A top Coinbase executive has outlined a financial maneuver that could allow a $100 billion US Bitcoin acquisition without adding to the national debt. On The Scoop podcast, Sebastian Bea, President of Coinbase Asset Management, explained how a statutory gold accounting adjustment could unlock budget-neutral capital for digital asset accumulation on a scale of sovereign reserves.

“If lawmakers revalue America’s gold holdings to market prices, they can legally free up hundreds of billions without affecting the deficit,” Bea said, pointing out a little-known accounting rule that if changed could change how the U.S. approaches Bitcoin.

The $900 Billion Gap in Fort Knox

Based on available data, the U.S. has 261.5 million ounces of gold, officially valued at $42.22 per ounce, last updated in 1973. At today’s price of over $3,300 per ounce, the actual value of the gold is over $860 billion more than its book value.

Bea says by amending 31 U.S.C. § 5117, Congress could allow the Treasury to issue new high-denomination gold certificates based on the updated valuation. Those certificates could then be used to fund a Treasury-controlled account modeled after a sovereign wealth fund, giving the government the legal framework to buy Bitcoin on a budget-neutral basis.

“When the revaluation occurs, that creates a $900 billion mark-to-market gain,” Bea told host Frank Chaparro. “The Treasury could then take that gain and buy a variety of things, including Bitcoin, without adding to the debt.”

This US Bitcoin acquisition via gold revaluation connects the dots between accounting policy and macro-level digital asset strategy using legal precedent instead of economic speculation.

Legal Framework Already in Motion

The strategy Bea outlined parallels Senator Cynthia Lummis’s BITCOIN Act introduced earlier this year. The bill directs the Treasury to buy one million Bitcoins, currently valued at around $100 billion, over five years without adding to the deficit. Instead, the bill recommends using gold revaluation and Federal Reserve remittances to fund the purchases. The legislative summary says the BITCOIN Act also requires a national digital asset storage framework for state-held Bitcoin. The bill has gotten attention for its combination of fiscal hawk and long-term thinking.

In a press release, Senator Lummis said Bitcoin could be a hedge against inflation and fiscal malfeasance.

“As the world goes digital, it’s smart for the U.S. to consider Bitcoin as part of our overall reserve strategy.”

Market Ripples and Global Signaling

Bea thinks the ripples of a US Bitcoin entry at this scale would be huge. With Bitcoin’s market cap at $1.8 trillion, a $100 billion buy-in would be 5.5% of all existing supply.

“It’s hard to see a scenario where other governments don’t feel compelled to measure up,” Bea said.

His argument is based on the gold precedent where central banks globally bought a record 1,037 tonnes in 2023 due to fiscal uncertainty.

The logic is that Bitcoin, like gold, is now seen as a non-sovereign store of value. If one big player moves, others will follow not out of curiosity but strategic necessity.

“Central bank demand for gold is driven by the overall level of debt and economic concerns. Why wouldn’t some reserves be moved into Bitcoin as a hedge, maybe at a ninety-to-ten gold-to-Bitcoin ratio?” Bea added.

Timing and Political Will

Bea wouldn’t commit to a timeline but said the statutory change to enable this could happen this year if legislative momentum builds behind the BITCOIN Act or similar bills.

His comments show a deeper understanding of how US financial systems work:

“Once you understand the pipes of how banks and the government work, you realize they can revalue gold and buy Bitcoin and still be budget neutral. The only missing piece is political will.”

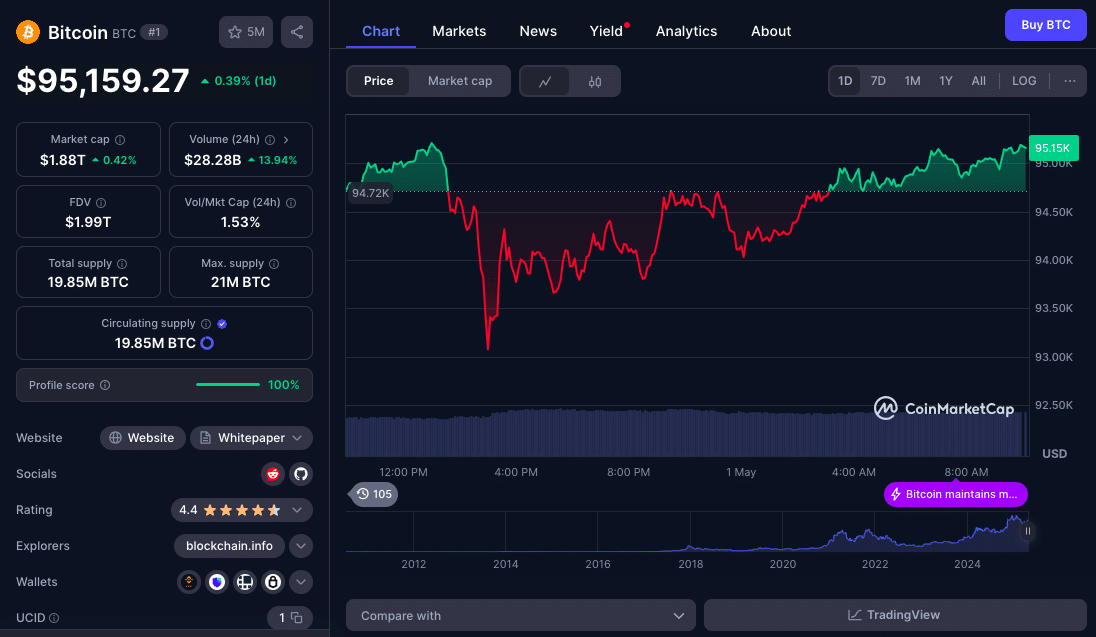

As of press time, Bitcoin was $95,159. If Treasury bought the full million Bitcoin target in the BITCOIN Act, it would immediately impact the market by absorbing a big chunk of supply, and trigger regulatory reactions domestically and internationally.

FAQs

How can the US Bitcoin acquisition be done without increasing the national debt?

By revaluing gold reserves to current market prices, the Treasury could gain almost $900 billion budget-neutral, which could be used to fund a Bitcoin reserve.

What law supports this?

Senator Cynthia Lummis’s BITCOIN Act outlines a 5-year plan to buy up to 1 million Bitcoins, of which one million will be used to fund a Bitcoin reserve.

Is this legal?

Yes, according to legal experts and Coinbase’s Sebastian Bea, it would only require a small change to existing code (31 U.S.C. § 5117) to re-strike gold certificates based on current valuation.

Would other countries follow if the US Bitcoin acquisition follows through?

Probably. Just as central banks follow each other in gold accumulation, a big Bitcoin buy by the US could trigger a wave of sovereign buying.

Glossary

Gold Revaluation: An accounting trick where a country’s gold reserves are valued at current market prices, potentially unlocking balance sheet capital.

Budget Neutral: A fiscal approach where existing funds or accounting adjustments offset new spending, no increase in national debt.

BITCOIN Act: A bill directing the US Treasury to buy up to 1 million Bitcoins over 5 years using budget-neutral mechanisms.

Mark-to-Market: A financial accounting method where an asset is valued at the current market price, not historical cost.

Sovereign Wealth Account: A state-controlled investment fund to hold currencies, gold, or now potentially Bitcoin, often to stabilize national reserves.

References

Disclaimer: This article is for informational purposes only and not financial or investment advice. Cryptocurrency investments are risky, consult a financial professional before making a decision.