This article was first published on Deythere.

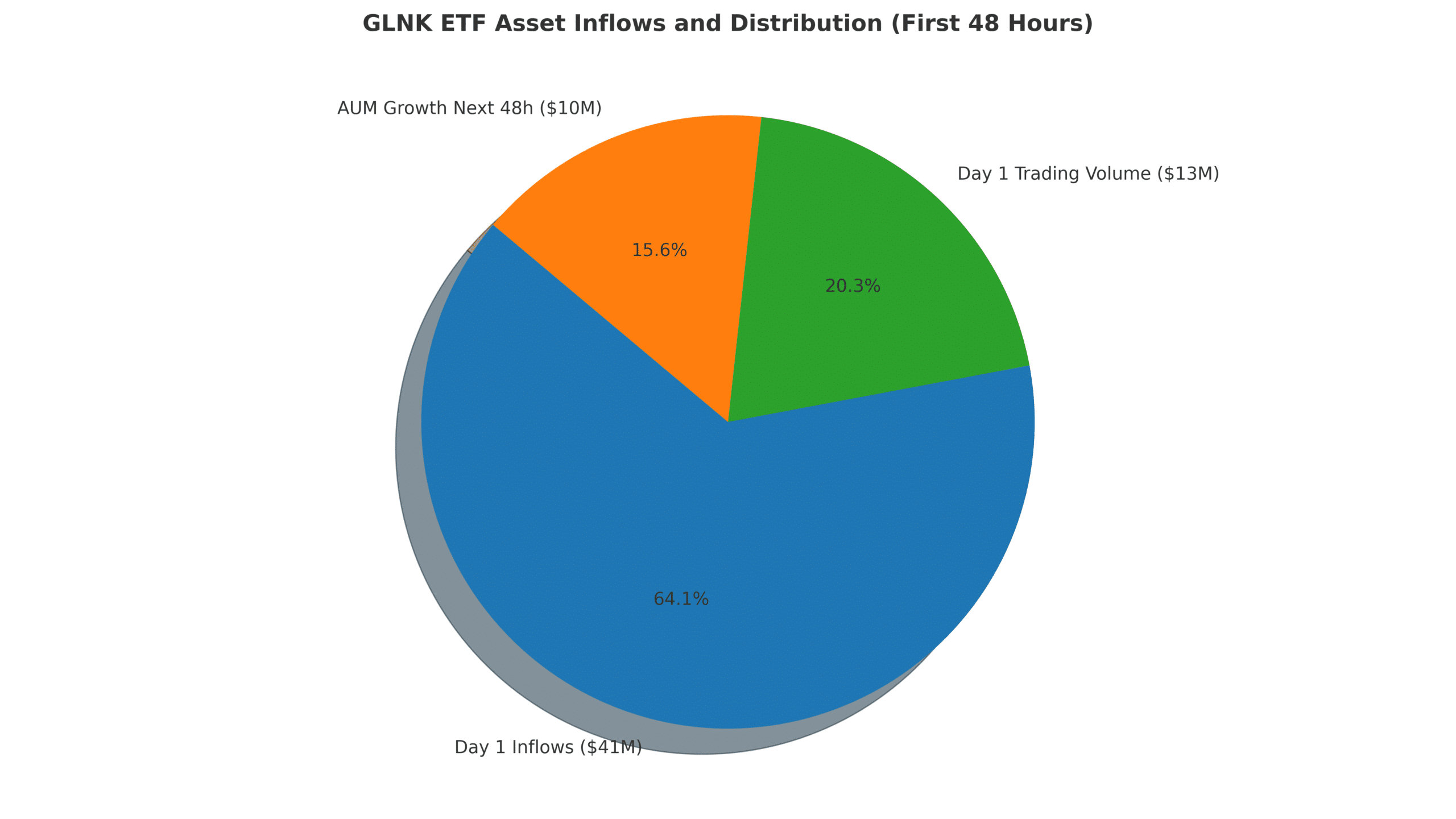

The Chainlink ETF hit the market with surprising strength when GLNK began trading on December 2, 2025 on NYSE Arca. According to the source, the fund gathered about $64 million in assets within the first 48 hours.

