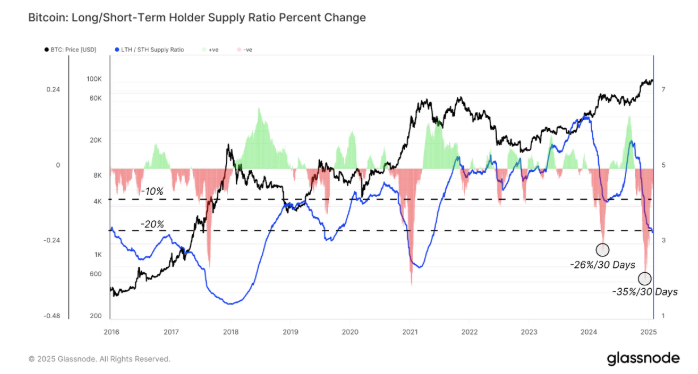

Distribution continues, yet the velocity at which long-term holders sell their BTC has decreased. The measured pace of supply dynamics between long-term to short-term holder transactions emerges through the monthly change examination. Long-term holder selling activity reached higher speeds during the early parts of the month, yet current data confirms market stability.

Experts suggest that decreased long-term holder selling slows down market movements. A slow movement of BTC to short-term traders creates a stabilized marketplace by reducing sharp price fluctuations. Bitcoin’s high pricing volatility appears to drive long-term investors toward holding their assets more steadily, according to behavioral data.

ETF Inflows Shift Bitcoin Supply Dynamics

Centralized exchanges have reduced their Bitcoin wallet ownership from 3 million BTC to 2.7 million BTC within a period of six months. The decrease of Bitcoin kept in exchange wallets indicates reduced market pressure, as fewer bitcoins are currently available to trade. Many traders view this price plot as bullish because it creates restricted coin availability which turns into upward market movements.

Many analysts suspect that the BTC withdrawals traced from exchanges don’t truly represent permanent storage activities. Exchange-traded funds (ETFs) have received significant Bitcoin transfers, which remain accessible for trading functions from the original Bitcoin pool. ETF holdings function as exchange reserves, which challenges the previous understanding of declining balances at trading platforms.

Research from Glassnode indicates that total exchange-reserved Bitcoin amounts stay higher than 3 million even after factoring inеріveǧement shifts. The data shows Bitcoin maintains high liquidity despite facing reduced selling pressure. ETF inflows established a new market pattern that requires revision of classic supply and demand signals.

Bitcoin Prices Expected to Rise with Steady Demand

Bitcoin’s marketplace fluctuation remains driven by approaches from investors who maintain their assets long-term and changes to market conditions. A measured pace of selling maintained by long-term holders seems to contribute to market stabilization while avoiding major price swings. Institutional and retail investors maintain sustained interest in Bitcoin, demonstrating ongoing market demand despite rising prices.

The adoption of Bitcoin into exchange-traded funds (ETFs) demonstrates an evolving fund distribution system that demands new supply trend analysis methods. Traditional exchange reserves are decreasing, but ETFs provide liquidity which creates active trading possibilities. Analytics expect Bitcoin to increase in value during the next months, so long as investor demand continues unflinchingly.

FAQs

Why are long-term Bitcoin holders selling their BTC?

Long-term Bitcoin holders are selling their BTC because of high demand and rising prices.

How does the selling by long-term holders affect Bitcoin prices?

The selling by long-term holders reduces supply, which can lead to higher Bitcoin prices.

What is the impact of Bitcoin moving into ETFs?

Bitcoin moving into ETFs keeps liquidity high and changes how supply is measured.