XRP ETF inflows have crossed an important milestone, but XRP’s price is still relatively flat. The contrast is hard to ignore. Even though more than $1.2 billion in spot ETF assets have moved into XRP-related products, the price has not reacted in line with the level of institutional interest.

- What do XRP ETF inflows actually indicate in the current market?

- Why hasn’t XRP’s price reacted to strong ETF demand?

- Are whale wallets regaining influence over XRP?

- What do technical indicators reveal about XRP’s current posture?

- How do XRP ETF inflows fit into the broader accumulation narrative?

- Why does XRP’s stability still signal underlying strength?

- Conclusion

- Glossary

- Frequently Asked Questions About XRP ETF Inflows

Instead, XRP continues to trade within a tight range, pointing to underlying market factors that are quietly influencing price behavior behind the scenes. This situation highlights how demand for XRP is increasing without triggering an immediate price reaction, while larger investors continue to build positions quietly and market indicators hint at what could come next for the asset.

What do XRP ETF inflows actually indicate in the current market?

They indicate steady buying by institutions rather than short-term speculation. Spot XRP ETFs have now lifted total net assets beyond $1.2 billion. Notably, these XRP ETF inflows have not shown up as sudden surges. Even during slower trading sessions, inflows have continued to stay in positive territory.

Analysts see this pattern as careful positioning by long-term investors rather than short-term traders chasing quick moves. Market watchers also point out that steady ETF demand like this often comes before a base-building phase, where price stability matters more than sharp price swings.

Why hasn’t XRP’s price reacted to strong ETF demand?

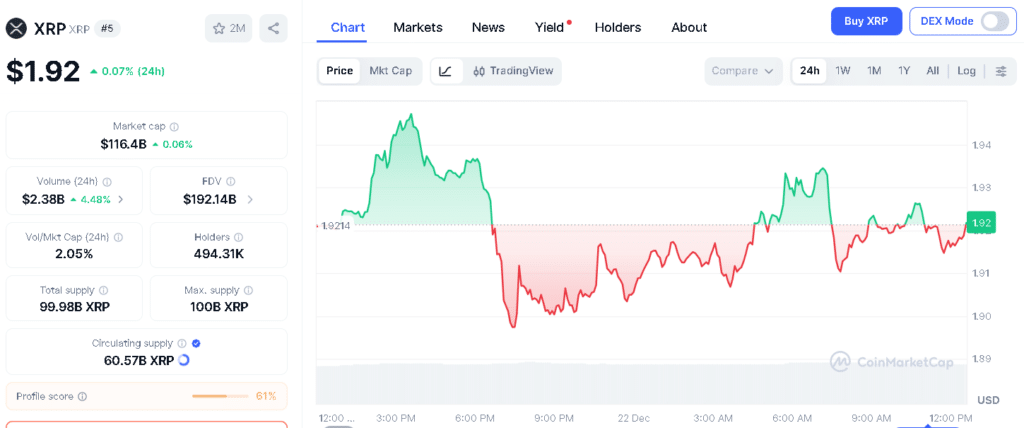

This is happening because accumulation is taking place without aggressive buying pressure. Despite the size of XRP ETF inflows, XRP has stayed close to the $1.90 level for a prolonged period. The token is now trading around $1.92.

The absence of sharp price moves suggests institutions are increasing their exposure slowly, absorbing available supply without driving prices noticeably higher. A senior digital asset strategist noted that when prices stay stable while inflows continue, it usually indicates that large investors are comfortable building positions quietly rather than making their moves obvious to the market.

Are whale wallets regaining influence over XRP?

Yes, and the change has happened quickly rather than gradually. Data shows that wallets holding between 100 million and 1 billion XRP have started increasing their holdings again. As a result, whale-controlled supply has moved back toward the 12.8% level after falling earlier in the month.

The rebound was sharp. After falling in mid-December, ownership among large holders rose quickly, showing active positioning rather than passive holding. When this is combined with XRP ETF inflows, it suggests that market control is slowly moving into the hands of fewer but stronger players.

What do technical indicators reveal about XRP’s current posture?

They point to stabilization rather than a confirmed bullish trend. XRP is still trading below its key exponential moving averages. The 20-day, 50-day, 100-day, and 200-day EMAs remain above the price, showing that the broader trend has not yet turned bullish. Momentum indicators also reflect this cautious tone.

The Relative Strength Index is around 43, showing a mild recovery but no strong buying pressure. On-Balance Volume has leveled off after falling earlier in the month, suggesting that selling has eased rather than new demand entering the market. Meanwhile, the MACD is still below zero, though downward momentum appears to be slowing.

| Metric | Value |

|---|---|

| Spot XRP ETF Net Assets | >$1.2B |

| Current XRP Price | ~$1.92 |

| Whale Supply (100M-1B wallets) | 12.8% of total |

| RSI (14-day) | 43 |

| OBV | Flattened |

| MACD | Below zero |

| Key EMAs (20/50/100/200-day) | All overhead |

How do XRP ETF inflows fit into the broader accumulation narrative?

They support the idea of controlled, long-term positioning. Supporting data shows that XRP spot ETFs have seen steady inflows since their launch, matching the view that institutional exposure is growing quietly. These XRP ETF inflows point to a patient approach rather than rushed buying.

These XRP ETF inflows reflect patience. Institutions seem focused on building a stable base instead of pushing for a quick breakout. One market analyst explained that disciplined accumulation often looks quiet, and the lack of excitement itself can be the strongest signal.

Why does XRP’s stability still signal underlying strength?

It points to strength, but without immediate upside momentum. XRP’s price remains steady near the $1.90 zone, even as more than $1.2 billion in ETF assets and a renewed rise in whale supply signal continued confidence.

XRP ETF inflows, combined with strategic positioning by large holders, suggest that control is consolidating quietly. The lack of a sharp rally does not indicate weakness. Instead, it reflects patience from both institutions and major investors.

Conclusion

XRP ETF inflows now reflect steady interest in the asset even without a price breakout. While XRP continues to trade within a narrow range, institutional buying and renewed whale activity indicate that ownership is gradually shifting.

Technical indicators point to stabilization rather than strong momentum, showing that the market is absorbing supply instead of pushing prices higher. The ongoing calm suggests that XRP is being positioned carefully, with control changing hands quietly rather than enthusiasm fading.

Glossary

Market Indicators: Tools that show the direction and strength of price movement.

Spot ETF: An ETF that holds the real asset and follows its market price.

MACD: A tool that shows changes in price momentum and trend.

On-Balance Volume: Tracks buying and selling activity using trading volume.

Exponential Moving Average: Shows the average price of an asset over a set time period.

Frequently Asked Questions About XRP ETF Inflows

How much money has flowed into XRP ETFs?

More than $1.2 billion has flowed into XRP ETF products so far.

Why is XRP’s price not moving much?

XRP’s price is steady. As buying is slow and careful, not hugely rushed.

How much XRP do whale wallets currently control?

As of now whale wallets control about 12.8% of the total XRP supply.

What do market indicators say about XRP right now?

Market indicators show stability. But they do not signal a strong uptrend yet.

What could happen to XRP next?

XRP could move higher later if buying continues and demand stays strong.