Tokenomics has emerged as one of the most significant buzzwords in the cryptocurrency business. Traders, analysts, and developers utilize it on a regular basis to determine if a project is constructed to endure or will fail.

- What is tokenomics, and why is it important?

- Supply and Demand: The Core of Tokenomics

- Utility: Why Tokens Must Do More Than Trade.

- Governance and Incentives: Community Shapes Value

- Case Study: Tokenomics Drives Solana’s Popularity

- Tokenomics and Market Psychology

- Risks and Regulatory Considerations in Tokenomics

- Why Tokenomics Is the Future of Cryptoanalysis

- Conclusion

- Glossary of Key Terms

- FAQs

To put it simply, tokenomics is the economic structure that drives cryptocurrencies. It describes how tokens are generated, distributed, utilized, and destroyed over time. Tokenomics, like supply and demand, is used in crypto economies to determine value, stimulate adoption, and maintain sustainability.

What is tokenomics, and why is it important?

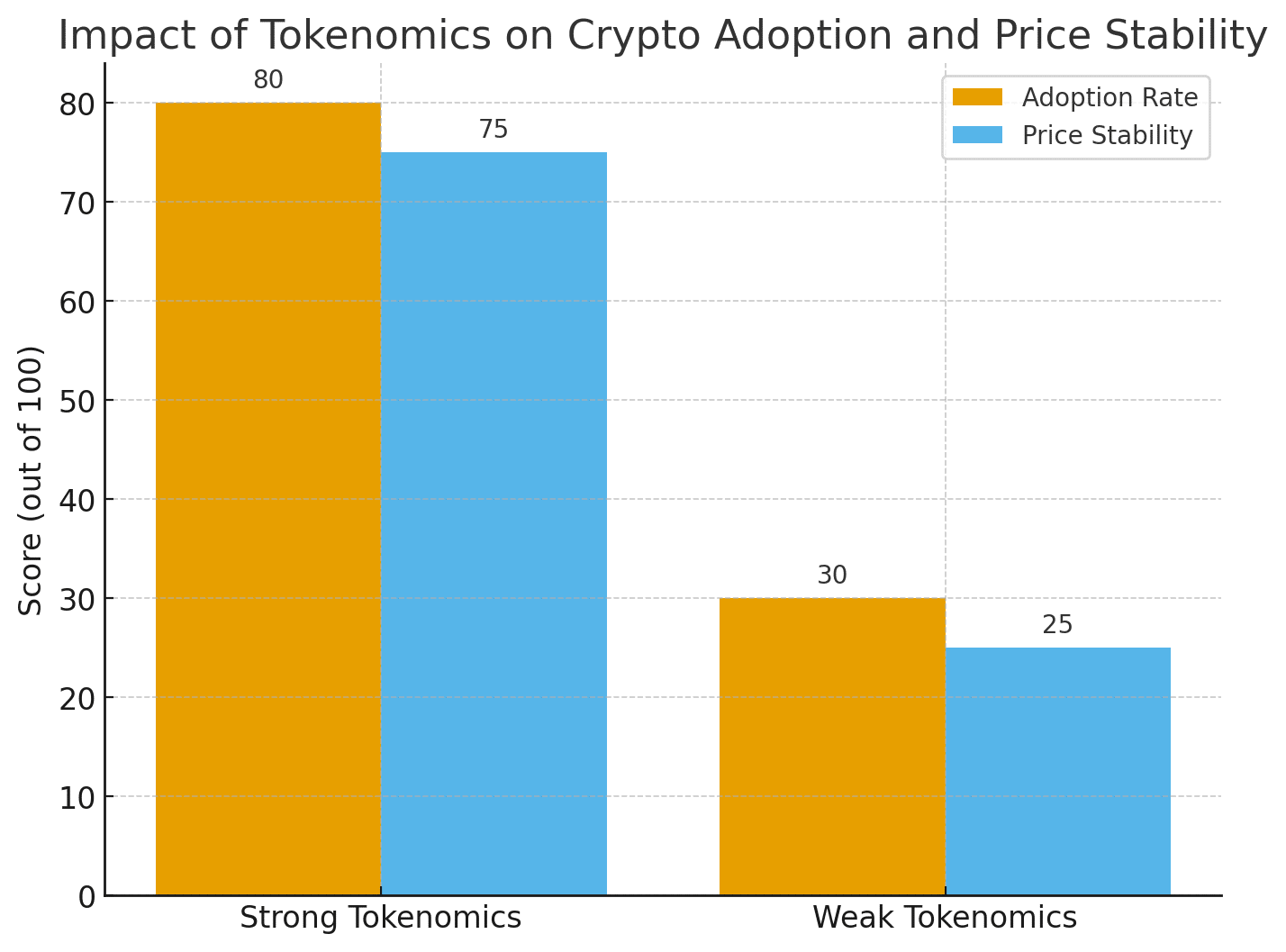

Tokenomics is the study of how a cryptocurrency’s design influences its price and future success. More than 65% of investor interest in new ventures is based on clear tokenomic models. Without it, tokens lack structure, resulting in unsustainable growth or abrupt collapse.

