The Rise of a New Digital Investment Strategy

- Yield Farming Explained in Simple Terms

- Why Everyone is Talking About DeFi Farming

- How Yield Farming Actually Works

- The Appeal of Crypto Passive Income

- The Risks You Can’t Ignore

- Tips for Getting Started Safely

- Real-World Impact of Yield Farming

- What Lies Ahead for DeFi Yield Farming

- Final Thoughts: A Tool for the Bold

- Glossary of Terms

- Frequently Asked Questions

The cryptocurrency market has always been about innovation, but one concept has rapidly become a cornerstone of decentralized finance: Yield Farming in DeFi. This practice has grown from an experimental trend into a major avenue for investors to earn crypto passive income without trading day to day.

Analysts often compare yield farming to earning interest in a bank account, but with one major difference. Instead of handing money to a bank, users provide liquidity directly to decentralized applications that run on blockchains. These platforms, powered by smart contracts, automatically reward participants for supplying funds to the system.

Yield Farming Explained in Simple Terms

At its core, yield farming is about putting idle cryptocurrency to work. Users deposit digital assets such as stablecoins, Bitcoin, or Ethereum into liquidity pools. These pools are like massive vaults that allow borrowing, lending, and trading on decentralized exchanges.

In return for making these services possible, farmers earn fees plus extra rewards in the form of governance or native tokens. This practice is also called liquidity mining, because the act of providing liquidity “mines” new rewards for the provider.

Some platforms have at times delivered eye-popping annual returns, far above what traditional investments offer. While such extreme yields often fade quickly, the model continues to attract billions in locked capital.

Why Everyone is Talking About DeFi Farming

The explosion of yield farming began during the “DeFi Summer” of 2020. At the time, the total value locked (TVL) in DeFi jumped from under $1 billion to over $15 billion in just a few months, as tracked by DeFi Pulse. That moment sparked a new era where decentralized finance investing was no longer just theory but a living, growing ecosystem.

The reason it spread so quickly is simple: yield farming gave crypto holders an option to generate steady rewards without selling their assets. By staking or depositing coins, they could enjoy both potential price growth and recurring passive income.

How Yield Farming Actually Works

Imagine someone deposits $5,000 worth of stablecoins into a DeFi protocol. Those funds join a larger pool that other users borrow or trade against. Every transaction generates a small fee. A portion of those fees is then returned to the depositor, plus additional token incentives distributed by the platform.

Some farmers take this further by reinvesting the rewards into the same or different pools, a strategy called compounding. This creates exponential growth, though it also magnifies risk.

Unlike banks, no central authority controls these operations. Smart contracts handle everything automatically. That transparency and efficiency is what attracts blockchain developers and financial analysts alike to study the sector.

The Appeal of Crypto Passive Income

What excites many investors about yield farming is its similarity to owning dividend stocks or rental property. The money works in the background, generating more money. But unlike dividends that pay quarterly or rent that arrives monthly, yield farming rewards can accrue by the minute.

For users in regions with weak banking systems, this is even more powerful. Yield farming allows anyone with a smartphone and digital wallet to participate in global finance. Researchers at the Cambridge Centre for Alternative Finance note that decentralized solutions are bridging access gaps in many underbanked economies.

The Risks You Can’t Ignore

Of course, DeFi farming strategies are not without risk. Smart contract bugs and hacks remain a constant threat. Chainalysis reports billions lost to DeFi exploits in recent years, underscoring the need for caution.

Another unique risk is impermanent loss. This occurs when the price of deposited tokens shifts significantly during participation in a liquidity pool. The result is often fewer valuable assets upon withdrawal compared to simply holding.

Regulation is another challenge. While the European Union’s MiCA framework is moving toward formal oversight, many countries still treat DeFi with uncertainty. The Financial Stability Board has even warned that interconnected lending platforms could trigger systemic risks if left unchecked.

