Investor sentiment in the cryptocurrency sector has reached a major inflection point in 2025. According to a new report by CoinShares, institutional and private portfolios have increased their crypto allocations to a yearly high of 1.8%, signaling a deepening commitment to digital assets.

This allocation growth — particularly among institutions with allocations up to 2.5% — reflects not only confidence in the macro trend of decentralized finance, but also strong momentum following Bitcoin’s resurgence.

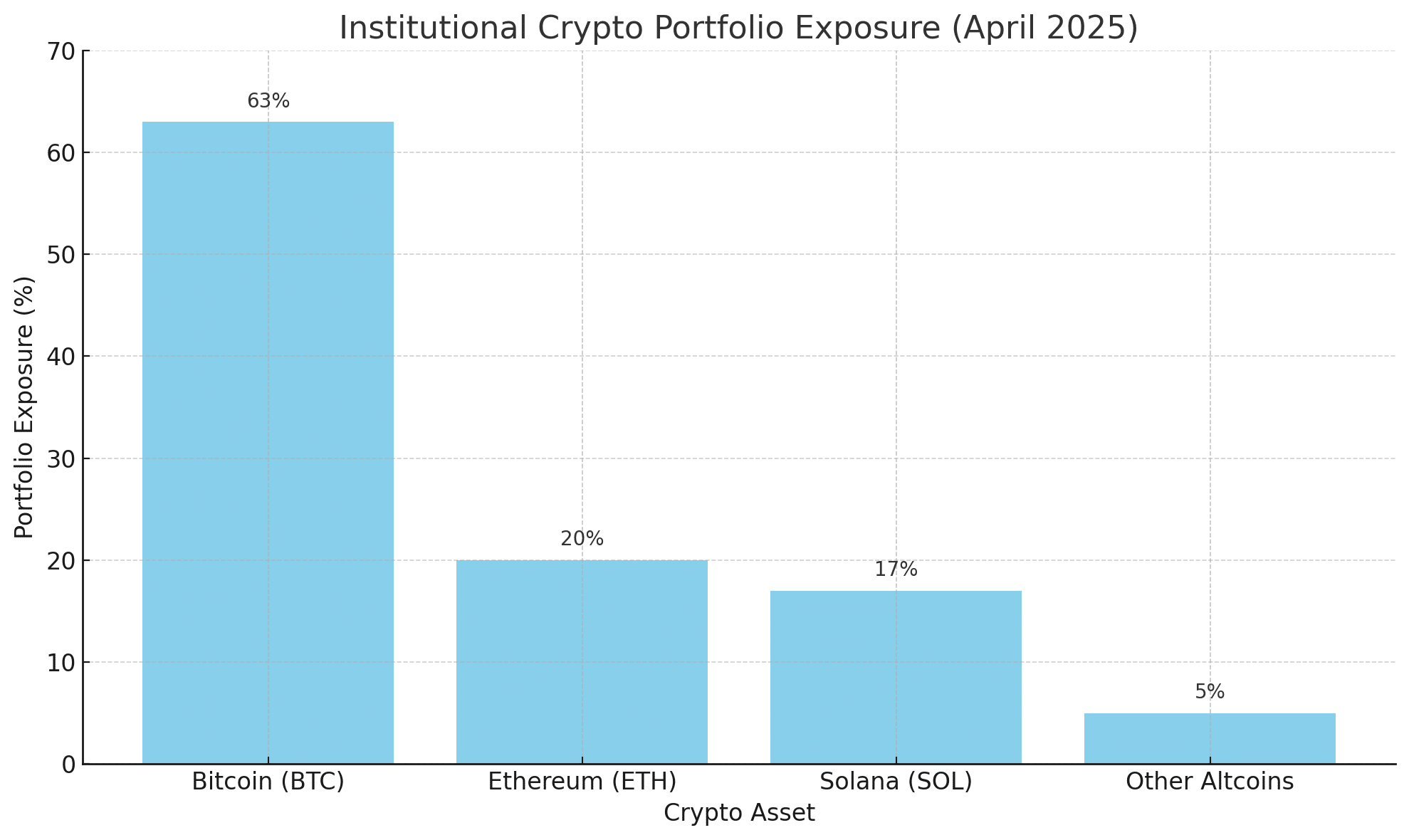

Bitcoin Dominates Portfolio Allocations

Bitcoin (BTC) continues to be the dominant digital asset across institutional portfolios.

63% of investors now report exposure to Bitcoin, up significantly from 48% in January 2025.

