This article was first published on Deythere.

XRP market performance has been recorded as one of leading digital currencies to see a higher come-back rate, even more than Bitcoin and Ethereum did, following the huge dump that took place on February 6.

Whereas Bitcoin and Ethereum recovered modestly, XRP surged around 38% from its low fueled by on-chain signs of accumulation and exchange outflows. This fresh vigor has brought the focus back on XRP’s trading dynamics while broader market volatility persists.

XRP Market Performance against Wider Crypto

The latest upsurge happened after the market-wide sell-off at the start of February. XRP has now been seen surging from about $1.12 to as high as $1.55, resulting in a price jump of about 38%.

That climb has been relatively sharper than Bitcoin’s and Ether’s recoveries, which have each gained 15 % from their respective lows since Feb. 6.

Data from credible market tracking firms also confirm that XRP market performance is higher when compared to slower moves experienced by Bitcoin and Ether. The quicker turnaround is believed to be from demand from both retail and institutional investors returning to crypto, particularly after the sharp sell-off that shook the space.

Exchange Outflows Signal Holder Accumulation

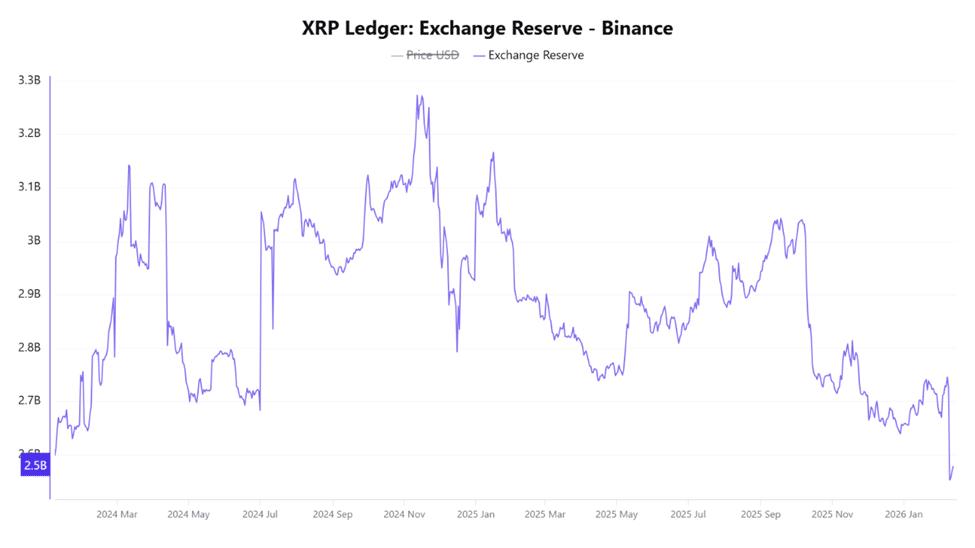

One of the strong drivers of XRP market performance has been a massive decline in XRP supply at central exchanges chiefly Binance. On-chain analytics recorded a decrease of 192.37m XRP from Binance’s reserves between Feb. 7 up to Feb. 9, which left the exchange with around 2.553 billion, its lowest holdings since early-2024.

Decrease in exchange reserves is generally read as holders moving assets off exchanges to private wallets, indicating more holding rather than trading. The contraction of the available supply can increase near-term selling pressure, and help sustain positive price moves whenever demand returns.

ETF Data and Institutional Interest

In addition to on-chain activity, XRP has also experienced an inflow of capital into ETF products which is way different from that of both Bitcoin and Ether during the market correction.

Recent figures show that XRP ETF products saw net inflows of almost $45 million the week before, from funds like Franklin Templeton’s XRPZ ETF and Bitwise’s XRP ETF.

Bitcoin and Ethereum ETFs had outflows during the same period, so XRP’s inflow may signal some institutional investors are seeing the token as a buy-the-dip asset at the moment.

This means XRP is pulling in different types of money flows compared to its higher-cap peers, even when the market is under duress.

Investor Behavior and Price Dynamics

The mix of exchange outflows and consistent ETF inflows shows a difference in the way investors are engaging with XRP. Long term holders seem to be taking coins off exchanges but institutional products are beginning to bring new capital into XRP exposure in a more subdued pace.

Market analysts say that when tokens exit exchanges in high volumes, it is often seen as indicating a move away from short-term trading and toward accumulation, particularly alongside inflows to regulated products.

Larger sustained demand in an overall downtrending market is strong for the price and could keep pushing XRP market performance to hold strength into its long-term recovery.

Comparisons show that in previous cycles, such as the late-2024 surge from $0.60 to over $2.40, supply reductions were a major factor. That same mechanism appears to be playing out again, although on a more moderate scale.

Conclusion

XRP market performance has been at the top this February, with large funds, both retail and institutional, buying at the time of market stress other than capitulating.

This strong XRP market performance against Bitcoin and Ether recovery shows how changes in holding behaviour and capital flows can move price action even during very volatile market conditions.

While overall cryptocurrency sentiment is mixed, XRP price performance shows a trend in recent days that has made it an interesting target for buyers to consider following a decline.

Glossary

Exchange reserves: The amount of cryptocurrency kept on centralized exchanges; a decline means holders are accumulating.

On-chain data: Public, verifiable information stored on a blockchain that traces activity such as token transactions and wallet balances.

ETFs flows: Money coming in and out of exchange-traded fund products, which shows investor interest in market sectors via fully regulated trading vehicles.

Dip buying: Buying an asset after its price has fallen, in expectation of future recovery.

Frequently Asked Questions About XRP Market Performance

Why is XRP market performance better than Bitcoin and Ethereum?

XRP is seeing strong accumulation indications that include huge outflows from exchange wallets and positive ETF flows, as Bitcoin and Ethereum have recorded more muted recoveries.

What does a decline in exchange reserves indicate?

A decrease in exchange reserves often suggests that holders are taking tokens off exchanges and putting them into private wallets, hence decreasing selling pressure and helping to maintain or raise the price.

Are institutional investors supporting XRP?

According to recent weekly figures, XRP ETP products have drawn roughly $45 million in net inflows, while other major crypto ETFs experienced outflows.

Does this suggest that XRP will continue its rally?

While in the past, such accumulation has corresponded to rising prices, markets are volatile, and performance relies on overall trends in demand.

How does this rally compare to past XRP rallies ?

XRP exchange balance decline and recovery patterns are similar to those observed in late 2024, when declining exchange reserves came along with a huge rally from $0.60 to more than $2.40.