This article was first published on Deythere.

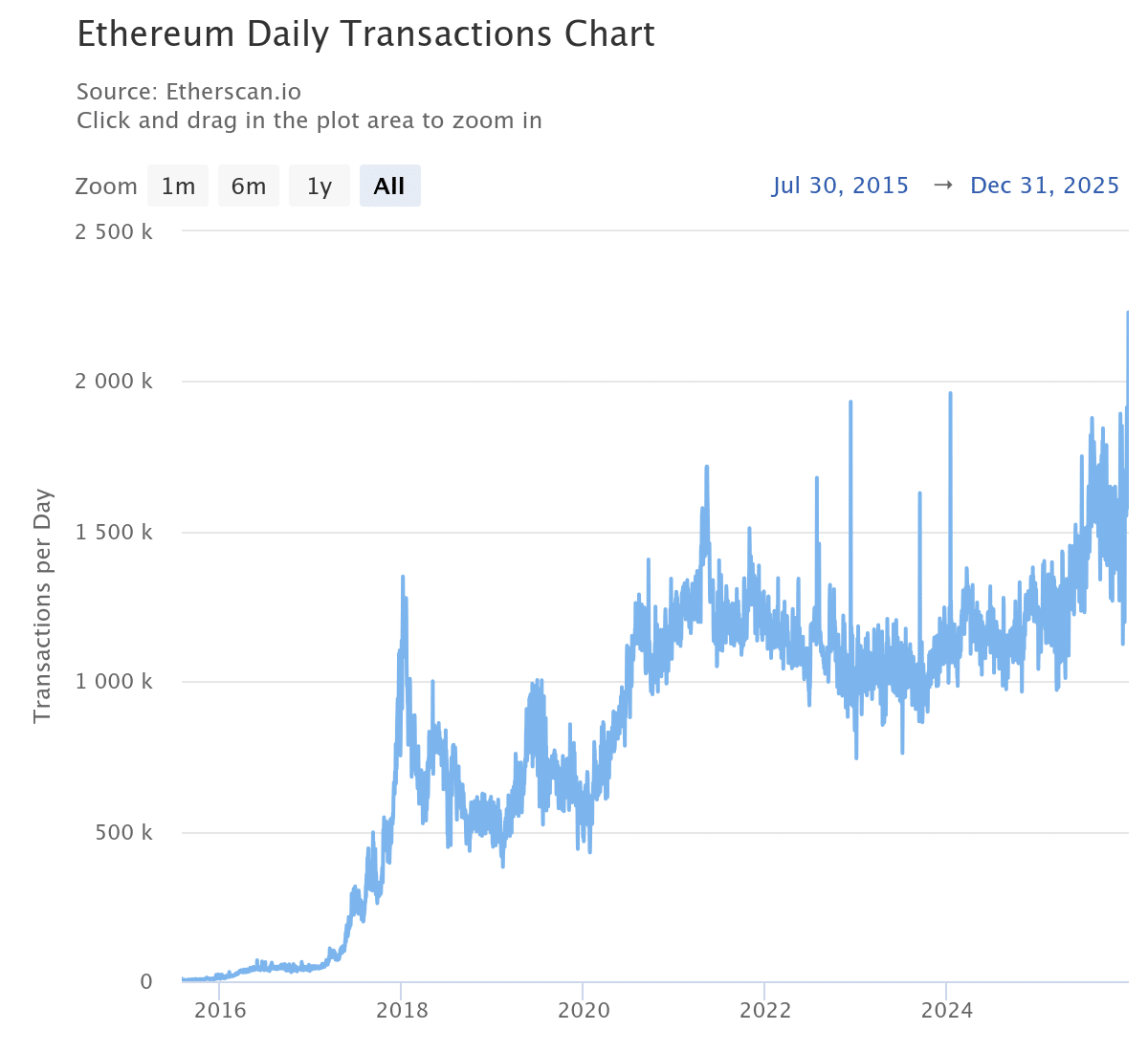

Ethereum transaction activity closed 2025 on a historic note, signaling more than just a spike in usage. The network processed its highest number of daily transactions ever, while a long-watched shift inside Ethereum’s staking system pointed to renewed confidence among validators and long-term holders.