Early trading also showed solid activity. GLNK traded roughly 1.17 million shares on day one, with trading volume between $13 million and $14 million. Investors poured in around $41 million on that first day alone. LINK, the native token tied to the ETF, saw its price jump nearly 20 percent in 24 hours, climbing to about $14.38 after the ETF listing.

The launch of the Chainlink ETF marks a new route for investors. It offers regulated exposure to LINK and removes the need for users to manage wallets or deal with complex custody practices. GLNK transforms a utility token into a traditional investment vehicle, opening doors for both retail and institutional participants seeking blockchain infrastructure exposure.

What GLNK Offers: Structure, Access, and Clarity

The Chainlink ETF trades under the ticker GLNK. It follows NYSE Arca rules for physically backed commodity vehicles, holding LINK as its sole asset. The fund started with a 0 percent management fee, a standard seeding strategy.

The fee will change to 0.35 percent on a set date or once the fund’s assets reach $1 billion. Cold storage for the tokens sits with a major custodian, giving investors familiarity and security.

Those features make GLNK more than just another crypto headline; it becomes a bridge between traditional finance and crypto infrastructure. Investors can now get exposure to a key oracle network using ordinary brokerage tools rather than wrestling with private keys or crypto-exchange accounts.

Initial Response: Buying Pressure Meets Token Surge

Market response to the Chainlink ETF was swift. High trading volume and substantial inflows reflect strong interest. For many buyers, the ETF provided a clean, regulated path to hold LINK.

On the token side, LINK responded sharply. With price moving up nearly 20 percent to reach roughly $14.38, many observers saw the launch as a fresh trigger for demand. Some market watchers even described the debut as “another insta-hit” for the broader altcoin ETF wave of 2025.

Still, not everyone expects smooth sailing. The ETF removes staking rewards and shifts risks onto price appreciation alone. Holding LINK inside GLNK feels different than staking or holding the token directly. Investors now pay a management fee and lose out on native crypto yields.

What’s Next: Will LINK Price Track Usage?

The key test for GLNK will come over the next several months. Analysts expect the fund could grow to $150 million–$300 million in assets under management by mid-2026. In a bullish scenario, it could even reach $400 million–$600 million, provided that institutional clients adopt public infrastructure rather than private oracle alternatives.

The bigger question remains whether real-world use of the underlying oracle network will translate into sustained LINK demand. If institutions pay fees in fiat, or build private oracle systems, LINK’s price may not rise — even if usage of the network increases.

So far, GLNK offers a clean, regulated gateway. But for LINK’s token economics to benefit, adoption must go hand in hand with token demand.

Conclusion

The debut of the Chainlink ETF signals growing trust in oracle networks and gives investors a regulated path into LINK. Early inflows and strong trading show clear interest, but long-term results still depend on real-world usage and steady demand from institutions.

As markets track the next steps in adoption, the Chainlink ETF sits at the point where traditional finance and blockchain finally meet with purpose.

Glossary

Chainlink ETF: A regulated fund offering exposure to LINK without requiring a crypto exchange.

GLNK ETF: The ticker for the first U.S. spot-based Chainlink ETF.

Spot ETF: An ETF that is investing in the actual underlying asset rather than futures or derivatives.

Staking Yield: The returns paid to token holders who lock up their assets to back certain operations on the blockchain.

- Institutional Investor: Large firms such as hedge funds, banks, and asset managers that invest professionally.

FAQs About Chainlink ETF

1. Can any investor buy the Chainlink ETF?

Yes. GLNK trades on a major U.S. exchange, so investors with access to U.S. brokerage accounts can buy it — no crypto wallets required.

2. Does the ETF provide staking or yield from LINK?

No. GLNK holds LINK but does not pass on staking rewards. Returns rely solely on price moves and ETF flows.

3. Could LINK’s price fall even if Chainlink usage rises?

Yes. If institutions use the network but pay in fiat or adopt private oracle systems, LINK demand could stay flat or even drop.

4. What fee does the ETF charge?

The fee is 0 percent initially. It will rise to 0.35 percent by early 2026 or once AUM hits $1 billion.