Bitcoin Cash (BCH), launched as a scalable alternative to Bitcoin, is a well-known crypto asset focused on fast, low-cost transactions. While its early promise as a peer-to-peer digital cash system has been competed against by newer blockchains, BCH still has relevance among investors looking for utility-driven altcoins.

As the broader crypto market evolves, attention turns to how Bitcoin Cash will perform in the years ahead, especially 2025 and 2026.

Analysts have given a wide range of price predictions for Bitcoin Cash. Some see BCH going above $700-$900 by end of 2025; while others highlight risks that could keep it near its previous lows.

Recent Developments (Mid 2025)

In the first half of 2025; BCH has shown some strength. BCH doubled from its April lows to near $500 by June 2025 with trading volumes reaching three month highs (around $627 million). This rally coincided with strong social media attention. One report notes BCH has been posting almost non stop gains for the past month, sparking renewed social media interest.

Open interest in BCH futures reached six month highs ($364 million), indicating institutional and trader interest. Recently, the coin broke above prior resistance at $468-$475 and held weekly gains above $480.

On-chain activity is still low (around 300k BCH transacted daily, 1.5% of supply) meaning BCH is still used as a payment coin rather than DeFi. In short, BCH’s mid 2025 upswing is driven by renewed market attention and broader crypto bullishness but on-chain usage is still very low.

2025 Bitcoin Cash Price Predictions

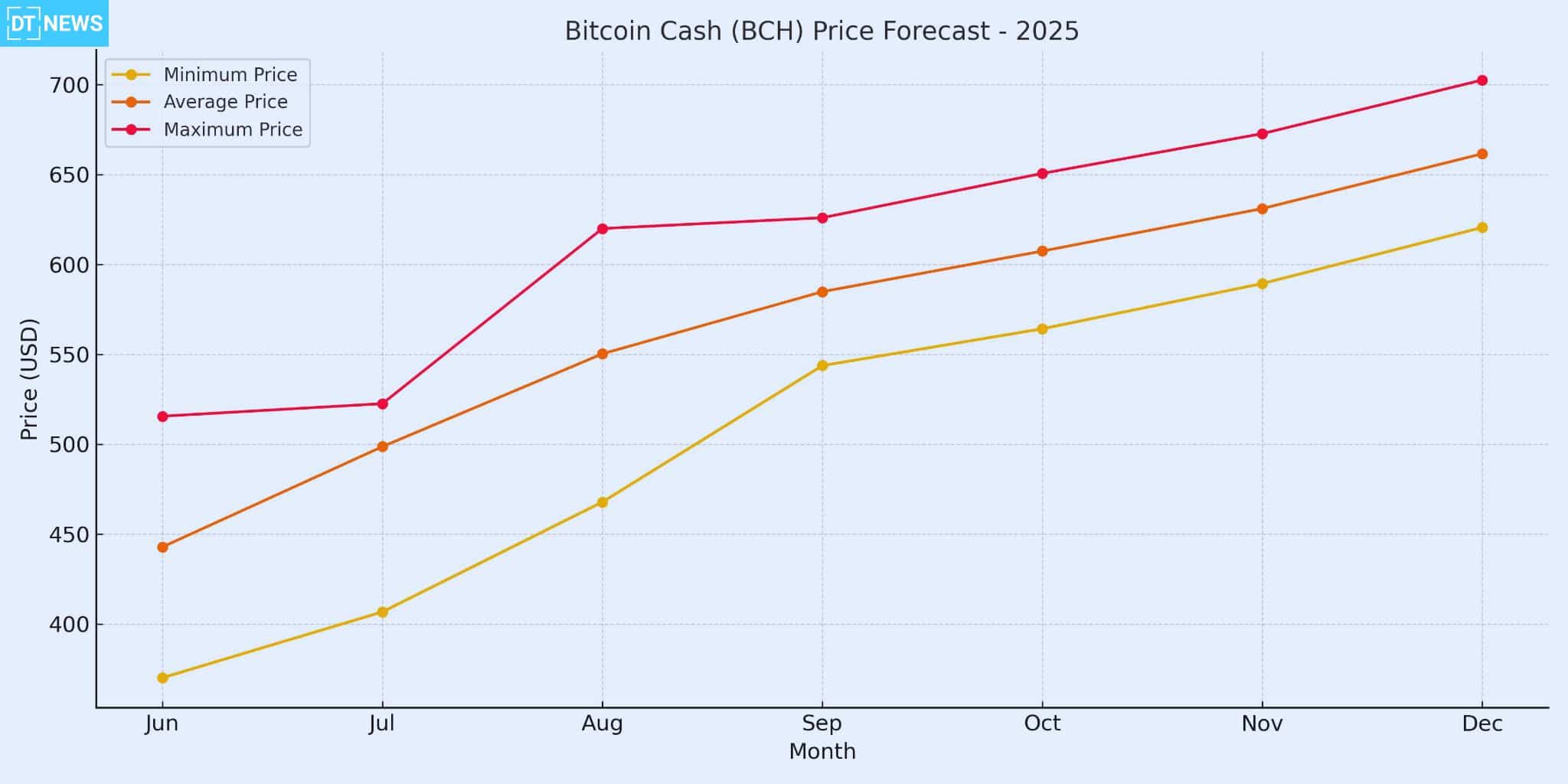

Below is the monthly BCH price ranges for 2025 (min, average, and max prices in USD).

