As the wider market turns defensive, XRP is getting a different kind of attention than Bitcoin and Ethereum. Prices across the board have been pressured, but XRP’s narrative has not fully followed the same script, largely because investors are watching infrastructure and access points, not only candles on a chart. In that context, XRP price prediction talk has shifted from pure momentum chasing to something closer to a checklist: flows, leverage, liquidity conditions, and whether regulated participation keeps expanding.

Bitcoin’s slide has coincided with visible stress across risk assets, and reports have pointed to a liquidation-heavy environment that tends to punish crowded trades first. In that kind of tape, the asset that looks “most sellable” often gets sold. The data being discussed this week suggests Bitcoin has been treated that way inside institutional wrappers, while XRP has been treated more like an incremental allocation.

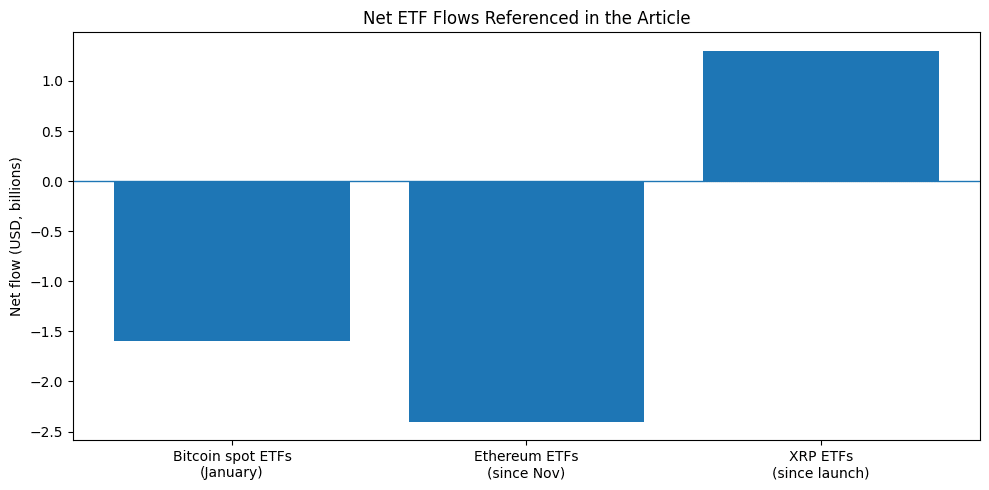

Spot ETF flows are sending a loud message

One of the cleanest signals in a messy market is where capital is moving when it has a choice. Recent reporting and market data summaries have highlighted January outflows of roughly $1.6B from spot Bitcoin ETFs, framing the month as one of the worst periods on record for the products. That matters because ETFs act like a daily scoreboard for demand, especially when discretionary investors are nervous and want liquidity.

By contrast, XRP-linked ETF products have been described as drawing meaningful inflows since their launch window, even as Bitcoin and Ethereum products faced selling pressure. The key point is not that an ETF guarantees price strength the next day, because it does not. The point is that flows can reveal positioning: Bitcoin is being trimmed in a risk-off phase, while XRP is being added in some portfolios as a targeted bet on future market structure.

This is where XRP price prediction becomes less about guessing a top and more about understanding what the marginal buyer is buying. When the marginal buyer prefers a regulated wrapper, that preference can influence liquidity and volatility in ways that spot-only markets do not always capture.

XRP price prediction: why this market is reacting differently to XRP

XRP has not been immune to drawdowns, yet traders are highlighting a potentially healthier reset in derivatives. A CryptoQuant note described Binance XRP open interest falling to about $405.9M, the lowest level since November 2024, which is typically read as leverage being washed out rather than piling in.

Options positioning has also been framed as skewing heavily toward calls, which implies some traders are choosing defined-risk upside exposure instead of loading spot during weakness. That blend, lower open interest plus call-heavy positioning, often shows up when the market is uncertain but still wants exposure to a rebound.

At the same time, the broader market has been dealing with liquidation pressure, with public dashboards and coverage pointing to large liquidations during the recent drop. (coinglass) This backdrop matters because leverage conditions are not just trivia. They shape short-term price behavior, and they can make “strong projects” trade weak when forced selling takes over.

Compliance-friendly rails are becoming part of the XRP story

A second pillar of the current narrative is that XRP’s ecosystem is leaning into institutional usability. Ripple announced that its prime brokerage platform added support for Hyperliquid, positioning the move as a way for institutional clients to access on-chain derivatives liquidity with familiar workflows such as consolidated access, margin, and risk controls.

Separately, the XRP Ledger has been documenting “Permissioned Domains,” designed to restrict certain activity to credentialed participants. The documentation describes accepted credentials and how access can be granted based on those credentials. For institutions that cannot fully open venues due to policy and counterparty requirements, this type of design is not a small detail. It can be the difference between “interesting technology” and “deployable rails.”

This is another reason XRP price prediction has become more conditional. The bullish case is not simply “XRP goes up.” It is “regulated participation grows because the rails are built for it.”

Regulatory risk looks smaller than it used to

Regulation has been a long shadow over XRP, so any credible reduction in legal uncertainty tends to change how investors model downside. In August 2025, the SEC announced a joint stipulation dismissing appeals and resolving the civil enforcement action against Ripple and two executives, while leaving the district court judgment in place. That does not erase every debate about how tokens should be treated, but it has been interpreted as a meaningful end to a multi-year overhang.

In the same broader “plumbing” narrative, RLUSD has been cited as reaching around $1.4B in supply, which supports the idea that Ripple is building a stack that institutions can actually plug into.

Put together, these factors explain why XRP price prediction discussions are sounding less like meme-driven optimism and more like a structured argument.

Conclusion

XRP is trading in the same storm as everyone else, but it is not being priced only as “another high-beta coin.” ETF flow divergence, a leverage reset in derivatives, and a clear push toward credentialed, compliance-aligned market infrastructure are shaping how investors talk about what comes next.

None of this guarantees an immediate upside move, especially in a market still digesting liquidations and macro anxiety. Still, the ingredients behind the current XRP price prediction narrative are tangible, and that alone is enough to keep XRP on institutional watchlists while others fight to stabilize.

FAQs

Why are ETF flows important for XRP right now?

ETF flows can reveal what institutions do when they want exposure through familiar, regulated structures. In a risk-off phase, those flows often matter more than social sentiment, and they can influence liquidity and volatility. That is why XRP price prediction coverage is leaning heavily on flow trends rather than only chart patterns.

Does lower open interest make XRP safer?

Lower open interest can reduce the odds of cascading liquidations because there is less leverage to unwind. It does not remove downside risk, but it can signal that speculative froth has cooled, which sometimes supports a more stable base for any rebound.

What are Permissioned Domains on XRPL meant to do?

They are designed to allow controlled environments where access to certain features can depend on credentials, aligning on-chain activity with compliance expectations. That institutional compatibility is one reason XRP price prediction arguments increasingly include product and protocol design, not only technical indicators.

Glossary of Key Terms

Open interest: The total value of outstanding derivatives positions that have not been closed, often used to gauge leverage and crowding.

ETF flows: Net inflows or outflows into exchange-traded funds, commonly used as a proxy for institutional demand.

Liquidation: The forced closing of leveraged positions when margin requirements are not met, often accelerating moves in volatile markets.

Coinbase Premium Index: A measure of price difference between Coinbase and offshore venues, sometimes used as a proxy for U.S.-led buying or selling pressure.

Permissioned Domains: XRPL concept enabling access-controlled activity based on accepted credentials, aimed at regulated participation.

Sources