China has swiftly retaliated against the United States’ recent imposition of tariffs, sending shockwaves through the cryptocurrency market. Investors grapple with heightened uncertainty and market volatility as the world’s two largest economies lock horns.

China’s Swift Retaliation: A New Chapter in the Trade War

Just moments after President Donald Trump’s 10% tariff on Chinese imports took effect, China responded with its own set of tariffs targeting key American exports. The Chinese government announced a 15% levy on U.S. coal and liquefied natural gas (LNG), along with a 10% tariff on crude oil, agricultural machinery, and certain automobiles. These measures are set to be implemented on February 10.

In addition to these tariffs, China has expanded its Unreliable Entity List, adding major U.S. companies such as PVH Corp., the parent company of fashion brands Tommy Hilfiger and Calvin Klein, and Illumina Inc., a biotech firm specializing in genomic sequencing. Being placed on this list subjects these companies to potential fines and restrictions on trade and investment within China.

Cryptocurrency Market Turmoil: Investors React to Escalating Tensions

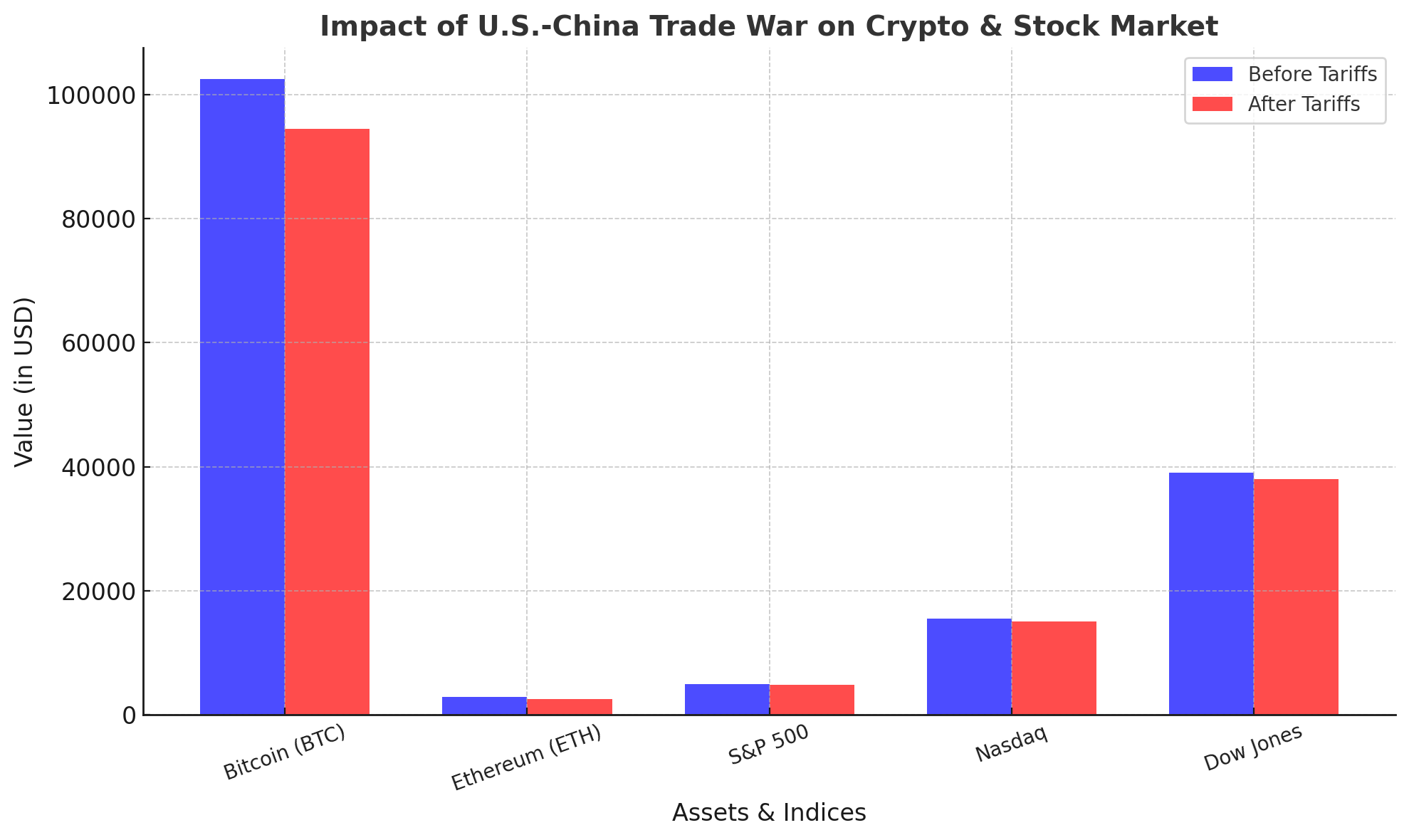

The escalating trade war has had a profound impact on the cryptocurrency market. Bitcoin (BTC), the flagship cryptocurrency, experienced a significant drop, falling to a three-week low of $94,476.18. Ethereum (ETH) also faced a downturn, reaching its lowest levels since early September,

This downturn was sparked by President Trump’s announcement of significant tariffs on Mexican, Canadian, and Chinese imports. Investor panic led to a sell-off, wiping out over $2 billion in liquidations within 24 hours. High-profile figures like Robert Kiyosaki expressed that this period could be an opportunity for wealth accumulation despite the market’s struggles. Digital wealth analyst Sydel Sierra advised against panic selling, encouraging investors to take a long-term view of the market.

