Bitcoin (BTC) is trading just under $107,000, but its sideways movement could be the calm before a storm. In the past 24 hours, multiple economic indicators and statements from Federal Reserve members have significantly shifted interest rate expectations. With major tariff deals on the horizon and inflation data surprising analysts, global markets—and the crypto space—are on edge.

US Inflation: Mixed Signals and a Market on Edge

The PCE (Personal Consumption Expenditures) data released today showed a weaker-than-expected rise in consumer spending. Core PCE—the Fed’s preferred inflation gauge—rose by 0.2% month-over-month and 2.7% annually, aligning with forecasts but signaling a cooling trend in price pressures. More notably, personal income growth missed expectations, while consumer spending unexpectedly declined.

Despite the burden of 10% to 20% tariffs across several economies, their feared inflationary impact has yet to materialize. This weakens the Fed’s argument that lingering inflation is still being stoked by tariffs. Markets are interpreting this as a green light for earlier-than-expected monetary easing.

What the Fed Is Signaling

In the past 24 hours, three Federal Reserve officials suggested that a rate cut in July is possible—provided inflation doesn’t unexpectedly spike. Among them, Fed Governor Christopher Waller emphasized that slowing job creation could justify a policy shift even sooner.

This is important: unlike previous meetings where the Fed’s decisions were nearly unanimous, future rate cuts may be decided by majority vote. That signals internal divergence within the FOMC and raises the probability of earlier easing.

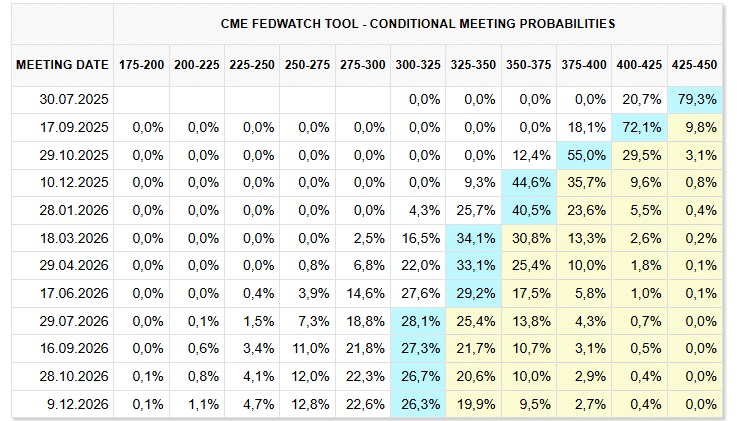

Market expectations now price in three rate cuts by the end of 2025. The probability of a September cut has surged to nearly 90%, and attention is turning to the July 9 tariff deal announcements that could further reduce inflation uncertainty.

Geopolitics and the Countdown to July 9

Former President Donald Trump and the U.S. Commerce Secretary have confirmed that multiple international tariff agreements are in final negotiation stages. These deals are expected to be revealed before July 9, which is now only 33 days away from the next Fed meeting.

If the agreements effectively reduce trade tensions without adding to inflation pressures, the Fed could act swiftly. In parallel, the European Union is reviewing the U.S. offer and preparing countermeasures, just in case talks fail. But hopes are high for breakthroughs that will restore stability to global markets.

What Comes Next?

Next week will be pivotal. If countries begin announcing finalized tariff agreements and economic data continues to ease concerns, the Fed could kickstart a series of rate cuts. These events are expected to have significant implications across asset classes—from traditional markets to Bitcoin.

BTC has shown restraint, not following the S&P 500’s record-setting rally this week. But according to analysts at Dey There, this could be a strategic pause before a major breakout aligned with monetary easing. With $15 billion in options expiry today and weekend volatility on deck, a sharp move could be imminent.

Stay tuned to Dey There for real-time updates as central bank commentary and global negotiations unfold.

Sources: