Bitcoin (BTC) has faced a sharp price correction, falling nearly 30% from its all-time high of $109,000 in January 2025 to around $77,000 in March. This downturn has sparked concerns among investors, raising questions about whether this marks the beginning of a bearish phase or a typical correction within an ongoing bull market.

Several key factors have contributed to this decline, including profit-taking by large holders, reduced institutional buying, shifts in market sentiment, and broader macroeconomic uncertainties. Despite the retracement, historical patterns suggest that such corrections are common in strong bull markets, making it essential for investors to analyze the current trends and future outlook before making any market moves.

Key Factors Behind Bitcoin’s Price Decline

1. Profit-Taking by Large Holders

One of the primary reasons behind Bitcoin’s recent decline is profit-taking by large holders (whales). Data from Santiment indicates that major stakeholders began selling off their BTC holdings in mid-February. Between February 20 and March 8, approximately 22,702 BTC (valued at nearly $1.8 billion) were transferred from private wallets to exchanges, signaling a readiness to liquidate assets. This increase in selling pressure has contributed significantly to the downward movement in price.

2. Reduced Institutional Accumulation

During the final months of 2024, institutional investors played a crucial role in Bitcoin’s surge past $100K. However, institutional accumulation slowed significantly after the U.S. presidential inauguration, causing a drop in demand. While some institutional buyers resumed purchasing on March 3, the buying volume has yet to counteract the sell-offs from retail investors and whales.

3. Shifts in Investor Sentiment

Investor sentiment has also played a pivotal role in Bitcoin’s correction. Market data shows that many retail investors who entered late in 2024 have now exited at losses. Short-term traders are facing an average loss of 11%, while long-term holders have experienced a 5% decline over the past year. Additionally, social media sentiment has turned bearish, further dampening demand and leading to increased selling pressure.

4. Macroeconomic Uncertainties and Policy Concerns

Broader macroeconomic conditions have also influenced Bitcoin’s price drop. Concerns over new tariff policies, global trade tensions, and the pace of regulatory developments in the U.S. have led to increased market uncertainty. While the Biden administration has been generally positive toward crypto, many investors fear that delayed policy implementations and potential regulatory hurdles could limit Bitcoin’s growth in the near term.

