According to reports, Bitcoin spot ETFs recorded a net inflow of $13.3 million on March 12, marking a sharp turnaround after seven consecutive days of outflows. This Bitcoin spot ETFs reversal brought the cumulative net inflow to $35.42 billion, according to SoSoValue data. The latest inflow suggests a renewed investor interest in Bitcoin ETFs, especially following a major outflow of $371 million on March 11. This shift in market sentiment could have significant implications for Bitcoin’s short-term price trajectory and institutional adoption of crypto assets.

Bitcoin Spot ETF Performance Breakdown

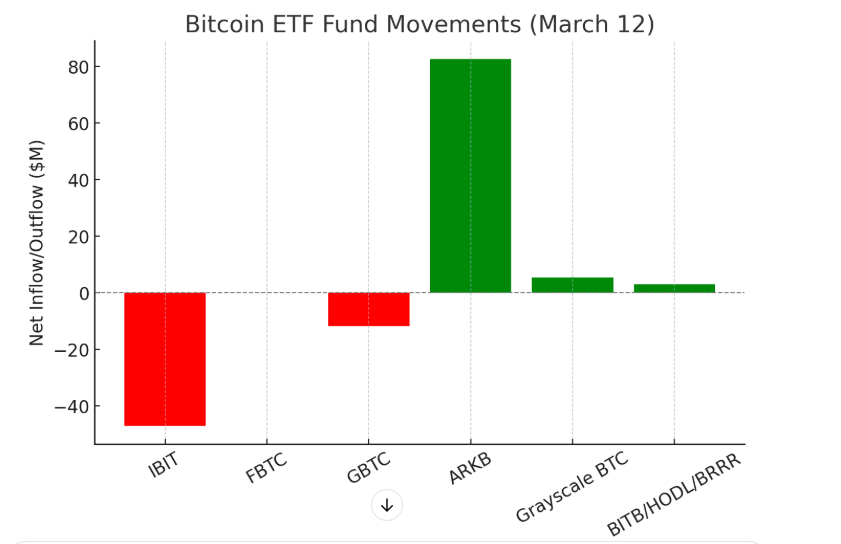

Despite the overall net inflow, some major ETFs still experienced outflows, indicating mixed sentiment among institutional investors. Here’s a closer look at the latest fund movements:

- BlackRock’s iShares Bitcoin Trust (IBIT) recorded an outflow of $47.05 million, signaling some investor caution.

- Fidelity Physical Bitcoin ETP (FBTC) remained stable, reporting no inflows or outflows.

- Grayscale Bitcoin Trust ETF (GBTC) saw an outflow of $11.81 million, continuing its downward trend.

- ARK 21Shares Bitcoin ETF (ARKB), on the other hand, recorded an inflow of $82.6 million, leading the market.

- Grayscale’s BTC ETF received a modest inflow of $5.51 million.

- Smaller funds like BITB, HODL, and BRRR recorded slight inflows, further reflecting mixed investor sentiment.

Overall, total trading volume across all Bitcoin spot ETFs reached $2.01 billion, while their combined net assets stood at $92.45 billion, making up 5.61% of Bitcoin’s total market cap.