According to the source, Ethereum’s main network recorded over 2.23 million transactions on December 29. Verified on-chain data shows this was the highest single-day total in the network’s history, achieved during a period of low fees and stable market conditions rather than congestion or speculation.

A Transaction Surge Built on Structural Change

This record did not happen in isolation. Two major protocol upgrades introduced in 2025 reshaped how Ethereum handles activity. The Pectra upgrade in May focused on validator efficiency and smoother interaction with Layer-2 networks. Later in the year, the Fusaka upgrade expanded block capacity by roughly 33 percent and introduced Peer Data Availability Sampling.

These improvements allowed the network to process more Ethereum transaction volume per block without increasing hardware strain on validators. Research published through publicly available blockchain studies explains that sampling-based verification reduces the need for nodes to download full datasets, preserving decentralization while improving throughput.

Verified transaction metrics supporting this milestone can be reviewed through publicly accessible blockchain data available here:

Why Layer-2 Growth Matters More Than Ever

Ethereum’s role has evolved. Much of today’s activity comes from Layer-2 networks that rely on Ethereum for settlement rather than execution. These networks post data using temporary containers known as blobs. Fusaka expanded blob handling and improved verification, allowing rollups to scale cheaply.

As a result, Ethereum transaction growth now reflects real usage rather than fee-driven congestion. Developers view this as a sign that Ethereum is settling into its role as a base layer for a broader ecosystem rather than competing with its own scaling solutions.

Ethereum Staking Inflows Flip the Narrative

At the same time, Ethereum staking inflows quietly overtook exits for the first time in six months. Roughly 740,000 ETH now sits in the validator entry queue, compared with about 350,000 to 370,000 ETH waiting to leave.

This reversal matters because Ethereum staking inflows reduce liquid supply and strengthen network security. Analysts often treat staking behavior as a long-term signal, since validators commit capital with extended lockups. Improved staking flexibility introduced under Pectra also shortened activation times, making entry more attractive.

Institutional participation played a role as well. Large deposits observed on-chain suggest that Ethereum staking inflows are increasingly driven by structured investment strategies rather than retail speculation.

Low Fees Reinforce Adoption

Despite the fact that transaction volumes surged, transaction fees declined quickly. At the time when the milestone was achieved, the average Ethereum fee was only $0.17 per transaction. As opposed to 2022’s all-time high of over $200 during times when the network is congested, this is miles away.

Lower fees encourage experimentation and sustained usage. That dynamic feeds directly into higher Ethereum transaction counts, reinforcing the effectiveness of recent upgrades.

Market Context Adds Perspective

ETH is trading near $2,974, with a 24-hour trading volume of around $16.09 billion, based on the latest live market data.

Price action has remained relatively steady, yet on-chain signals continue to strengthen beneath the surface. Network activity and validator behavior show improving fundamentals.

Historical analysis of proof-of-stake networks suggests that rising Ethereum staking inflows often point toward longer-term valuation shifts, rather than short-lived rallies driven by speculation.

Conclusion

Ethereum’s record transaction day was not a fluke. It reflected years of engineering choices finally aligning with real-world demand.

With low fees, rising Ethereum staking inflows, and scalable infrastructure, Ethereum now resembles financial plumbing rather than experimental technology. That quiet transition may prove more important than any headline rally.

Glossary of Key Terms

Ethereum transaction: A confirmed action recorded on Ethereum’s blockchain.

Ethereum staking inflows: ETH entering validator queues to secure the network.

Blob data: Temporary storage used by Layer-2 networks for settlement.

PeerDAS: A method that verifies data through sampling instead of full downloads.

FAQs About Ethereum Transaction

Why did Ethereum transaction activity reach a record?

Network upgrades increased capacity while keeping fees low.

What do rising Ethereum staking inflows indicate?

Growing long-term confidence and stronger network security.

Did higher usage increase fees?

No, fees declined to multi-year lows.

Does this affect Ethereum’s future role?

It strengthens Ethereum’s position as a settlement layer.