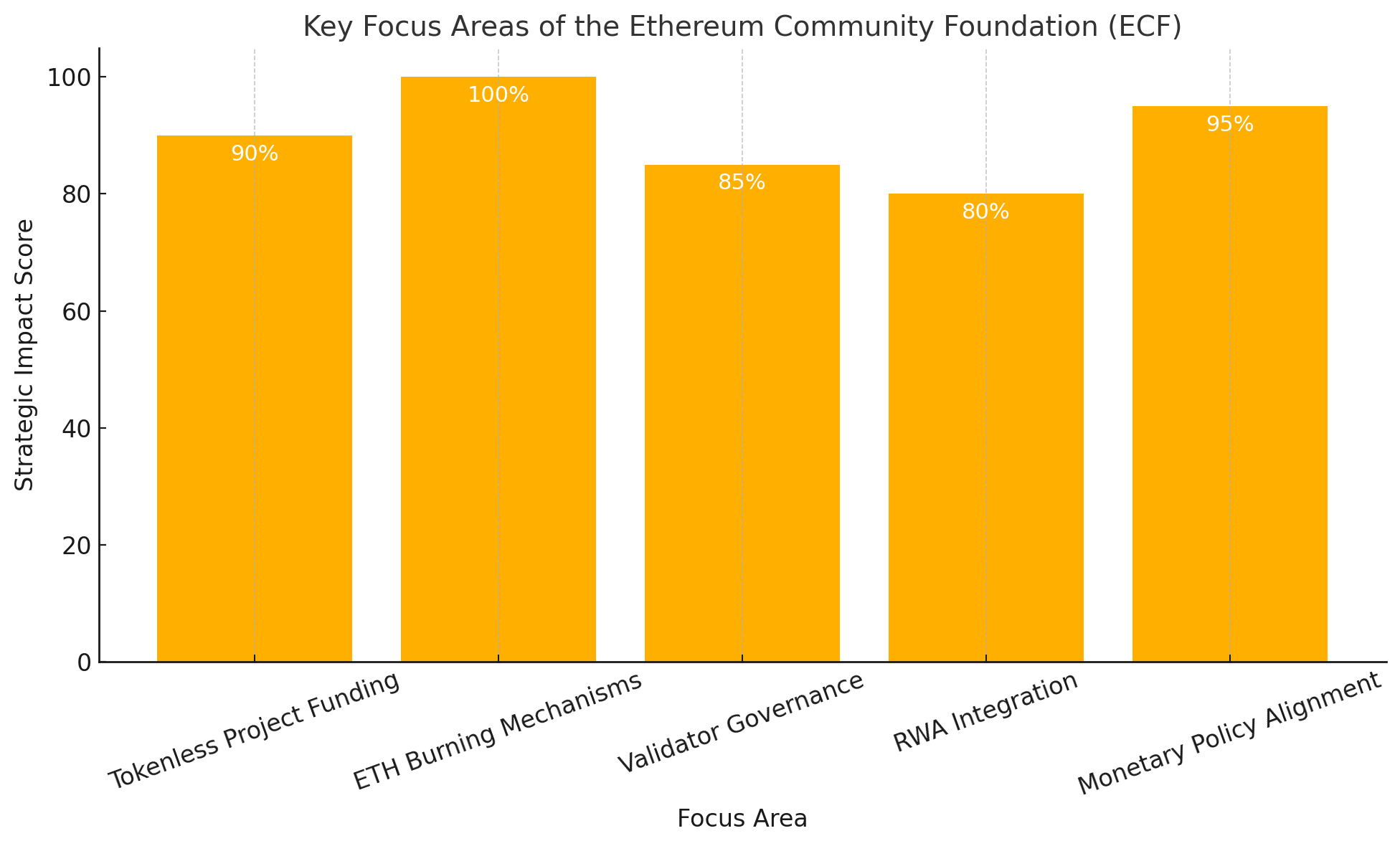

Ethereum core developer Zak Cole has introduced the Ethereum Community Foundation (ECF), a grant program dedicated to funding ETH burning mechanisms through tokenless infrastructure. The strategy rejects inflationary tokens in favor of projects that permanently remove ETH from circulation, aiming to fortify Ethereum’s deflationary narrative and validator influence.

