The Bitcoin $300K call option, expiring June 26, 2025, has become the second most popular trade on Deribit, the largest crypto options exchange, with over 5,000 contracts and $484 million in notional open interest. Based on available data, few actually expect Bitcoin to triple in value in weeks, but the trade’s popularity says more about market psychology and macro-political undercurrents than it does about price targets.

Inside the Bitcoin $300K Call Option

At its core, this option play is about asymmetry. For a relatively low premium, around $60 per contract in recent trades, traders get exposure to an outcome that, while unlikely, could deliver an outsized payoff. One Deribit contract is one Bitcoin, so if Bitcoin were to hit $300,000, the profit per contract would be massive.

The timing isn’t coincidental. June 26 is the largest quarterly expiry of 2025, when institutional and high-net-worth traders re-evaluate positions and risk. According to Deribit data, the $110K strike still has the most open interest, but the surge in Bitcoin $300K call option interest shows a turn toward speculative optimism or maybe calculated hedging against major tail risks.

Political Catalysts Add Fuel to the Fire

Some of the recent call interest is not due to technical market indicators but to political developments. GSR trader Simranjeet Singh attributes part of the call accumulation to “bets on a broader US regulatory narrative being pro-crypto” referencing the resurfaced idea of a Bitcoin strategic reserve floated by policymakers earlier this year.

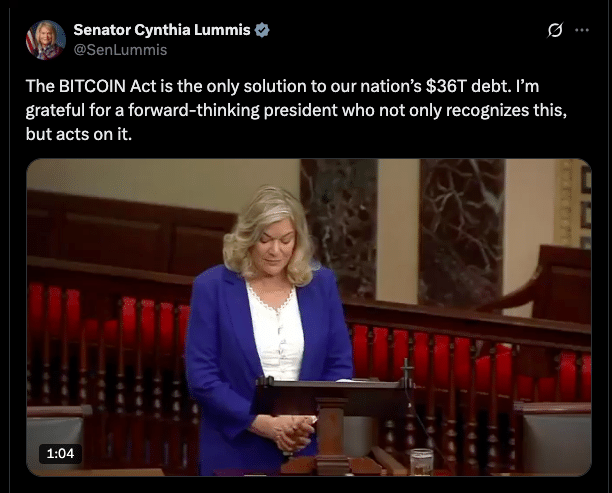

The theory gained more traction after Senator Cynthia Lummis publicly endorsed the BITCOIN Act, a legislative proposal that would allow the US Treasury to hold Bitcoin as a strategic reserve asset.

“The BITCOIN Act is the only solution to our nation’s $36 trillion debt” Lummis said in a speech on April 26, after President Donald Trump was said to be backing the plan.

While the bill is far from law, its symbolic weight hasn’t gone unnoticed by traders.

Why Traders Compare This Bet to a Lottery Ticket

The $300K call is a deep out-of-the-money (OTM) or “wing” option; cheap to buy but requires dramatic price moves to be profitable.

“Maybe people just like buying lottery tickets,” said Spencer Hallarn, a derivatives trader at GSR. “As evidenced by the call skew, there are always people that want the hyperinflation hedge.”

The skew refers to the imbalance in call vs put interest, where people are willing to speculate on extreme bullish outcomes more than hedge against downside risks. This isn’t new but the size of the position is historic. Second only to the $110K call.

Who’s Buying the $300K Calls?

While buyers are looking for upside, sellers are using these strike levels for income generation. Tony Magadini, Director of Derivatives at Amberdata, said April saw a lot of $300K call selling, part of a covered call strategy to earn premium income while holding spot Bitcoin.

“Each option was sold for about $60 at 100% implied volatility,” Magadini told CoinDesk.

So sellers are more interested in cashing in on the optimism than betting against a $300K Bitcoin.

This is common in both crypto and traditional finance. By selling calls far above the current spot price, traders can collect the premium without expecting the option to be exercised. It’s a way to monetize the bullish sentiment without going all in.

Conclusion: A Quick Look at Market Sentiment

The interest in the Bitcoin $300K call isn’t a sign that people think it will happen. It’s a sign of the current speculation, macro-political rumors and strategic hedging.

Bitcoin is volatile in 2025 and even as spot prices consolidate, options data shows lots of activity. Traders are walking the tightrope between FOMO and strategic exposure. The $300K call, despite the long odds, is both a dream and a hedge.

As Bitcoin is well below six figures, the $300K call frenzy shows how speculative crypto markets are. It’s more than a financial bet, it’s a bet on policy shifts, inflation fears and the intersection of politics and digital assets. The trade is now a Q2 2025 market sentiment indicator and a reminder that in crypto, the impossible gets priced.

FAQs

What is the Bitcoin $300K call?

It’s a derivatives contract that gives the holder the right but not the obligation, to buy one Bitcoin at $300,000 on or before June 26, 2025.

Why is the $300K call popular?

It’s cheap, has high upside and political events like the BITCOIN Act proposal suggesting strategic adoption by the U.S.

Is $300K a realistic bet?

Most people don’t think so; it’s a speculative trade, like a lottery ticket or a hedge against unlikely but big events.

What’s Deribit’s role in this?

Deribit is the biggest Bitcoin options exchange with over 75% market share. It’s for institutional and retail speculation and hedging.

What’s a covered call?

Selling calls against a long position in the underlying asset to earn premium income. Common in both crypto and traditional markets.

Glossary

Bitcoin Call Option: A contract that gives you the right to buy Bitcoin at a certain price by a certain date.

Deep Out-of-the-Money (OTM): An option with a strike price far from the current price, ‘cheaper but less likely to be exercised.

Open Interest: The total number of outstanding derivative contracts (options or futures) ‘that haven’t been settled.

Covered Call: An ‘options strategy where you hold a long position in an asset and sell call options on that same asset to earn income.

Implied Volatility (IV): A measure of market’s expectation of future volatility used’ in options pricing.

BITCOIN Act: A legislative proposal that ‘suggests the US could hold Bitcoin as a reserve asset.