Ethereum (ETH) follows with nearly 20% allocation.

Solana (SOL) holds the third spot at 17%, outpacing other altcoins.

This shift underscores a broader institutional preference for blue-chip cryptocurrencies, with Bitcoin positioned as a macro hedge and long-term store of value.

“We’re seeing Bitcoin viewed as a digital bond alternative — it’s now in the same conversation as gold and treasuries for institutional allocators,” noted a CoinShares analyst.

Altcoin Allocations See Decline

While Bitcoin, Ethereum, and Solana enjoy increasing adoption, the broader altcoin market is witnessing a reduction in exposure:

Assets such as Polkadot (DOT), Cardano (ADA), and XRP registered minimal presence in surveyed portfolios.

This indicates a flight to quality within the crypto asset class, as investors favor liquidity, stability, and regulatory clarity.

“Altcoins are no longer getting a free pass. There’s more scrutiny now on utility, team execution, and network activity,”

said a portfolio strategist at a London-based hedge fund.

Why Institutions Are Increasing Exposure

The report highlights three primary motives for crypto inclusion:

Diversification: 30% of respondents cited portfolio diversification as the leading reason for holding crypto assets.

Technology Exposure: Interest in distributed ledger technologies (DLT) remains a key driver.

Speculative Opportunity: Some investors still see crypto as a high-risk, high-reward play.

These motives are supported by structural market changes — particularly the introduction of spot Bitcoin ETFs, improving regulation, and growing acceptance of digital assets by major financial players.

Recent Examples of Institutional Adoption

The report arrives amid a series of high-profile institutional moves into crypto:

Cantor Fitzgerald recently spearheaded a $3 billion investment initiative into Bitcoin.

The venture includes partnerships with Tether, SoftBank, and Bitfinex, targeting tokenized financial services and real-world asset integration.

Major U.S. pension funds and family offices are reportedly reevaluating their crypto exposure in 2025 portfolios.

These developments reinforce the notion that crypto is no longer an outlier — but an emerging asset class with a growing seat at the institutional table.

Crypto Allocation Trends: Yearly Snapshot

| Asset | Portfolio Exposure (April 2025) | Change Since Jan 2025 |

|---|---|---|

| Bitcoin | 63% | +15% |

| Ethereum | 20% | +3% |

| Solana | 17% | +5% |

| ADA, DOT, XRP | <5% | -4% to -6% |

Positioning for Q3 and Beyond

As the market matures, crypto is shedding its image as a speculative bet and becoming part of strategic asset allocation frameworks. Analysts expect crypto portfolio allocations to cross 3% average by Q4 2025, particularly if macro conditions remain favorable.

Institutional focus is expected to remain on:

Spot ETFs

Tokenization of assets

Real-world utility protocols

Risk remains — especially regulatory — but the risk-to-reward profile is evolving fast.

Conclusion: The New Reality for Digital Assets

The sharp increase in crypto portfolio allocations — led by Bitcoin — signals that digital assets are no longer on the fringe. Institutional adoption is driving the normalization of crypto in traditional finance, with risk frameworks, custody solutions, and ETF access all playing a role.

While Bitcoin leads the charge, Ethereum and Solana are carving their own niches. And while altcoins face increased scrutiny, the evolving regulatory clarity could allow select projects to rise back into investor focus in future quarters.

FAQs

Why are crypto allocations rising in 2025?

Investor confidence has grown due to stronger regulation, Bitcoin ETF inflows, and increased institutional access to crypto products.

What is the top asset in crypto portfolios now?

Bitcoin leads, with 63% of investors holding it in their portfolios, up from 48% in early 2025.

Are altcoins like Cardano and XRP still popular?

They’ve seen a drop in allocation, with institutional investors now focusing more on high-liquidity, blue-chip assets.

What’s the forecast for crypto allocations in 2025?

Analysts predict that crypto allocations could surpass 3% in average institutional portfolios by Q4 2025.

Glossary of Key Words

Portfolio Allocation – The percentage of total capital allocated to specific assets or asset classes in an investment portfolio.

Spot ETF – An exchange-traded fund that holds the underlying asset (like Bitcoin) directly, allowing exposure without direct ownership.

DLT (Distributed Ledger Technology) – A decentralized database used to record transactions across multiple nodes.

Blue-chip Crypto – Established and liquid digital assets with large market caps and proven adoption (e.g., BTC, ETH, SOL).

Sources

CoinShares Weekly Digital Asset Fund Flows Report – April 2025 Edition