Tips for Getting Started Safely

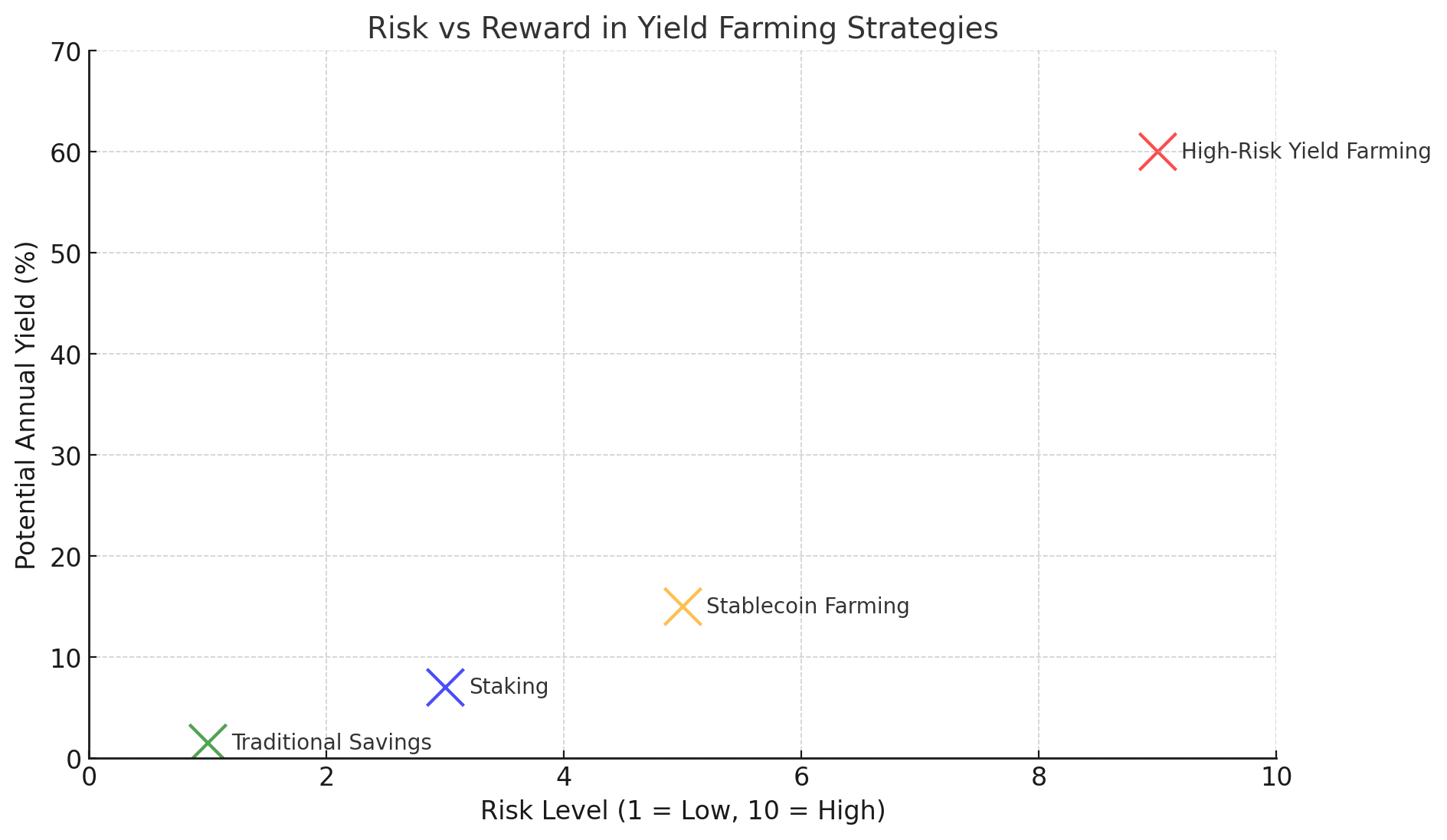

For beginners, experts suggest starting with stablecoin farming since these pools are less exposed to price swings. Reading audit reports of protocols before investing is also essential. Verified audits provide assurance that the smart contracts controlling funds have been tested for vulnerabilities.

Diversification remains a key principle. Spreading capital across multiple pools and platforms can reduce the impact of a single protocol failure. Using blockchain explorers or analytics dashboards can also help track pool health, token distribution, and overall liquidity.

Above all, seasoned investors advise never committing more than you are prepared to lose. DeFi rewards can be enticing, but they carry risks not found in traditional finance.

Real-World Impact of Yield Farming

Yield farming is not just a buzzword. It has played a direct role in the success of decentralized exchanges, many of which rival traditional platforms in daily transaction volume. Liquidity incentives brought traders into DeFi ecosystems, fueling adoption across the sector.

In some countries struggling with high inflation, stablecoin yield farming has offered individuals a way to preserve value while earning a modest return. For these communities, the strategy goes beyond profit-seeking — it serves as an economic lifeline.

What Lies Ahead for DeFi Yield Farming

Looking ahead, yield farming will likely evolve with stronger security, better insurance products, and clearer regulation. Institutional investors are also showing signs of interest, particularly in tokenized assets such as real estate or government bonds. If integrated properly, these could bring massive new opportunities into decentralized finance investing.

Still, the balance between innovation and oversight remains delicate. Regulators like the SEC in the U.S. are intensifying scrutiny, while Europe is implementing structured rules. The way governments handle this balance will determine how far yield farming can scale.

Final Thoughts: A Tool for the Bold

Yield Farming in DeFi is one of the most inventive financial strategies to emerge from blockchain technology. It allows individuals to earn income by supporting the infrastructure of decentralized markets. Yet it is also a space filled with volatility, uncertainty, and constant change.

For those willing to navigate the risks, it offers a glimpse into the future of money. For others, it serves as a fascinating case study in how finance can evolve without traditional intermediaries.

Disclaimer

This article is for educational purposes only and should not be taken as financial advice. Always conduct independent research before investing.

Glossary of Terms

DeFi (Decentralized Finance): Blockchain-based financial services without intermediaries.

Liquidity Mining: Another term for yield farming, where users earn rewards for supplying liquidity.

APY (Annual Percentage Yield): The yearly return on an investment, including compounding.

Impermanent Loss: A potential loss that happens when token prices fluctuate while locked in a pool.

Stablecoin Farming: Yield farming strategy that uses tokens pegged to stable assets like the U.S. dollar.

Smart Contract Audit: A review process to test blockchain code for security flaws.

TVL (Total Value Locked): The total assets locked in DeFi protocols as a measure of adoption.

Frequently Asked Questions

1. What is the goal of yield farming in DeFi?

The main goal is to earn passive income by providing liquidity to decentralized financial platforms.

2. What is the difference between staking and liquidity mining?

Staking secures blockchain networks, while liquidity mining provides funds to trading pools in exchange for rewards.

3. Can yield farming generate stable income?

It can, but income depends on pool conditions, token value, and platform stability.

4. Is stablecoin farming safer than farming volatile tokens?

Yes, stablecoins reduce exposure to price swings, but risks like hacks and smart contract bugs remain.

5. Will regulators shut down yield farming?

Unlikely. Instead, regulators are expected to create frameworks to make DeFi safer for wider participation.