This article was first published on Deythere.

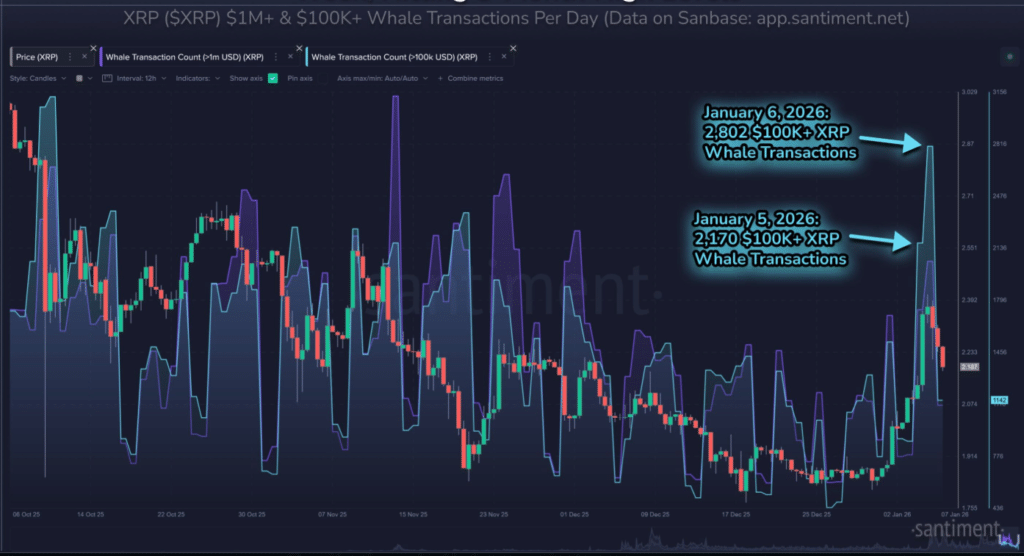

XRP whale transactions reached a 3-month high after 2,802 transfers exceeding $100,000 were recorded in a single day. Santiment data shows this is the highest level of large-scale XRP movements observed over the past three months.

The figures indicate an increase in high-value on-chain activity compared with recent periods. The data focuses solely on transaction size and frequency and does not specify the purpose or direction of the transfers, while confirming elevated activity involving large XRP holders.

What Are XRP Whale Transactions?

XRP whale transactions describe large XRP transfers that cross the $100,000 mark and involve wallets holding sizable XRP balances. Santiment groups these movements based on transaction value alone.

The data does not separate one type of holder from another, and it does not attempt to explain why the XRP was moved. What’s recorded is simply the transfer itself and its size.

Why Has Whale Activity Surged Now?

XRP whale activity picked up sharply, with 2,802 large transactions recorded in a single day, marking the highest count seen in the past three months. Data shows a clear rise in major XRP transfers compared to recent weeks.

Although the figures don’t specify whether these moves were buys or sells, they highlight a notable jump in whale-level activity during the day.

How Does This Compare to Previous Activity

Historically, similar levels of XRP whale transactions have tended to align with periods of higher network activity and short-term price volatility. The current level of activity stands out as the strongest seen since earlier in the quarter.

The data suggests that $XRP continues to draw attention from major holders, pointing to large-scale transfers becoming a more visible part of how the market is observed.

What XRP Whale Transactions Reveal About Market Engagement

For traders and market participants, the rise in XRP whale transactions is often viewed as a useful reference point for gauging liquidity and engagement. While the data does not clarify whether the transfers represent buying or selling activity, it can still be used to observe patterns in high-value movements.

Market observers generally stress the importance of considering this information alongside other available signals when assessing conditions.

Are There Broader Implications for XRP?

The surge in XRP whale transactions signals heightened activity among major holders, potentially influencing the wider $XRP market. With 2,802 transfers, the data points to sustained interest from institutional and high-net-worth participants.

Such movements often reflect strategic positioning or anticipation of market shifts, signaling that XRP remains a token under careful observation by major players.

Conclusion

XRP whale transactions hit a three-month high, underscoring major holders’ active market role. While transfer directions remain unclear, the volume hints at potential volatility ahead.

Santiment’s data confirms XRP’s pull with big investors through record whale activity that traders should watch. The 2,802 transfers over $100,000 in one day spotlight whales’ sway on short-term price moves.

Glossary

On-Chain Activity: Any crypto transfer recorded on the blockchain.

Liquidity: How easily a cryptocurrency can be bought or sold without changing its price.

Santiment: A platform that tracks large crypto transactions and blockchain activity.

XRP Whale Transactions: XRP transfers over $100,000 made by large holders.

High-Value Transactions: Crypto moves above a set amount that show market activity.

Frequently Asked Questions About XRP Whale Transaction

How many XRP whale transactions were recorded recently?

Santiment reported 2,802 XRP whale transactions in a single day, the highest in three months.

Can whale transactions affect XRP prices?

They can influence market movement, but Santiment data does not predict price changes directly.

What does this whale activity tell us about $XRP?

Big holders are circling $XRP right now, pushing more action on the blockchain than we’ve seen lately.

What’s behind a spike in XRP whale transactions?

It usually means whales are shuffling hefty stacks of XRP around, which ramps up overall trading buzz and liquidity shifts.

Why are traders glued to XRP whale moves?

They use these big transfers as clues to what the heavyweights plan next, helping gauge market flow before retail jumps in.

Should investors be concerned about these transactions?

Investors should monitor whale activity as an indicator of market engagement, but the intent behind transfers is unknown.