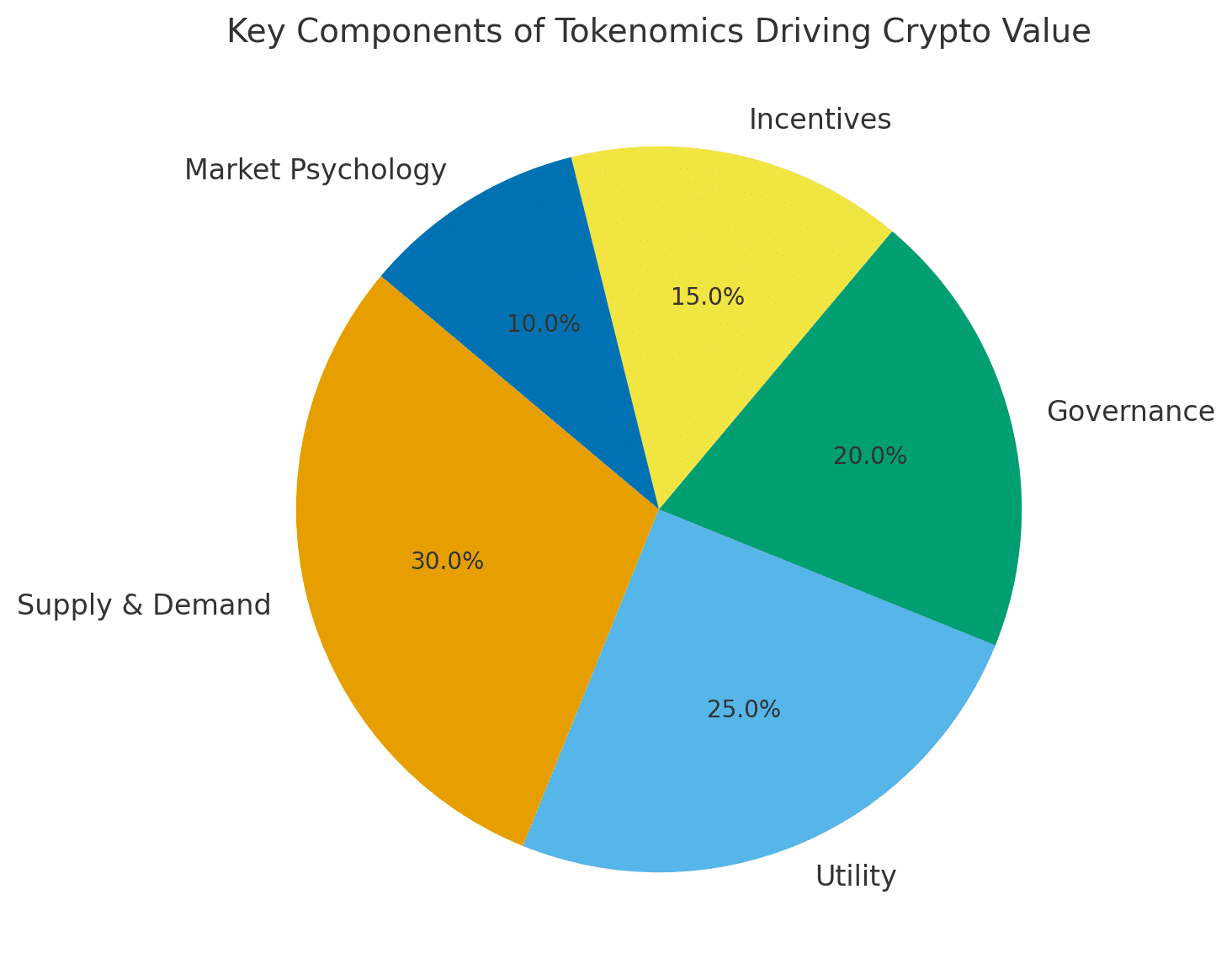

Tokenomics is fundamentally about supply mechanics, distribution models, utility, governance rights, and incentives. A solid tokenomic structure promotes user engagement, investor trust, and steady growth. Weak tokenomics frequently leads to speculative bubbles and sharp drops.

Supply and Demand: The Core of Tokenomics

Every cryptocurrency trader understands that scarcity creates value. Bitcoin remains the finest example, with a fixed quantity of 21 million coins. This restricted design assures that as demand grows, the price rises.