Ethereum Spot ETFs Struggle as Outflows Continue

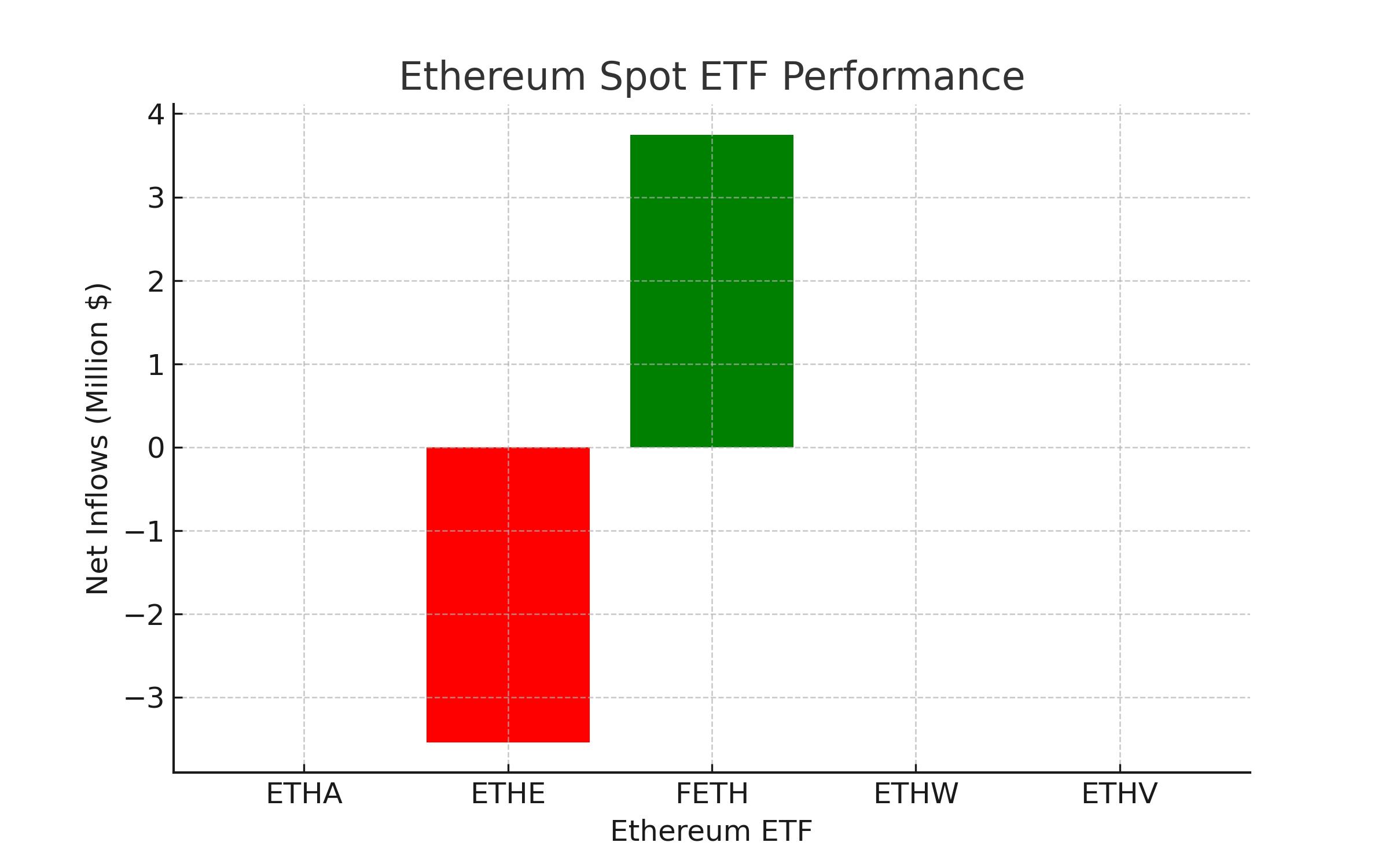

While Bitcoin ETFs saw renewed inflows, Ethereum spot ETFs continued their negative streak, reporting a net outflow of $10.4 million on March 12.

Ethereum ETF Performance:

- ETHA (BlackRock Ethereum ETF): No inflows or outflows, maintaining its $4.2 billion net inflow.

- ETHE (Grayscale Ethereum Trust ETF): Outflow of $3.54 million, bringing its total net inflow down to $606.14 million.

- FETH (Fidelity Ethereum ETF): Recorded a modest inflow of $3.75 million, increasing its total to $1.43 billion.

- ETHW (Bitwise Ethereum ETF): No movement, holding steady at $320.26 million in net inflows.

- ETHV (VanEck Ethereum ETF): No inflows or outflows, keeping its total net inflow at $136.39 million.