Why Tokenless and ETH Burning Mechanisms Matter

The ECF will consider only applications that meet four strict criteria: immutability, community ownership, open-source licensing, and, above all, robust ETH burning mechanisms. By eliminating native tokens, the foundation seeks to steer attention toward Ethereum itself, using ETH burning mechanisms as a built-in incentive instead of speculative emissions. Cole’s blueprint extends the logic of EIP-1559, arguing that systemic burns can transform the network into a self-reinforcing store-of-value platform.

Ethereum Validator Association: Voices for Stakers

ECF’s maiden grant finances the Ethereum Validator Association (EVA), a nonprofit that enables stakers to cast on-chain signals using their validator keys. The EVA charter mandates that governance upgrades incorporate ETH burning mechanisms whenever possible, whether via base-fee burns, penalty slashing, or layer-two roll-ups funneling fees back to the main-net. The result, Cole contends, will be a feedback loop in which validator preferences directly shape monetary policy.

Funding Real-World Asset Integrations

Another ECF target class is real-world assets (RWA) protocols, equity, debt, and commodities, that clear trades on Ethereum without creating new governance tokens. Transaction fees from these RWAs will be designed as ETH burning mechanisms, linking traditional finance volume to Ether scarcity. Analysts predict that institutional demand for on-chain treasuries could transform ETH into the base money of a global settlement layer.

Timing the Deflationary Wave

Spot-market data show $1.1 billion in fresh ETH inflows since late June, coinciding with renewed discussion around ETH exchange-traded funds in the United States. Cole’s announcement rides this momentum, positioning ETH burning mechanisms as the centerpiece of Ethereum’s value proposition just as institutions seek deflationary assets with transparent monetary policies.

Expert Commentary

Katie Talati, Head of Research at Arca, noted:

“Focusing on tokenless, ETH-burning infrastructure is a step toward sustainable monetary policy. This isn’t about another hype token, it’s about ecosystem-level discipline.”

Meanwhile, analysts at Coin World added:

“Zak Cole’s ECF is in dialogue with the Ethereum Foundation’s shifting priorities, it’s institutionalization through integrity.”

Comparative View: Beyond the Foundation’s Grants

Traditional Ethereum Foundation grants occasionally include token-launch projects. In contrast, ECF prohibits them outright, insisting that ETH burning mechanisms create sufficient incentives for builders. Observers frame the two funds as complementary: one nurtures early research, while the other aligns on-chain economics with long-term scarcity.

What’s Next

July Grant Round: ECF opens its first call for proposals within weeks; all applicants must detail their planned ETH burning mechanisms.

Validator Signaling Beta: EVA will roll out slashing-secure voting modules, letting stakers endorse upgrades tied to ETH burning mechanisms.

RWA Pilot Launch: A collateralized treasury-bill platform is rumored to be the first RWA to channel fee revenue into automatic burns.

Conclusion

Zak Cole’s Ethereum Community Foundation reshapes ecosystem incentives by pairing tokenless architecture with rigorous ETH burning mechanisms. If successful, the program could hardwire deflation into daily network usage, bolster validator governance, and attract traditional capital seeking transparent monetary discipline.

Eight mentions of the primary keyword underscore its strategic importance and, more importantly, mirror the initiative’s central thesis: Ethereum’s future value may hinge not on new tokens but on how effectively ETH burning mechanisms can turn activity into scarcity.

Frequently Asked Questions

Q1: Why avoid new tokens?

Removing token issuance limits dilution, regulatory complexity, and speculative churn.

Q2: How are grants allocated?

ETH holders will coin-vote on proposals; all transactions remain publicly auditable.

Q3: Do burns affect gas prices?

No. Base-fee algorithms remain unchanged; burn size depends on usage, not fee spikes.

Q4: Can developers still earn revenue?

Projects generate cash flow from services and may share fee rebates, but without minting governance tokens.

Glossary

ETH burning mechanisms: Protocol rules that permanently remove ETH from circulation.

Tokenless project: An application launched without a native token.

Validator association: A collective that voices staker preferences on protocol upgrades.

EIP-1559: Ethereum upgrade that introduced base-fee burns.

RWA protocol: Platform that tokenizes real-world financial instruments on blockchain.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)