This article was first published on Deythere.

XRP price analysis has drawn new attention after the token climbed to 2.17 dollars, amid a market where many significant assets moved with little direction. The latest rise sparked interest because Bitcoin and Ether remained quiet, while XRP saw a wave of confident buying and more vigorous trading.

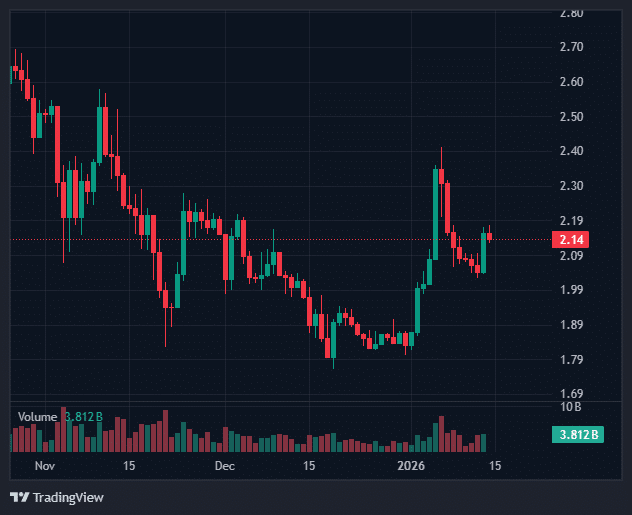

According to the source, buyers pushed XRP through the 2.14-dollar resistance zone, with volume rising nearly 189 percent above average, and 167.9 million XRP traded at the peak of the move.

Live market data shows that XRP posted one of the strongest moves among large-cap assets during the session. This shift encouraged analysts to study the pattern more closely and reassess the market’s appetite for risk.

Institutional Demand Adds Fuel to the XRP Surge Story

In early 2026, institutional flows continued to support the market. Spot XRP exchange-traded funds recorded consistent inflows, a sign that long-term investors still see value in the asset.

A report highlighted that XRP’s supply on major exchanges sits near multi-year lows. This condition often leads to sharper price swings when buying pressure increases. The environment helped shape the latest XRP surge and added credibility to the move.

Some analysts noted that XRP has held a stronger structure than Bitcoin over the past month. After a long stretch of sideways movement, XRP is forming a cleaner trend. Even so, major resistance areas remain overhead.

These zones rejected several rallies throughout 2025 and will need strong participation to break with conviction. Traders continue to track how XRP behaves as it approaches these long-term barriers.

Breakout Structure Offers Key Clues in the Ongoing XRP Price Analysis

The charts tell a clear story. XRP price moved from 2.05 to 2.17 dollars in a single day, briefly touching 2.18 dollars before settling lower, clearing a level that stopped several attempts in recent sessions. Trading activity almost tripled during the breakout. A quick pullback near 2.16 dollars formed a short V shape before the price recovered, showing strong buying interest at the breakout zone.

Updated numbers confirm that XRP still holds above the key area tested earlier in the rally. Another technical review noted that XRP broke above a descending trendline that held the price down since late December. Breaking that line often signals a shift in momentum.

The improvement placed XRP among the day’s better-performing assets, suggesting the move carried more weight than a simple rebound.

Market conditions added to the spotlight. Bitcoin and Ether struggled to extend their gains, making XRP’s surge stand out even more. Traders searching for assets with clearer direction pointed toward XRP as one of the few showing disciplined structure and stronger participation.

What Traders Expect After This XRP Surge

The rally holds as long as XRP stays above the 2.14-2.16 dollar range. Many analysts believe this zone will guide the next leg of movement. If buyers defend it, the price may aim for the 2.26 dollar region next.

Some experts also watch the 2.40 dollar area, which capped earlier rallies. If the price slips under 2.14 dollars, traders expect a return to the broader consolidation area near 2.03 dollars.

Conclusion

This stage of XRP price analysis shows how quickly market tone can change when volume, structure, and confidence move together.

The recent XRP surge points to renewed strength, yet long-term resistance levels still determine how far the trend may run. The following sessions will show whether momentum holds or if price settles back into a familiar range.

Glossary of Key Terms

Resistance Level: A price area where selling often increases.

Support Zone: A level where buyers tend to slow declines.

Volume Spike: A sharp rise in trading activity.

Consolidation: A sideways phase after a trend move.

FAQs About XRP Price Analysis

What led to the recent XRP surge?

A rise in volume, steady ETF inflows, and low exchange supply supported the breakout.

Is XRP facing primary resistance levels?

Yes, long-term resistance remains above current price zones.

How do ETFs influence XRP price analysis?

Consistent inflows help build stability and support a stronger market structure.

What happens if XRP falls below 2.14 dollars?

Price may return to a wider consolidation area near 2.03 dollars.