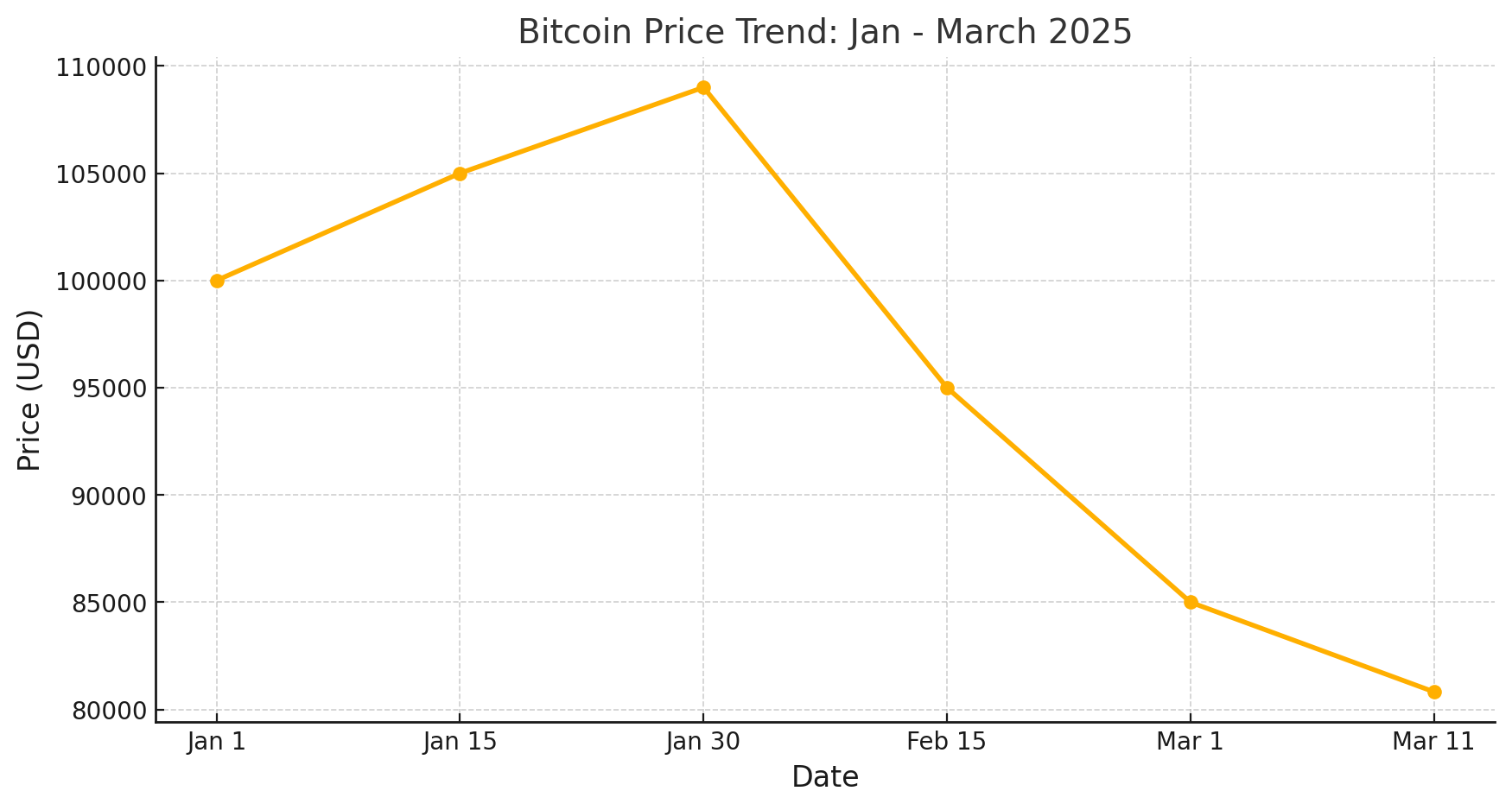

Bitcoin Price Trends: A Look at Recent Data

| Date | Price (USD) |

|---|---|

| Jan 1, 2025 | 100,000 |

| Jan 15, 2025 | 105,000 |

| Jan 30, 2025 | 109,000 |

| Feb 15, 2025 | 95,000 |

| Mar 1, 2025 | 85,000 |

| Mar 11, 2025 | 80,825 |

Bitcoin is currently trading around $80,825 as of March 11, 2025, marking a 1.44% decrease from the previous day. While this correction may seem severe, industry experts believe it is consistent with previous bull market trends.

Is Bitcoin Headed Lower or Ready for a Rebound?

Crypto analysts, including BitMEX co-founder Arthur Hayes, suggest that Bitcoin could further decline to $70,000 before finding strong support. Hayes believes this pullback is normal for bull markets, and historical patterns indicate that similar corrections have occurred before major rallies.

Additionally, monetary easing by central banks could provide a liquidity boost to financial markets, helping Bitcoin regain upward momentum in the coming months. Investors should closely monitor macroeconomic indicators, Federal Reserve policies, and institutional buying behavior for further insights into BTC’s trajectory.

Conclusion

Bitcoin’s recent price retracement reflects a combination of profit-taking, reduced institutional demand, investor sentiment shifts, and macroeconomic factors. While the decline may cause uncertainty in the short term, historical trends suggest that similar corrections have preceded major rallies in past bull markets. Investors should stay informed, analyze market conditions, and adopt a strategic approach to navigate the current landscape effectively.

FAQs

1. What caused Bitcoin’s recent price decline?

The decline is attributed to profit-taking by large holders, reduced institutional accumulation, shifts in investor sentiment, and macroeconomic uncertainties such as tariff policies and regulatory concerns.

2. Is this decline a sign of a bear market?

Not necessarily. Corrections of 30-40% are common in bull markets, serving as healthy adjustments before potential future rallies.

3. What should investors do during this correction?

Investors should avoid panic selling, assess long-term market trends, and closely monitor macroeconomic developments and central bank policies to make informed decisions.

4. What are the future prospects for Bitcoin?

While short-term volatility is expected, long-term projections remain bullish, especially if institutional demand increases and monetary easing measures support market growth.

Glossary of Key Terms

- Bitcoin (BTC): A decentralized digital currency without a central bank or administrator.

- Whale: A large-scale investor who holds significant amounts of cryptocurrency.

- Correction: A decline of 10% or more in the price of an asset from its most recent peak.

- Bull Market: A market condition characterized by rising prices and strong investor confidence.

- Bear Market: A prolonged period of declining prices and negative sentiment.