Canada leads the world again in crypto financial innovation as the Ontario Securities Commission (OSC) approved the world’s first spot Solana (SOL) exchange-traded funds (ETFs) which launch on April 16. Four major asset managers; Purpose Investments, Evolve ETFs, CI Global Asset Management and 3iQ, got regulatory approval to issue these Solana ETFs which will offer real-time exposure to SOL’s price and staking rewards to investors.

First of Its Kind: A Spot Altcoin ETF That Pays Yield

Unlike futures-based crypto ETFs, which have underperformed in volume and investor confidence, this spot Solana ETFs will hold actual SOL tokens on-chain. The structure allows investors to get direct exposure to Solana’s price performance like Canada’s spot Bitcoin and Ethereum ETFs.

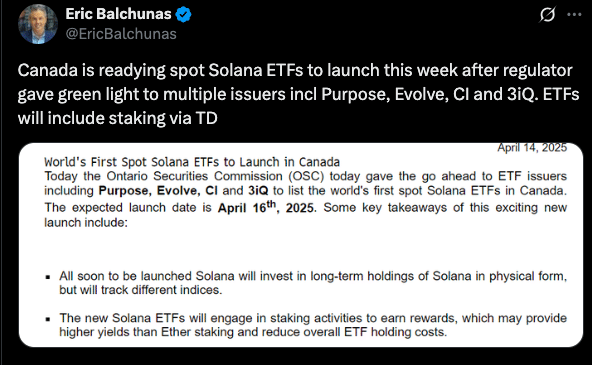

What makes this new product unique is the staking. According to the ETF documentation shared by Bloomberg analyst Eric Balchunas, the funds will participate in Solana staking, generating yield and redistributing those rewards to shareholders. This helps offset management fees and offers potential net-positive returns in a way no other ETF has before.

Although the staking framework is not disclosed yet, reports say Sol Strategies Inc. has been selected as the staking provider for at least one of the issuers, 3iQ. The company has established infrastructure in Solana’s validator ecosystem and provides institutional-grade capabilities that adds credibility to the operational side of the ETF.

Balchunas noted in his post that TD Bank was listed in the documentation but not participating in the staking or acting as custodian.

Staking Economics: Higher Yield Than ETH

Including staking is more than a value-add feature, it’s a statement on where altcoin-based financial products are headed. Solana offers staking yields that are higher than ETH with current rates ranging from 6% to 8% annually depending on network conditions. For investors, this means an ETF that is both passive and yield generating, like DeFi but fully regulated. Distributing staking rewards to ETF holders reduces the effective cost of holding the asset, a new benchmark for what ETFs can do.

U.S. Regulatory Gridlock Highlights the Gap

While Canada moves forward, the US is stuck in neutral. The US Securities and Exchange Commission (SEC) has yet to approve a single spot ETF for Solana or any other altcoin besides Ethereum, despite growing institutional demand.

The only Solana exposure available to US investors is through futures-based ETFs, products that have been a total snooze. According to Balchunas, these have had low volume and assets under management (AUM) and were quickly surpassed by a 2x leveraged XRP ETF. The difference shows how risk appetite and regulatory positioning can make or break an asset in the capital markets.

The Canadian move will put pressure on US regulators. As Balchunas said,

“It’s a global test case now. If these [Solana] ETFs do well in Canada, expect more noise from fund managers in the US.”

Other jurisdictions, such as Hong Kong and the UAE, are watching closely as ETF frameworks expand into digital-native asset classes.

A Regulated Crypto ETF Ecosystem in Canada

With Solana now joining Bitcoin and Ethereum in Canada’s regulated ETF ecosystem, Canadian investors have access to a more diversified, on-chain product suite than almost anywhere else. These ETFs are publicly listed, audited and backed by custodial infrastructure that complies with national securities law.

Canada was the first country to approve a spot Bitcoin ETF in 2021 and is one of the few to allow direct crypto exposure through registered investment accounts.

What’s interesting is the regulatory willingness to blend traditional and decentralized models. The OSC’s acceptance of staking within a listed fund could open the door to future ETFs tied to decentralized finance protocols, liquidity pools or even governance-based reward systems.

Conclusion: A Test Case for Altcoin ETFs

By combining direct blockchain exposure with yield generation, these ETFs are a structure that’s more in line with actual crypto economics than anything in US markets today. The world is watching, but Canada is leading. If these ETFs work, they’ll be the template for the next gen financial products that bridge the gap between traditional capital markets and decentralized protocols.

FAQs

What’s different about Canada’s Solana ETFs vs U.S. crypto ETFs?

Canada’s Solana ETFs are the first in the world to offer direct spot exposure along with staking rewards, whereas U.S.-based ETFs are still limited to futures and lack staking functionality.

How does staking benefit investors in these ETFs?

Staking allows the ETFs to earn yield from Solana’s network, which is redistributed to shareholders, effectively reducing management fees and increasing net returns.

Who will do the staking?

Sol Strategies Inc. is listed as the staking provider for 3iQ’s ETF, offering institutional-grade infrastructure within the Solana validator ecosystem.

Are there U.S. equivalents?

No. The U.S. SEC has yet to approve any spot altcoin ETFs beyond Ethereum. Solana exposure is limited to futures-based ETFs with limited traction.

What are the risks of investing in a Solana ETF with staking?

Like all crypto assets, these ETFs carry price volatility, potential regulatory changes, and smart contract risks associated with staking. But they are regulated under Canadian securities law.

Glossary

Solana (SOL): A ‘high-performance blockchain with scalability, low fees and proof-of-stake.

ETF (Exchange-Traded Fund): A regulated investment ‘vehicle that tracks an asset or index and trades on traditional stock exchanges.

Spot ETF: An ETF that holds the underlying asset directly, not futures.

Staking: A blockchain mechanism where token holders lock up assets to help secure the network and earn rewards.

OSC (Ontario Securities Commission): Canada’s regulatory body for securities in Ontario, including ETF approvals.