Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, continues to be a focal point for investors and developers alike. As we progress through 2025, Ethereum price dynamics are influenced by various factors, including technological upgrades, market sentiment, and significant whale activities. This article delves into Ethereum’s price predictions for 2025 and 2026, examining the underlying factors that could drive its value in the coming years.

- Ethereum (ETH) Price Forecast for 2025

- ETH Whales Activity: Accumulation and Distribution Patterns

- Key Factors Influencing Ethereum Price

- Global Institutional Interest: ETH as a Digital Commodity

- From PoW to PoS: Ethereum’s Evolving Economic Model

- Ethereum Technical Analysis and Market Sentiment

- Conclusion

- Frequently Asked Questions (FAQs)

- Glossary of Key Terms

Ethereum (ETH) Price Forecast for 2025

| Month | Predicted ETH Price (USD) | Commentary |

|---|---|---|

| January | $2,350 | ETH started the year with modest growth, recovering from late-2024 lows. |

| February | $2,480 | Gradual price appreciation driven by growing ETF interest. |

| March | $2,670 | Market sentiment improved as staking deposits surged past 25M ETH. |

| April | $2,835 | Whale accumulation resumed ahead of major upgrade announcements. |

| May | $3,050 | Anticipated breakout fueled by PECTRA upgrade and rising DeFi TVL. |

| June | $3,280 | Increased developer activity and Layer-2 adoption boosted Ethereum price stability. |

| July | $3,540 | Bullish sentiment around ETF filings pushed ETH to new yearly highs. |

| August | $3,725 | Staking withdrawals slowed, reinforcing long-term holder confidence. |

| September | $3,950 | ETH approached the $4K resistance amid strong dApp and NFT usage. |

| October | $4,175 | Institutional demand continued to rise as the macroeconomic outlook improved. |

| November | $4,420 | ETH crossed psychological resistance with growing TVL and ecosystem growth. |

| December | $4,650 | Year-end surge driven by retail FOMO and favorable regulatory signals. |