Some coins employ inflationary models in which additional tokens are created over time. Others use deflationary strategies, such as burning (which permanently removes tokens from circulation). Projects with balanced supply mechanics see more sustained long-term acceptance.

This demonstrates that tokenomics is about more than simply the number of tokens available, but also how they flow into the market. A token with a limitless supply and little demand frequently struggles to maintain value.

Utility: Why Tokens Must Do More Than Trade.

Tokens that survive bad markets typically provide significant benefit. Utility refers to what a token can actually do, beyond mere conjecture. It might provide access to decentralized apps, enable staking incentives, or act as collateral for loans.

Ethereum’s token, for example, drives smart contracts and decentralized finance (DeFi). This real-world use case has kept ETH relevant during tumultuous periods. According to one blockchain engineer, “Utility is what separates a long-lasting project from a short-lived hype coin.”

When utility is high, demand increases organically because consumers require the token to interact with services. Without it, the enterprise risks withering as trade speculation declines.

Also read: US GDP Goes On Blockchain Immutable Data For Global Access

Governance and Incentives: Community Shapes Value

Governance is an important consideration in modern tokenomics. Holders of multiple tokens can cast votes on improvements, funding allocations, and future initiatives. This democratic design provides investors a sense of ownership and control, which increases loyalty.

Incentives such as staking and yield farming are equally significant. By compensating holders for locking tokens, projects lessen selling pressure while increasing scarcity. According to Bank for International Settlements reports, token models with community-driven governance are more likely to be adopted over time.

Case Study: Tokenomics Drives Solana’s Popularity

Analysts on social media have noted Solana’s growing price potential as a direct result of its tokenomics. The network compensates validators with staking incentives while keeping transaction fees low. This blend of incentives and usability has generated a thriving community, with traders describing it as “one of the most efficient ecosystems in the space.”

Community confidence in tokenomics has been a primary driver of Solana’s uptake, demonstrating how design decisions may have a direct influence on market outcomes.

Tokenomics and Market Psychology

Tokenomics has an impact on psychology in addition to finances. Traders examine vesting timelines (how tokens are unlocked for early investors), distribution fairness, and team allocations. A project where insiders control the majority of the supply frequently raises warning signals.

In contrast, transparent distribution schemes guarantee investors that value growth will not be improperly influenced. According to a Deloitte analysis from 2024, investor trust in tokenomics is one of the top three factors driving institutional investment in cryptocurrency markets.

Risks and Regulatory Considerations in Tokenomics

Tokenomics provides valuable insights, but it is not without pitfalls. Poorly built systems may cause inflation, erode confidence, and even destabilize entire ecosystems. Tokenomic models are increasingly being scrutinized by regulators under frameworks like as the EU’s MiCA law and the US Securities and Exchange Commission recommendations.

This emphasizes the necessity for investors and developers to create tokenomics that adhere to legal norms. Sustainable cryptocurrency acceptance is dependent on balancing innovation and compliance.

Why Tokenomics Is the Future of Cryptoanalysis

For traders, tokenomics is becoming just as crucial as technical analysis. Tokenomics, like candlestick charts, tells if a token is worth investing in for the long run.

Understanding tokenomics entails comprehending the DNA of a cryptocurrency. It determines whether the token is intended to be traded in the near term or kept as a digital asset. Analysts frequently remind the market that “price may be temporary, but tokenomics lasts forever.”

Conclusion

Tokenomics isn’t just a buzzword. It serves as the cornerstone for any cryptocurrency’s value, acceptance, and longevity. Tokenomics discusses how tokens function in actual markets, including supply dynamics, usefulness, governance, and incentives.

When properly developed, it may accelerate adoption, attract investors, and ensure long-term success. When ignored, trust may be destroyed overnight.

For more news and informative articles visit our platform.

Glossary of Key Terms

Burning – The permanent removal of tokens from circulation to reduce supply.

Utility Token – A token that provides access to services or applications in a blockchain ecosystem.

Governance Token – A token that allows holders to vote on project decisions.

Staking – Locking tokens in a network to support operations and earn rewards.

Vesting Schedule – The timeline for unlocking tokens allocated to early investors or teams.

FAQs

1. What is tokenomics in simple words?

Tokenomics is the economic system behind a cryptocurrency, showing how it gains value and stays sustainable.

2. How does tokenomics affect price?

It shapes supply, demand, utility, and incentives, which directly influence how much traders are willing to pay.

3. Why is utility important in tokenomics?

Utility ensures that tokens have real use cases beyond trading, which drives natural demand and long-term growth.

4. Can bad tokenomics crash a crypto project?

Yes. Poorly designed supply models or unfair distributions can destroy trust and lead to collapse.

5. Is tokenomics the same as technical analysis?

No. Technical analysis studies charts and price movements, while tokenomics studies the economic design of the token.