According to latest reports, Bloomberg analyst has announced that the launch of the first U.S. Dogecoin ETF is around the corner. This breakthrough is also followed by a $68 million corporate treasury purchase by Cleancore, carrying Dogecoin’s finance vehicle straight into the mainstream markets.

Memecoin Financial Innovation Arrives

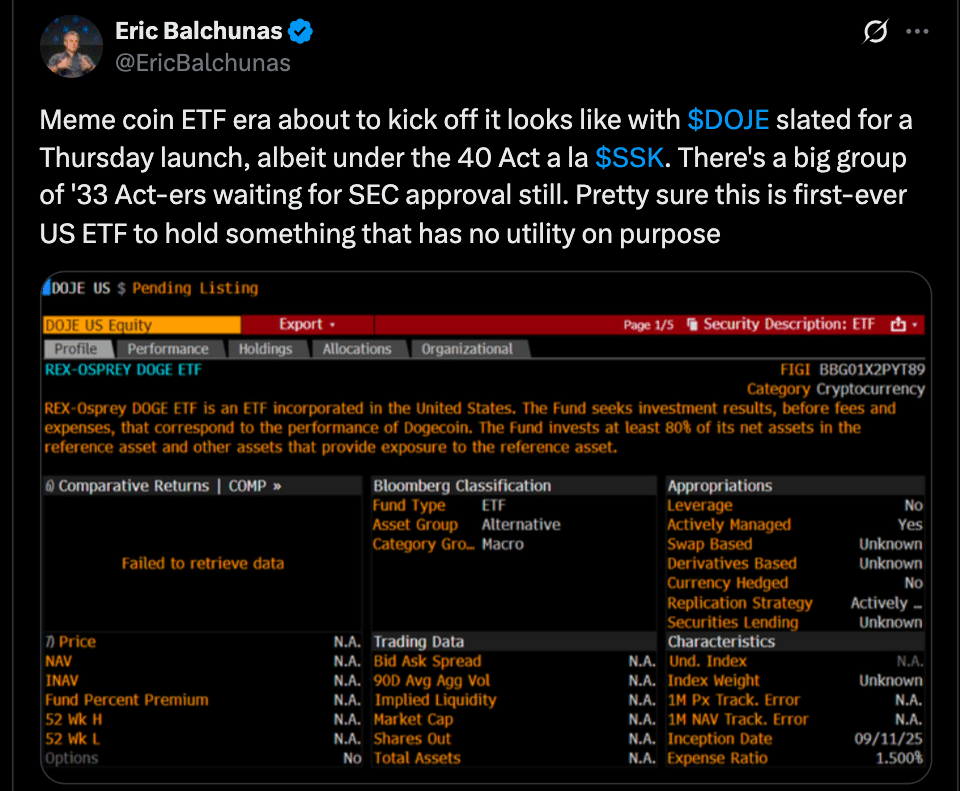

For years, $DOGE was dismissed as pure speculation. This is seemingly about to change as Bloomberg analyst Eric Balchunas announced that Rex-Osprey is launching the first US exchange-traded fund directly linked to Dogecoin on September 11.

This is the acceptance of an asset with no intrinsic utility yet gaining legitimacy as a traded financial instrument. The ETF, ticker DOJE, is a fast-track structure under the Investment Company Act of 1940 routed through a Cayman Islands subsidiary; an approach that speeds up the launch vs the traditional 19b-4 process.

While quick, this setup raises tax and structural questions, even as it pulls meme-based tokens into the ETF mainstream.

Also read: Dogecoin ETF Nears SEC Approval: First U.S. Launch Could Be Next Week

Corporate Treasuries Embrace $DOGE

At the same time, CleanCore Solutions, listed on the NYSE American, announced it bought 285.42 million DOGE, a $68 million investment, as part of a plan to accumulate 1 billion DOGE in 30 days.

This makes it the largest corporate Dogecoin treasury holder. The accumulation is in line with the firm’s goal to own 5% of the token’s supply over time. The initiative is fully backed by the Dogecoin Foundation and facilitated through its corporate arm House of Doge.

It restructures Dogecoin as functional, embedded into use cases like payments, tokenization, staking-style products, and cross-border transfers.

Custody and transaction services will be handled through a partnership with Bitstamp USA operating under Robinhood to increase transparency and lay the groundwork for yield-bearing $DOGE products.

Market Response and Culture

The financial markets reacted bullishly to CleanCore’s announcement. Their shares went up 38% in after-hours, and Dogecoin’s price went up about 7% immediately. Beyond the numbers, the market is now looking at Dogecoin differently.

This institutional acceptance of $DOGE is part of the meme coin financial innovation narrative, where meme coins are being systematically integrated into instruments and reserves.

Why This Matters

By launching a Dogecoin ETF (DOJE) outside the traditional filing process; the financial industry is expanding what is considered an investable asset, even those previously dismissed.

CleanCore’s approach is a new model: treasuries backed not by cash or bonds but by digital collectibles with high liquidity and cultural significance. It shows how volatility can be an asset when cohesion and transparency are added.

The connection between CleanCore, House of Doge, and Robinhood-backed Bitstamp shows emerging infrastructure for DOGE-backed financial products. This includes payment rails, tokenized use cases, staking products, and yields, giving economic utility to Dogecoin.

Also read: Solana, XRP, Dogecoin ETFs in Sight as SEC Releases New Crypto Guidelines

Conclusion

Based on the latest research, the combination of the first-ever Dogecoin ETF and a corporate treasury DOGE reserve is changing the perspective with which meme coins are viewed.

DOJE brings $DOGE into regulated investing, and CleanCore’s treasury shows it can support corporate strategy. The fusion of meme culture, corporate finance and institutional service platforms means $DOGE’s future goes into real, innovative finance.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

With the launch of the U.S.’s first Dogecoin ETF and CleanCore’s billion-DOGE treasury strategy, $DOGE is moving beyond its meme roots. Institutional structures, corporate finance and utility-driven frameworks are coming together to remodel how meme-based tokens work in the modern financial system.

Glossary

Memecoin Financial Innovation – The process of integrating meme-based cryptocurrencies like Dogecoin into structured finance, including ETFs, corporate treasuries and utility tokens.

DOJE ETF – The first U.S. exchange-traded fund directly linked to Dogecoin, launching under Rex-Osprey’s structure.

Investment Company Act of 1940 Structure – Regulatory pathway allowing for faster ETF launch through a fund structured as a C-corp with offshore holdings; avoiding SEC review.

Official Dogecoin Treasury – Corporate treasury strategy by CleanCore to hold DOGE as a reserve asset, targeting one billion tokens.

House of Doge – Corporate arm of the Dogecoin Foundation, involved in CleanCore’s treasury strategy and utility rollout.

FAQs for Dogecoin ETF Launch

What does the Dogecoin ETF (ticker DOJE) mean?

DOJE is the first U.S. ETF for a meme coin with no traditional utility.

How did CleanCore buy $DOGE?

CleanCore acquired 285.42 million DOGE ($68M) as part of its Official Dogecoin Treasury, targeting one billion DOGE and backed by the Dogecoin Foundation and House of Doge.

What’s the role of Robinhood’s Bitstamp?

Bitstamp USA, via Robinhood’s platform, will custody and execute CleanCore’s DOGE reserves to bring institutional grade reliability and transparency.

Why is this innovation?

Memes in mainstream finance via ETFs and corporate treasury reserve strategies means new frontiers where cultural digital assets become financial instruments, changing asset utility.