This article was first published on Deythere.

- XRP Sentiment Spike And Capital Rotation

- Lending and Collateral Expansion Supports XRP’s Narrative

- XRPL’s Permissioned Infrastructure Attracts The Eyes Of Institutions

- Ripple’s Strategy and Institutional Positioning

- Market Signals as They Stand Now and What They Reveal

- Conclusion

- Glossary

- Frequently Asked Questions About XRP Sentiment Surge

- What does the XRP sentiment surge indicate?

- What are the importance of the involvement of institutions in XRP?

- What is the relation between XRP and Coinbase lending?

- What are Permissioned DEXs?

- References

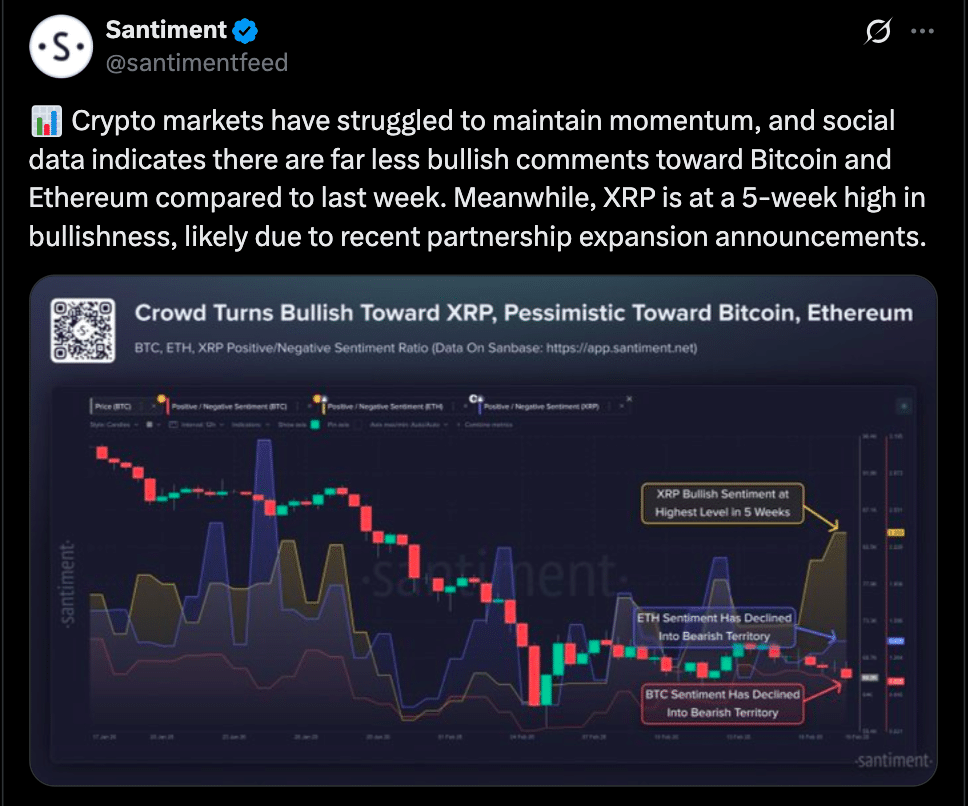

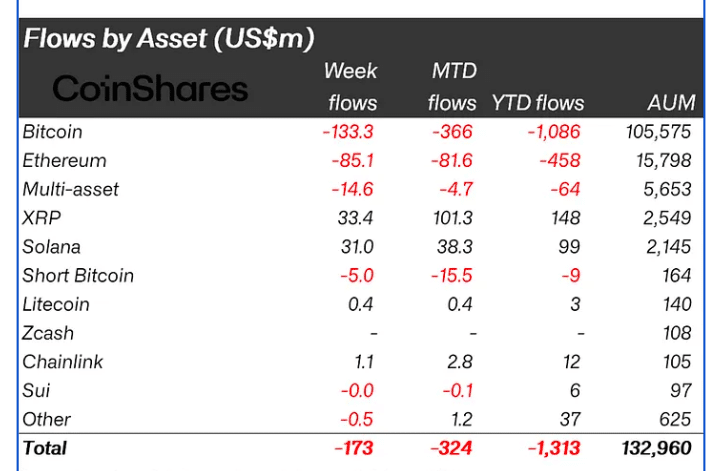

Today in the crypto market, all eyes are on an XRP sentiment surge as the altcoin posts substantial gains that rival even Bitcoin and Ethereum. XRP reportedly attracted net inflows of about $150 million in new capital even as BTC and ETH ETF products saw large outflows in the latest CoinShares data.

This rotation is evident in flows and on-chain sentiment indicators record bullish commentary around XRP hitting a five-week high.

XRP Sentiment Spike And Capital Rotation

The surge in XRP sentiment can be seen among fund flows reported by CoinShares which point to a notable divergence between flows for XRP and other large assets.