Global Markets React: A Ripple Effect Across Economies

The repercussions of the U.S.-China trade tensions are being felt across global markets. European stocks dipped after China announced its retaliatory tariffs. The Stoxx Europe 600 index dropped 0.1%, and the UK’s FTSE 100 fell 0.2%. Analysts noted that the market’s reaction was muted as China’s response was measured. Asian markets performed better, with Hong Kong’s Hang Seng index rising 2.8%, driven by gains in Chinese tech stocks such as Tencent and Alibaba.

In the U.S., major indices such as the S&P 500, Nasdaq, and Dow Jones saw declines of up to 1.9%. Analysts warned of increased economic disruption and inflation in the U.S. due to the tariffs, contrary to investor expectations that Trump’s threats were mere negotiating tactics. The new tariffs could also delay potential rate cuts from the Federal Reserve, adding further volatility to the markets.

Expert Insights: Navigating the Uncertainty

Financial experts are closely monitoring the situation, offering insights into the potential long-term impacts. Shier Lee Lim from Convera noted that China’s tariffs are designed to pressure key U.S. export sectors while managing domestic inflation, predicting that U.S. GDP may slow significantly. Naka Matsuzawa highlighted Trump’s focus on China as a crucial economic rival, suggesting ongoing tariffs unless China makes major economic concessions. Charu Chanana observed market volatility due to uncertainty, indicating potential ongoing disruptions even if a trade deal is reached.

Looking Ahead: What This Means for Investors

As the trade war between the U.S. and China intensifies, investors are advised to exercise caution. The cryptocurrency market, known for its volatility, may continue to experience significant fluctuations in response to geopolitical events. Diversification and a long-term investment strategy remain key. Staying informed through reliable news sources and consulting with financial advisors can help you navigate these turbulent times.

Conclusion

The escalating trade tensions between the U.S. and China have introduced a new wave of uncertainty in global markets, notably affecting the cryptocurrency sector. As both nations implement tit-for-tat tariffs, investors worldwide feel ripple effects. Remaining vigilant, informed, and strategic is essential as this economic saga unfolds.

FAQs

Q: How have the recent U.S.-China trade tensions affected the cryptocurrency market?

A: The trade tensions have led to increased volatility in the cryptocurrency market, with significant drops in the prices of major cryptocurrencies like Bitcoin and Ethereum.

Q: What specific tariffs has China imposed in response to U.S. measures?

A: China has announced a 15% tariff on U.S. coal and liquefied natural gas (LNG), and a 10% tariff on crude oil, agricultural machinery, and certain automobiles, effective February 10.

Q: How are global markets outside of cryptocurrencies reacting to the U.S.-China trade war?

A: Global markets have experienced declines, with European stocks dipping and U.S. indices such as the S&P 500, Nasdaq, and Dow Jones seeing significant drops.

Q: What steps can investors take to navigate the current market volatility?

A: Investors are advised to diversify their portfolios, adopt a long-term investment strategy, stay informed through reliable news sources, and consult with financial advisors.

Q: Are there any indications of a resolution between the U.S. and China?

A: As of now, both nations continue to implement retaliatory measures, and a resolution does not appear imminent. Investors should prepare for ongoing volatility.

Glossary of Key Terms

Tariff – A tax imposed by a government on imported or exported goods. In this case, the U.S. and China are imposing tariffs on each other’s products, affecting global trade.

Trade War – An economic conflict in which countries impose tariffs or other trade barriers against each other in retaliation for economic policies. The U.S.-China trade war has caused market instability.

Unreliable Entity List – A Chinese government blacklist that restricts trade and investment for foreign companies deemed to be harming China’s interests. Companies on this list face fines and restrictions.

Export Controls – Regulations that limit the sale or distribution of certain products to foreign countries. China introduced export controls on critical minerals, impacting industries worldwide.

Antitrust Investigation – A legal inquiry into whether a company is engaging in monopolistic or anti-competitive practices. China’s antitrust investigation into Google is part of its broader retaliation against the U.S.

Cryptocurrency (Crypto) – A digital or virtual currency that uses cryptographic technology for security. Bitcoin (BTC) and Ethereum (ETH) are among the most well-known cryptocurrencies.

Market Volatility – The degree of variation in the price of assets over time. High volatility in crypto markets means rapid price swings, often influenced by global events.