Ethereum Price Prediction for 2026

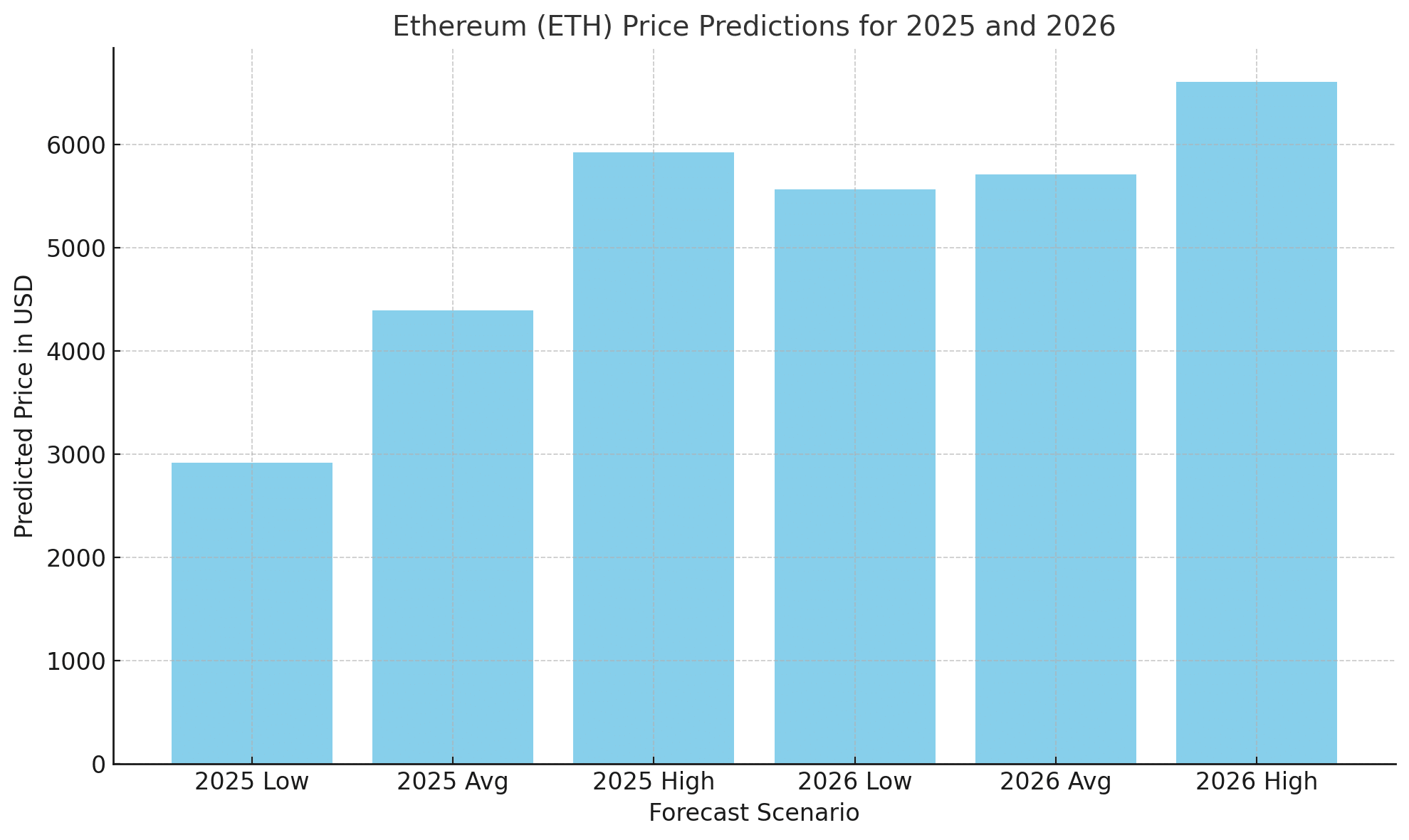

Analysts have provided a range of price forecasts for the Ethereum price in 2025 and 2026, reflecting varying market conditions and adoption scenarios.

| Year | Potential Low | Average Price | Potential High |

|---|---|---|---|

| 2025 | $2,917 | $4,392 | $5,925 |

| 2026 | $5,566 | $5,713 | $6,610 |

These projections consider factors such as the implementation of Ethereum’s PECTRA upgrade, which aims to enhance scalability and performance, and the broader adoption of decentralized applications (dApps) and decentralized finance (DeFi) platforms.

ETH Whales Activity: Accumulation and Distribution Patterns

Whale activities have a significant impact on Ethereum price movements. In recent months, large holders have exhibited both accumulation and distribution behaviors.

| Date | Activity Type | ETH Amount | USD Value |

|---|---|---|---|

| April 2025 | Accumulation | 7,074 ETH | ~$13 million |

| April 2025 | Distribution | 262,000 ETH | ~$445 million |

Sources: Finextra, CryptoRank

These activities suggest a strategic approach by whales, balancing profit-taking with long-term confidence in Ethereum’s potential.

Key Factors Influencing Ethereum Price

1. Technological Upgrades

Ethereum’s roadmap includes significant upgrades aimed at improving scalability and reducing transaction costs. The PECTRA upgrade, combining the Prague and Electra proposals, is expected to enhance the network’s efficiency and attract more developers and users.

2. Institutional Adoption

The approval of Ethereum-based ETFs and increased interest from institutional investors are contributing to Ethereum’s credibility as an investment asset. These developments could lead to increased capital inflows and Ethereum price appreciation.

3. Regulatory Landscape

Regulatory clarity, particularly concerning Ethereum’s classification and staking mechanisms, will play a crucial role in its adoption and Ethereum price trajectory. Positive regulatory developments could boost investor confidence and drive demand.

Global Institutional Interest: ETH as a Digital Commodity

Ethereum is on a fast course toward acceptance as a bona fide digital commodity, leaving its origins as a speculative crypto asset far behind. In 2025, several of the most respected asset managers in the world—BlackRock and Fidelity, included—are still engaged in promoting the approval of Ethereum ETFs in multiple jurisdictions.

While the U.S. opens the doors of approval, regulators in Canada, Germany, and the UAE are also examining Ethereum-based financial products, which amplify global confidence. The growing institutional interest doesn’t just further liquidate the market; it also lends credibility to Ethereum from the perspective of relatively conservative investors and pension funds.

ETH is currently being considered in the light of diversified portfolios along with traditional commodities and tech equities. Aside from this, the narrative of Ethereum’s participation in real-world asset (RWA) tokenization—from real estate to bonds—has been gaining traction in the story of financial innovation.

These trends are bound to gain momentum, and analysts think that Ethereum’s utility-based value could be the first to decouple from the cyclical short-term hype of its crypto peers. ETH will see a fresh valuation avenue in perspective as institutional adoption and asset tokenization hit scales by 2026 and beyond.