Together, Bitcoin and Ether have seen roughly $1.5 billion in cumulative outflows while XRP has drawn $150 million of net inflows so far in 2026. This flow divergence suggests some investors moving capital into assets perceived as having either new catalysts or unique demand dynamics.

Santiment confirmed this behavior, noting an increase in bullish XRP sentiment as discussion around Bitcoin and Ethereum died down, meaning that the focus of the market is rotating.

Lending and Collateral Expansion Supports XRP’s Narrative

One of the major reasons for the XRP sentiment surge is the expansion of XRP’s utility beyond simple trading and payments. Coinbase announced its on-chain lending with the Morpho protocol added XRP as an eligible collateral option on February 18.

This offering allows XRP holders as well as DOGE, ADA, and LTC holders to borrow up to $100,000 in USDC stablecoin without selling their holdings.

This changes XRP’s role from being used only as a transactional and speculative asset to one that can help unlock liquidity for holders, mitigating selling pressure due to liquidity demands.

By enabling users to use XRP holdings to obtain loans, Coinbase has introduced a new use case that may encourage HODLing rather than selling

XRPL’s Permissioned Infrastructure Attracts The Eyes Of Institutions

Another pillar driving XRP sentiment higher is improvement in the infrastructure of XRPL. Just recently, there was a launch of Permissioned Domains and the activation of Permissioned DEX, which is a regulated, credential-gated institutional trading venue. These regulated venues, unlike public DEXes, allow institutions to trade with compliance safeguards such as KYC and AML features.

The Permissioned DEX uses the XRPL’s native decentralized exchange logic with the restriction to participating entities that are verified, providing a bridge between blockchain efficiency and regulatory demands.

Functionality including token escrow and domain-specific order books aim to attract banks and regulated firms who want compliance hurdles smoothed when assessing on-chain liquidity.

The presence of these upgrades hints at the growth of XRPL’s infrastructure and makes it more appealing for institutions seeking custody, regulated trading, and programmable settlement

Ripple’s Strategy and Institutional Positioning

Executives such as Ripple CEO Brad Garlinghouse have repeatedly pointed out that XRP is at the heart of the company’s expanding stack of enterprise solutions, such as settlement, custody, brokerage and treasury tools. Garlinghouse added that XRP is the “North Star,” providing the fuel for these services and making them successful across regulated market structures.

This is also supported by the likes of Société Générale’s EUR CoinVertible (EURCV) and its deployment on the XRPL, which includes integrating stablecoin infrastructure with custody and settlement services.

Market Signals as They Stand Now and What They Reveal

The sudden surge in XRP sentiment is happening when the market is still quite uncertain. Price itself has been mostly range-bound and volatile, despite bullish sentiment and net inflows. Recent news emphasizes the fact that aggressive whale flows such as billions of XRP pouring en masse into exchanges can both indicate strategic rebalancing and, at the same time, exert sell-side liquidity pressure.

Standard Chartered, one of the world’s largest banks, recently cut its end-2026 XRP target to $2.8,0 signaling continued caution amongst traditional analysts despite new structural drivers.

Conclusion

The XRP sentiment surge is a rebalancing in the allocation of crypto capital, as institutional interest, lending utility and regulated on-chain infrastructure all gain steam.

According to CoinShares data, funds are flowing into XRP as exchange-traded products selling Bitcoin and Ethereum record outflows. The enhanced support of additional collaterals by Coinbase, and the permissioned trading amendment to the XRPL enhance XRP’s position even more firmly in today’s markets.

Though price is still under pressure and traditional forecasts are still cautious, these changing fundamentals explain why sentiment around XRP is at a five-week high.

Glossary

Collateral lending: Financial service in which crypto holders can borrow stablecoins against pledged assets without the need of selling it.

Permissioned Domains: Access-controlled portions of the XRP Ledger designed for institutions with compliance needs.

Permissioned DEX: This is a controlled decentralized version of an exchange; only approved participants can trade.

On-chain liquidity: assets directly on the blockchain for trading and settlement.

Frequently Asked Questions About XRP Sentiment Surge

What does the XRP sentiment surge indicate?

It shows bullish tones around XRP have picked up, as institutional flows look to be rotating into XRP while major assets see outflows.

What are the importance of the involvement of institutions in XRP?

Institutional participation implies longer form activity and use beyond short term price moves as well, especially given both regulated infrastructure and collateral products are live.

What is the relation between XRP and Coinbase lending?

By permitting XRP to be held as collateral for loans, Coinbase gives investors access to liquidity without selling any of the digital asset. This in turn could ease downward pressure on XRP values.

What are Permissioned DEXs?

They’re decentralized exchanges on the XRPL that allow only licensed entities to participate, bringing blockchain trading standards into line with compliance requirements.