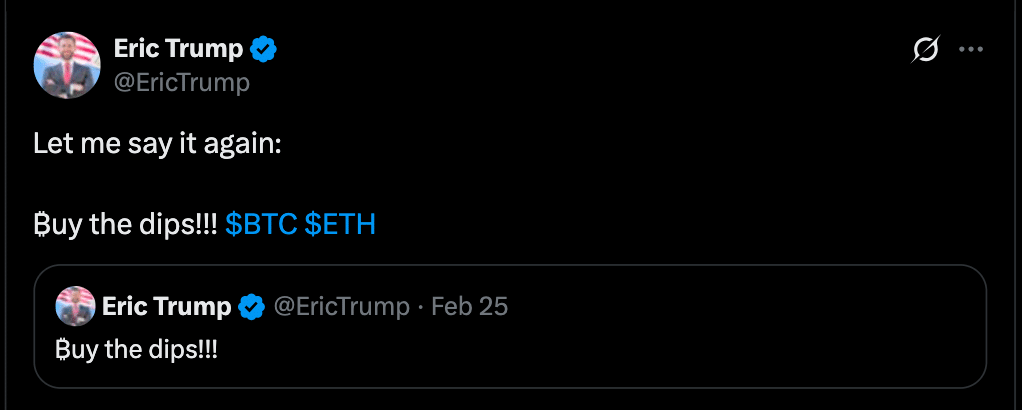

Bitcoin has dropped below the $117k–$120k zone over the past few days, down about 3.8% in three straight daily candles. This has triggered Eric Trump’s advice to accumulate now and buy the dip.

- Bitcoin’s Trend: Post-Halving August History Hints Mixed Signals

- Current Conditions: Weak ETF Demand and Macro Pressures

- Should Traders Buy the Dip? Projected Scenarios for Bitcoin

- Conclusion

- FAQs

- Does Bitcoin usually rise in August?

- What did Eric Trump say?

- Should traders follow that advice now?

- What are Bitcoin’s levels now?

- Glossary

He’s made comments like this before in February, when Bitcoin dropped below $90,000, telling his followers to buy the dip. However, that rebound didn’t hold and BTC fell to $77k as leveraged longs got liquidated.

Bitcoin’s Trend: Post-Halving August History Hints Mixed Signals

Going back through history, August hasn’t always been Bitcoin’s friend. Over the past dozen Augusts, about 60% showed negative monthly returns. This has seemingly become a typical market seasonality where August follows a strong July and then stalls as trading calms.

Nevertheless, August after halving years (2013, 2017, 2021) often stood out. In those years, BTC posted double-digit gains in August. According to experts, those were raw post-halving rallies; supply shrank, demand returned and momentum surged. Since 2024 was a halving year, the idea behind Eric Trump’s buy the dip call is based on that history. Some experts, however, say today’s conditions aren’t the same.

Current Conditions: Weak ETF Demand and Macro Pressures

Bitcoin ETFs have seen large outflows in the last few weeks. Over $800 million left U.S. funds in a single day, the worst quarter since earlier this year. This just reminds the market of Eric Trump’s previous call in February to buy the dip but that rally didn’t hold.

Reports show a small bounce followed but the price reversed sharply and by the end of the week BTC fell to $77k as leveraged longs got liquidated.

Meanwhile, macro pressures are building. Trade tariffs, high labor costs and uncertainty around U.S. Federal Reserve policy is weighing on risk assets. All these make August look less like a rally season and more like a pause. The resistance around $120k–$125k is firm and if investors are cautious, Bitcoin could stay in this range.

Should Traders Buy the Dip? Projected Scenarios for Bitcoin

If $BTC holds support around $110k–$112k and macro sentiment improves, it may break above $117k and reach toward $120k–$125k. That would be like past post-halving moves and reflect renewed interest.

If ETF outflows continue and risk appetite weakens, BTC could break below $110k. A drop to $100k is possible, as experts have warned that bearish sentiment would drag it lower.

Even though August history is mixed, half-year patterns can be powerful. August 2013 saw double-digit gains, 2017 and 2021 had similar strong rallies. Those years had less BTC and rising demand. If institutions return and sentiment shifts, history may repeat; but only if conditions align.

Market Chart shows August gains in those years ranged from 14% to 65%. That is attractive, but relying on that cycle alone could be risky. Unlike previous cycles, today’s backdrop has trade wars and no Fed clarity.

Instead of jumping in, experts say cautious traders may wait for confirmation, looking at sustained inflows, defined volume spikes, or a break above $120k with strength. That would be more conviction than a buy the dip call alone.

Conclusion

Based on the latest research, Eric Trump’s call to “buy the dip” may get attention but the crypto market shows reasons to pause. August has been a losing month more often than not.

This year’s conditions, such as weak ETF inflows, macro uncertainty, and resistance levels, make it hard to bet on a rally. If Bitcoin holds support and sentiment improves, there is upside. But without those shifts, the risk remains.

Investors are advised to wait for clearer signs before acting on social media calls alone.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

Bitcoin is on shaky ground as August begins. The recent dip brings up memories of earlier failed rebounds. Past August performance is negative except in halving years when gains were stronger. ETF outflows and macro risks add uncertainty. Eric Trump’s dip call echoes past cycles but history and indicators suggest caution.

FAQs

Does Bitcoin usually rise in August?

Most Augusts have been weak for BTC, though post-halving years like 2013, 2017 and 2021 saw strong gains.

What did Eric Trump say?

He told his followers to “buy the dip” when BTC fell below $90k in February and again on this recent drop. Those calls have gotten attention but mixed results.

Should traders follow that advice now?

It’s up to investors; but traders are advised to wait for volume confirmation or clearer macro signals before entering.

What are Bitcoin’s levels now?

Support is around $110k–$112k. Resistance is near $120k–$125k. A break either way could set August’s tone.

Glossary

Support level: a price area where demand could prevent further falls.

Resistance level: a price zone where selling slows gains.

ETF outflows: money leaving Bitcoin fund products, reducing demand.

Halving year: the year after Bitcoin’s issuance reward halves—historically tied to strong rallies.

MACD: a trend-following indicator showing momentum shifts.

Liquidity event: when a lot of assets are sold, often causing price moves.

Sources