| Month | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| Jun 2025 | 370.12 | 442.86 | 515.60 |

| Jul 2025 | 406.78 | 498.67 | 522.56 |

| Aug 2025 | 467.87 | 550.28 | 619.96 |

| Sep 2025 | 543.73 | 584.85 | 625.97 |

| Oct 2025 | 564.21 | 607.42 | 650.63 |

| Nov 2025 | 589.38 | 631.06 | 672.74 |

| Dec 2025 | 620.55 | 661.56 | 702.57 |

2026 BCH Price Forecast

Going into 2026, forecasters expect more gains for BCH if the crypto markets stay positive. One technical model, Changelly, sees a 2026 range of $595-$985 (avg $790). The Cryptomus analysis also estimates BCH hitting at least $676.46 (min) and potentially up to $858.45 (max) by end-2026, with an average of $782.

Cryptocurrency strategist Benjamin Cowen thinks ongoing blockchain adoption could push BCH into the $800-$1,000 zone in 2026.

Some forecasts however warn of challenges: new blockchain projects could take capital away and regulators could slow down crypto growth. Still, most models show BCH going up year over year.

Expert Opinions & Forecasts

Michael van de Poppe of CryptoQuant , says BCH has low fees and broad usage and could be $700-$900 by end 2025. If BCH “capitalizes on increased adoption”. Others technical analysts say BCH will “experience further corrections due to growing competition and regulation” and expect a more conservative 2025 range of $620-$660.

Coinpedia’s analysis sees 2025 BCH ranging from $300 (support) to $700 (peak) and 2026 lows of $595 with highs of $985. WalletInvestor’s model (via Cryptomus) has a 2026 end-range of $676-$858. Binance’s user-input forecast (assuming 5% annual growth) has BCH at $507 in 2026 (and $482 in 2025). Of course, these algorithmic tools come with disclaimers.

BCH is set to go up modestly in 2025-2026 but big moves require best-case scenarios. Most experts see Bitcoin Cash end-2025 in the mid-hundreds and into the high hundreds by 2026 if crypto demand stays strong. Conservative scenarios (new competition, crypto winter) will keep BCH flat or down.

Bitcoin Cash Price Factors

Several key factors will shape BCH’s long term price. Market adoption and usage matter, increased merchant acceptance or institutional investment can boost demand while competition from Bitcoin and other chains can cap BCH’s market share.

Technical updates also play a role. BCH’s larger block size (from its Bitcoin fork design) is for faster transactions but any future updates (or delays) can impact investor confidence. Global regulations impact all crypto; favorable crypto laws can boost BCH while crackdowns can hinder it.

Macroeconomic trends such as inflation, interest rates and risk appetite also steer crypto markets. Short term sentiment (crypto “bull” or “bear” trends) often drives rallies or sell offs. BCH’s price “depends on many factors” like adoption, competition, tech improvements, regulation, macro trends and market sentiment.

Conclusion

Bitcoin Cash’s price in 2025–2026 will depend on many factors. Technical breakout above key levels suggests more upside, but long term moving averages and blockchain usage data advises caution. Experts forecast vary as some say BCH will reach $1,000 by 2026 if adoption grows, others $300–$600 if growth slows.

It should be noted that volatility is high and predictions are uncertain. Traders and investors are advised to watch adoption metrics, major blockchain updates and regulatory news as that will impact BCH’s real world performance.

FAQs

What affects Bitcoin Cash’s price?

Bitcoin Cash’s price is driven by adoption (merchants, institutional investment); competition from other cryptocurrencies such as BTC and ETH, network upgrades (speed/fees); and broader crypto trends. Regulatory news and macroeconomic factors (inflation, interest rates) also impact investor sentiment.

Will Bitcoin Cash reach $1,000 in 2025 or 2026?

Most analysts don’t see $1,000 by 2025. Only in very optimistic scenarios will BCH hit four digits by 2026. Forecasts generally cap around $700–$900 for 2025 and $850–$1,000 by 2026 if adoption grows. Under normal conditions, BCH is expected to be below $1,000 through 2026.

What’s happened recently to BCH?

In mid 2025; BCH had a big rally, briefly above $500. This was partly due to the current crypto market (Bitcoin pushing new highs) and increased trading volume. Developer updates or major partnerships for BCH could propel price. Any negative crypto news will pull BCH down with other altcoins.

Glossary of Key Terms

Bitcoin Cash (BCH): cryptocurrency created in 2017 via a Bitcoin hard fork. BCH has larger blocks (32 MB) to allow faster, cheaper transactions than Bitcoin.

Blockchain: A decentralized ledger that records all transactions of a cryptocurrency. BCH’s blockchain is similar to BTC’s but with different parameters (e.g. block size) to improve transaction throughput.

Hard Fork: Split in a blockchain where a new currency is created. Bitcoin Cash resulted from a hard fork of Bitcoin in 2017, changing rules like block size.

RSI (Relative Strength Index): Momentum indicator (0–100). RSI around 50 is neutral; above 70 is overbought.

Market Capitalization: Total value of a cryptocurrency (price × circulating supply). BCH’s market cap was around $9–10 billion in mid 2025, ranking it among top coins.