Ethereum spot ETFs saw a total trading volume of $299.41 million, while total net assets stood at $6.66 billion, making up 2.92% of Ethereum’s total market cap.

Expert Insights & Market Analysis

According to Glassnode, Bitcoin holders who bought near its all-time high of $109,000 in January are panic-selling as prices decline.

Glassnode’s report states:

“Continued selling pressure could push Bitcoin’s price down to $70,000, as short-term holders are deeply underwater in the $71,300–$91,900 price range. The probability of forming a temporary floor in this zone is meaningful, at least in the near term.”

Market analysts believe that institutional players are still evaluating macroeconomic conditions before making large ETF investments. James Butterfill, Head of Research at CoinShares, commented:

“While Bitcoin ETFs have seen renewed inflows, we need sustained momentum to confirm an upward trend. Federal Reserve policies and institutional sentiment will play a key role.”

Market Outlook: Will Bitcoin Spot ETFs Maintain Momentum?

The resurgence of inflows into Bitcoin spot ETFs could indicate renewed institutional interest, especially given the asset’s strong long-term growth narrative. However, several key factors will determine whether this trend continues:

- Macroeconomic Conditions: Interest rate decisions by the U.S. Federal Reserve could impact risk asset investments.

- Institutional Adoption: More traditional financial firms may begin allocating funds into Bitcoin ETFs if sentiment remains bullish.

- Regulatory Clarity: Uncertainty around crypto regulations remains a major factor that could influence future inflows.

For now, Bitcoin spot ETFs market remains volatile, with inflows and outflows fluctuating amid shifting investor sentiment.

Conclusion

The recent inflow of $13.3 million into Bitcoin spot ETFs marks a potential shift in investor sentiment after a prolonged period of outflows. While this may indicate renewed institutional interest, market uncertainty remains high, with external factors such as regulatory developments and macroeconomic conditions playing a crucial role in future inflows. Ethereum ETFs, on the other hand, continue to struggle, reflecting weaker institutional demand and ongoing skepticism about Ethereum’s near-term price performance.

As the cryptocurrency market evolves, ETF inflows will serve as an essential indicator of institutional confidence. Investors should remain cautious, keeping an eye on trading volumes, macroeconomic signals, and broader market trends before making investment decisions.

Stay updated with Deythere as we’re available around the clock, providing you with updated information about the state of the crypto world.

FAQs

1. What caused the recent Bitcoin spot ETF inflow?

After seven consecutive days of outflows, institutional investors regained confidence in Bitcoin ETFs, leading to a net inflow of $13.3 million on March 12.

2. How much Bitcoin ETF volume was traded recently?

On March 12, total Bitcoin ETF trading volume reached $2.01 billion, with net assets totaling $92.45 billion.

3. Why are Ethereum spot ETFs still experiencing outflows?

Ethereum ETFs have struggled due to market uncertainty and weaker institutional demand, leading to a net outflow of $10.4 million on March 12.

4. Could Bitcoin’s price drop further due to selling pressure?

Yes, according to Glassnode, continued selling pressure from short-term holders could push Bitcoin’s price down to $70,000 if the trend persists.

Glossary

ETF (Exchange-Traded Fund): A financial product that allows investors to gain exposure to an asset, such as Bitcoin, without directly owning it.

Net Inflow: The total amount of money entering an ETF over a specific period.

Outflow: The total amount of money withdrawn from an ETF over a specific period.

Market Cap: The total value of all circulating assets, calculated by multiplying the current price by the total supply.

Capitulation: A market event where investors sell assets at a loss due to fear or declining prices.

References

- Cryptonews

- Glassnode Market Analysis

- BlackRock

- Fidelity Investments – FBTC ETF

- Grayscale Bitcoin Trust ETF

Disclaimer

This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are subject to market risk, and past performance does not guarantee future results. Investors should conduct their own research and consult with a financial professional before making any investment decisions.