This article was first published on Deythere.

Avalanche is back in the ETF spotlight after Grayscale filed Amendment No. 2 to convert its existing AVAX trust into an exchange-traded fund that would list on Nasdaq under the ticker GAVX. The document is dated December 23, 2025, and it reads less like hype and more like plumbing: custody, share creation, and the rules of the road for how shares should track the underlying token. For a market that often trades on whispers, this is the rare update that is written in ink.

Inside the Update: Baskets, Listings, and the Arbitrage Mechanism

The filing explains that shares would be created and redeemed in baskets of 10,000 shares, with authorized participants acting as the bridge between the fund and the market. It also states that Nasdaq has regulatory approval to allow creations and redemptions via in-kind transactions, meaning AVAX can be exchanged for shares, not only cash. That matters because in-kind flow usually strengthens the arbitrage mechanism that keeps ETF prices from drifting too far above or below net asset value.

Why In-Kind Is a Bigger Deal Than It Sounds

The prospectus is blunt about the risk: if in-kind activity is limited to only a few authorized participants, spreads can widen and premiums or discounts can grow, especially during volatility. In other words, an ETF can exist and still trade off if liquidity pipes are thin. That nuance helps explain why filings spend so much time on participant agreements and settlement mechanics. It is not paperwork for paperwork’s sake, it is price tracking.

Fees and Staking: Competitors Put Numbers on the Table

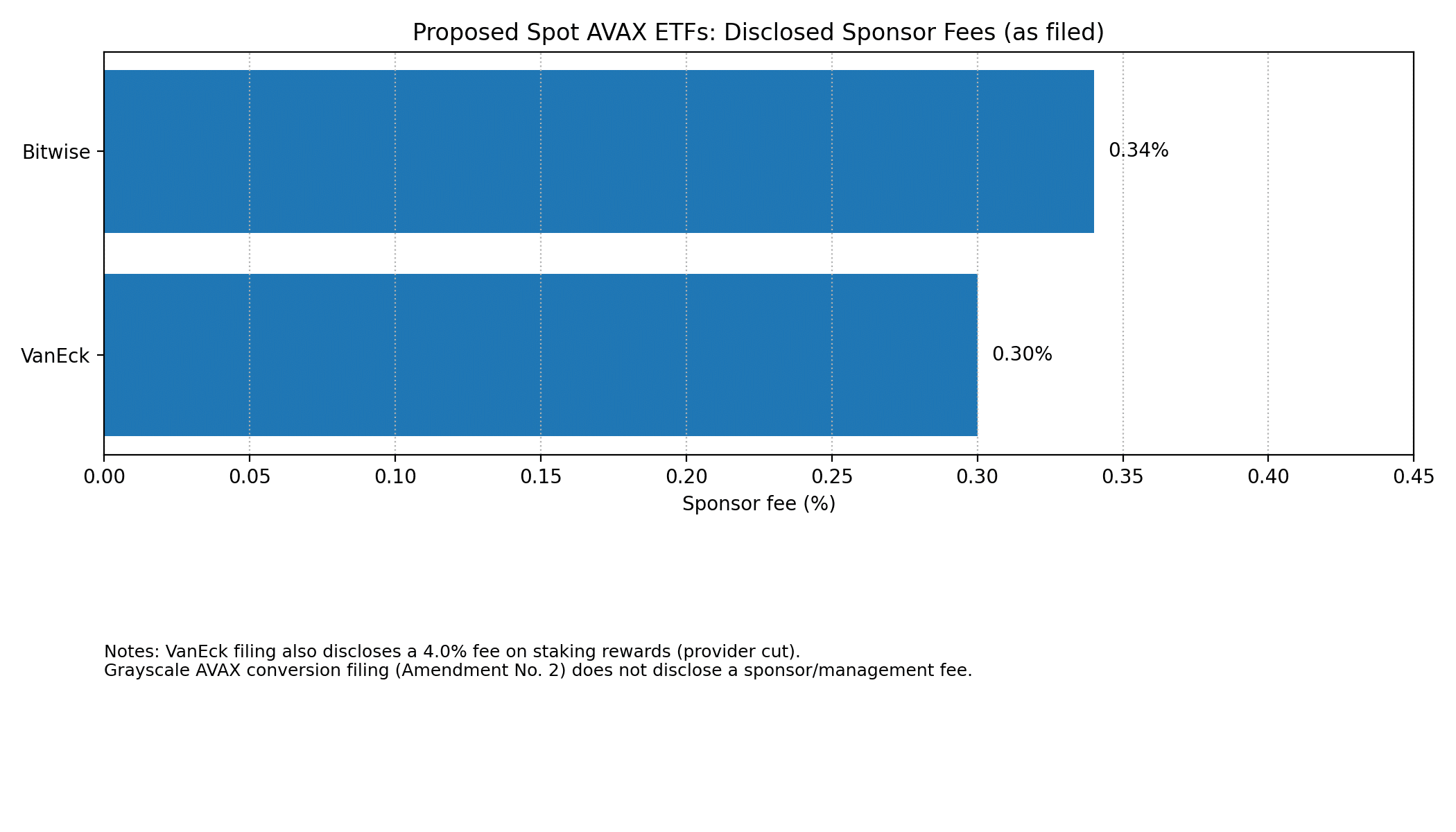

This is also becoming a pricing war. VanEck’s updated prospectus lists a unified sponsor fee of 0.30% and describes staking rewards flowing to the fund after a 4.0% staking provider cut, with the custodian staking facilitation fee currently at 0.0%.

Bitwise discloses a 0.34% annual sponsor fee, plus a stated secondary goal of seeking additional AVAX via staking, alongside a short fee waiver window tied to early assets. Together, those details set expectations for what institutional-ready AVAX exposure looks like in 2026, including how yield is earned and how costs show up in NAV.

Where AVAX Trades While the Process Plays Out

AVAX is not pricing in an approval stamp yet. On December 25, 2025, it trades near $12.18, a level that has acted like a revolving door for months, with rallies struggling to hold and dips attracting bargain hunters. The ETF narrative can change that calculus over time by widening the investor funnel, but the near-term tell is still behavior around liquidity: sustained volume, daily closes above nearby resistance, and whether pullbacks stay orderly instead of panicked.

Conclusion

The newest amendment does not promise an ETF launch date, but it does show the effort moving from concept to mechanics: in-kind flows, authorized participants, custody, and staking economics. For AVAX investors, that is the important signal. When documents get specific, products get closer to real trading, and narratives stop being just narratives.

Frequently Asked Questions

What is a spot AVAX ETF?

A spot AVAX ETF is a listed fund designed to hold AVAX directly and mirror its market price through exchange-traded shares, net of fees and expenses.

What does in-kind creation and redemption mean?

It is a process where authorized participants exchange AVAX for new ETF shares, or ETF shares for AVAX, which can help keep the share price aligned with net asset value.

Will staking increase returns?

Staking can add yield by earning extra AVAX, but the result depends on staking rates, lockup and liquidity policies, and the fees deducted by service providers and custodians.

Glossary of Key Terms

Authorized Participant: A firm approved to create or redeem ETF share baskets.

Basket: A large block of shares, such as 10,000, used for creations and redemptions.

In-Kind: Settlement using AVAX instead of cash.

NAV: Net asset value, the per-share value of holdings minus liabilities.

Staking: Locking AVAX to help secure the network in exchange for rewards.