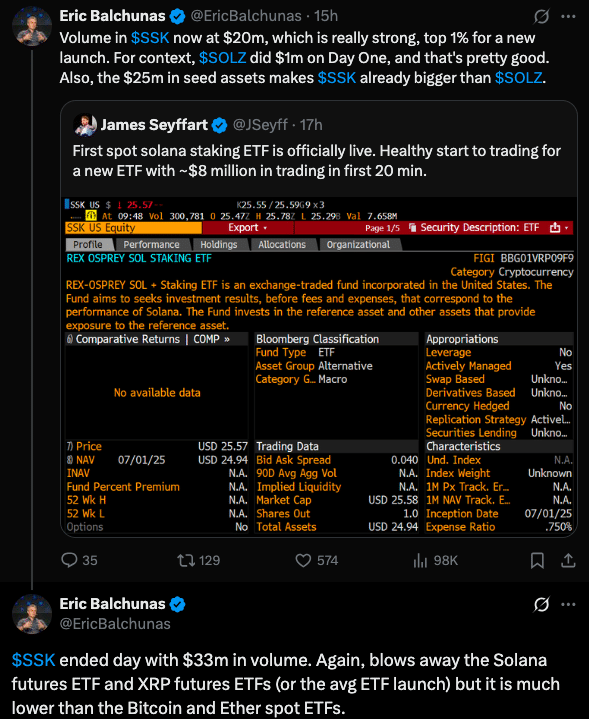

Based on the latest news reports, the first US Solana staking ETF just launched on July 2, 2025. Trading under the ticker ‘SSK’ on the Cboe BZX Exchange, the REX-Osprey Solana + Staking ETF had $33 million in volume and $12 million in inflows on its first day according to Bloomberg ETF analyst Eric Balchunas.

- How the Solana Staking ETF Works

- Anchorage Digital: The Institutional Backbone

- How It Compares: Costs, Rewards, and Future Outlook

- Why It Matters for Crypto ETFs in 2025

- Conclusion

- FAQs

- What is the Solana staking ETF?

- What staking model does it use?

- Who handles custody and staking?

- What are the fees?

- Is the ETF approved by the SEC?

- Glossary

This is a big deal for the US crypto investment space. Unlike previous Solana and XRP futures-based ETFs, SSK gives investors direct spot exposure to SOL and on-chain staking yield; a first in the US ETF market.

How the Solana Staking ETF Works

SSK is regulated under the Investment Company Act of 1940, a structure known for its investor protection and custody standards. It tracks the CME CF Solana-Dollar Reference Rate, so the price is tied to SOL’s real-time market performance.

About 80% of the fund’s assets are invested in Solana. Of that, at least half is staked using validators like Galaxy and Figment, so the ETF generates passive staking rewards. Those rewards are paid out as monthly cash dividends; a unique feature that sets SSK apart from futures-based or synthetic products.

The rest of the fund is in liquid staking tokens like JitoSOL and SOL-related ETFs listed in Canada and Europe for diversified Solana staking exposure.

Anchorage Digital: The Institutional Backbone

Custody and staking operations for the ETF are managed by Anchorage Digital, the first federally chartered crypto bank in the US. This was essential in getting SEC approval given the regulatory concerns around staking mechanics and asset classification.

After months of back and forth between REX Shares, Osprey and the SEC, the agency had no further objections after June 28, and as a result, SSK is now listed.

This fund is a regulatory breakthrough and unlocks compliant access to on-chain yield. It’s what institutional investors have been waiting for.

How It Compares: Costs, Rewards, and Future Outlook

SSK has a 1.4% total expense ratio broken down into a 0.75% management fee and 0.65% tax-related expense. That is higher than most spot Bitcoin or Ethereum ETFs (which are often under 0.5%) but proponents argue the integrated staking feature and direct monthly payouts add value for long-term holders.

It outperformed several altcoin futures ETFs and sent Solana (SOL) up over 4% in 24 hours to close above $150.

There are nine more Solana ETFs filed with the SEC and awaiting approval from major issuers like Fidelity, Franklin Templeton and VanEck. SSK may be the template for future products that combine spot crypto exposure with yield-generating mechanisms.

Why It Matters for Crypto ETFs in 2025

SSK is the first U.S. ETF to offer regulated access to a staking-enabled altcoin, which could change how investors interact with crypto assets in their brokerage accounts. It combines the passive income model of staking with the regulatory oversight and accessibility of ETFs.

It follows a wave of ETF approvals, including Bitcoin spot, Ethereum spot, and the Grayscale Crypto Index ETF, which covers a basket of leading digital assets like BTC, ETH, XRP, Solana, and Cardano.

Analysts think the approval of SSK opens the door for staking ETFs on other blockchains, like Polkadot, Avalanche, and Cardano, as investor appetite for yield-based products grows amid macro uncertainty.

Conclusion

The launch of the Solana staking ETF in the United States is a big deal. With $12 million in inflows, a compliant structure under the 1940 Act, and direct exposure to on-chain yield, SSK has set a new standard for altcoin ETFs. As more staking-based products move through the SEC pipeline, SSK’s early success will determine how future crypto products blend DeFi with traditional frameworks.

Summary

The U.S. saw its first Solana staking ETF launch on July 2 with REX-Osprey SSK on the Cboe exchange. Backed by Anchorage Digital, the ETF offers spot SOL exposure and staking rewards, saw $33M in volume and $12M in inflows on day one. With 80% of assets in SOL and monthly cash payouts from staking, SSK combines on-chain yield with regulated structure under the 1940 Act.

FAQs

What is the Solana staking ETF?

It’s the first U.S. ETF offering both spot SOL exposure and on-chain staking rewards in a regulated wrapper.

What staking model does it use?

The ETF stakes at least 50% of its SOL via institutional validators and distributes rewards as monthly cash payouts.

Who handles custody and staking?

Anchorage Digital, the only federally chartered crypto bank, does both.

What are the fees?

SSK charges 1.4% per year; 0.75% for management and 0.65% for tax handling of staking rewards.

Is the ETF approved by the SEC?

Yes. The SEC dropped objections by June 28 so the ETF can launch under the 1940 Act.

Glossary

Solana staking ETF – An ETF offering spot SOL exposure and staking yield.

Anchorage Digital – The regulated crypto bank that oversees custody and staking for the ETF.

CME CF Solana-Dollar Reference Rate – The price index that tracks SOL’s value.

Liquid staking tokens (LSTs) – Staked assets that are transferable, like JitoSOL.

1940 Act – U.S. law that governs investment companies.