From PoW to PoS: Ethereum’s Evolving Economic Model

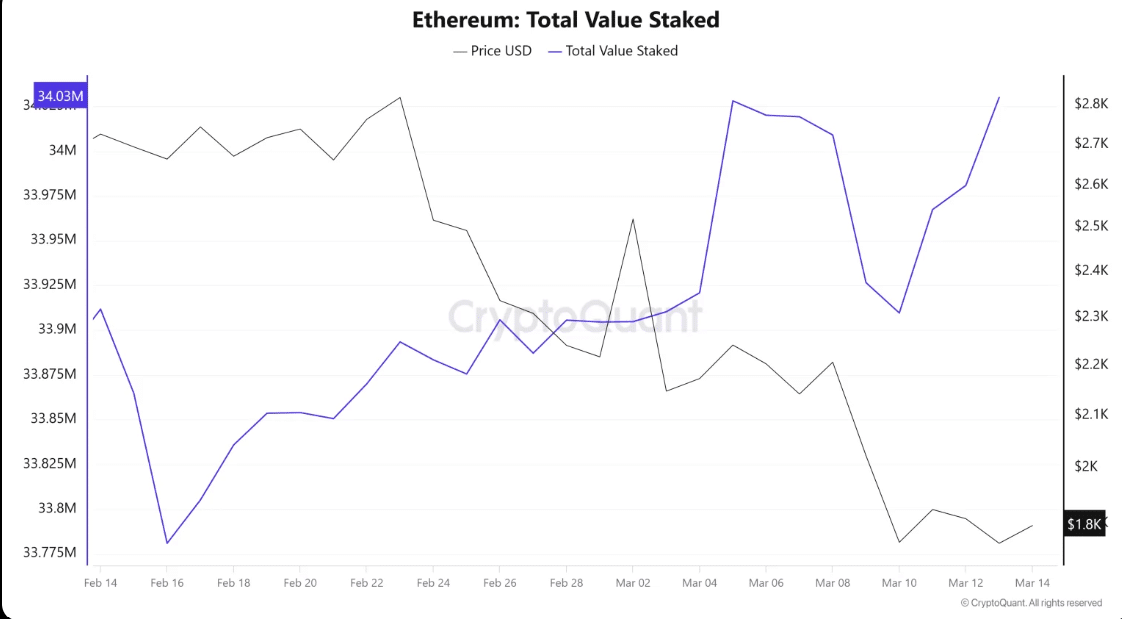

The Merge transitioned Ethereum from PoW to PoS, drastically impacting its tokenomics, and the effects continue to unfold into 2025. Following the transition, ETH issuance dropped drastically, often resulting in a net-deflationary model due to EIP-1559 burning part of transaction fees.

This has reduced the circulating supply over the long term, effectively making Ethereum price scarcer over time. Furthermore, staking rewards bolster holding behavior such that there are currently over 27 million ETH locked up in validator contracts. With increasing quantities of ETH being taken out of active circulation, market analysts are seeing the development of supply shock conditions—one of the vital ingredients for advancing price rallies.

The upcoming PECTRA upgrade is projected to further lower gas fees and improve throughput, which may spike activity in Ethereum’s dApps and user acquisition. These macroeconomic changes, in turn, reinforce ETH’s deflationary character as a yield-generating asset, forming a strong rationale for investors to anticipate sustained upward Ethereum price pressure leading into 2026.

Ethereum Technical Analysis and Market Sentiment

As of May 2025, the Ethereum price is trading around $1,825.22. Technical indicators suggest a neutral to bullish outlook, with the Relative Strength Index (RSI) hovering around 50, indicating neither overbought nor oversold conditions. The Moving Average Convergence Divergence (MACD) shows a potential bullish crossover, which could signal upward momentum.

Market sentiment remains cautiously optimistic, with the Fear & Greed Index indicating a state of “Greed,” suggesting that investors are leaning towards risk-on behavior.

Conclusion

Powerful fundamentals- superimposed upgrades, growing institutional trust, and a maturing DeFi ecosystem- are what determine Ethereum’s price journey through 2025 and into 2026. With PECTRA upgrades to improve scalability and staking dynamics to tighten supply, Ethereum is poised not just for short-term gains but for a magnitude of a good long-term future.

Whale movements and ETF interest add to the bullish case here. One thing, though: volatility is always going to be present in the crypto markets. But Ethereum’s changing place as a financial backbone makes this rise toward $6k not just possible, but more likely.

Frequently Asked Questions (FAQs)

Q1: What is the current price of Ethereum?

As of May 3, 2025, Ethereum is trading at approximately $1,825.22.

Q2: What are the Ethereum price predictions in 2025 and 2026?

Analysts predict that Ethereum could reach between $2,917 and $5,925 in 2025, and between $5,566 and $6,610 in 2026, depending on market conditions and adoption rates.

Q3: How do whale activities affect Ethereum’s price?

Whales, or large holders of Ethereum, can influence price movements through significant buying or selling activities. Accumulation by whales can signal confidence and drive prices up, while large sell-offs can lead to price declines.

Q4: What is the PECTRA upgrade?

The PECTRA upgrade is a planned enhancement to the Ethereum network that aims to improve scalability and performance by combining the Prague and Electra proposals.

Q5: Is Ethereum a good investment for the long term?

Ethereum’s ongoing development, widespread adoption, and position as a leading smart contract platform make it a strong candidate for long-term investment. However, investors should consider market volatility and conduct thorough research.

Glossary of Key Terms

Ethereum (ETH): A decentralized, open-source blockchain featuring smart contract functionality.

Whale: An individual or entity that holds a large amount of cryptocurrency, capable of influencing market prices.

PECTRA Upgrade: An upcoming Ethereum network upgrade aimed at enhancing scalability and performance.

ETF (Exchange-Traded Fund): A type of investment fund traded on stock exchanges, holding assets such as stocks or cryptocurrencies.

RSI (Relative Strength Index): A momentum indicator measuring the speed and change of Ethereum Price movements.

MACD (Moving Average Convergence Divergence): A trend-following momentum indicator showing the relationship between two moving averages of a security’s price.

Fear and Greed Index: A tool used to gauge investor sentiment in the market, ranging from extreme fear to extreme greed.

Sources and References

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.