This article was first published on Deythere.

- ETF Surge: Franklin Templeton and Grayscale Take the Lead

- Clarity on the Regulatory Front: Ripple Settlement Paves the Way for a New Era

- Why Institutions Are Bullish: The Real-World Use Case for XRP

- New Chapter for XRP

- Conclusion

- Glossary

- Frequently Asked Questions About New Frank Templeton and Grayscale XRP ETFs

- What does the new XRP ETFs actually own?

- Why did the price of XRP soar based on news of an ETF?

- Is XRP now completely “safe” from the watchful eyes of regulators?

- Why are technologies opting for XRP, not just Bitcoin or Ethereum?

- Who can invest in these XRP ETFs?

- References

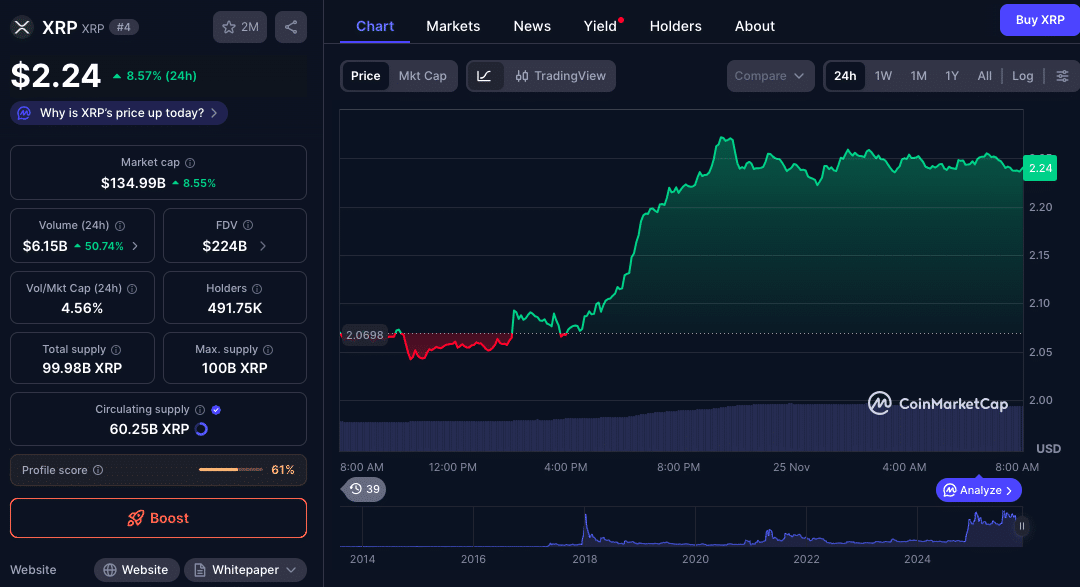

XRP has taken a leap, surging almost 9%, following the debut of two major spot XRP ETFs by Franklin Templeton and Grayscale on the NYSE Arca.

The news not only propelled trading volume but also institutional faith in $XRP following Ripple’s $125 million terms of settlement with the SEC just months before.

Now, with legacy finance powerhouses rolling out regulated products, $XRP’s low-cost and high-speed transaction technology is being praised as the next generation of cross-border payments.

ETF Surge: Franklin Templeton and Grayscale Take the Lead

Franklin Templeton’s XRPZ ETF launches on NYSE Arca to provide investors with wide, regulated exposure to XRP. The fund follows the CME CF XRP-USD Reference Rate, while Coinbase Custody will secure assets and BNY Mellon will serve as administrator.

On its first day, the ETF had traded about 769,000 shares, indicating strong initial demand.

That same day, Grayscale also converted its XRP Trust into the Grayscale XRP Trust ETF (GXRP). The ETF offers exposure to the price of XRP through a passively held trust.

Institutions similar to Goldman, and even retail investors, can now hold $XRP in their brokerage accounts.

Clarity on the Regulatory Front: Ripple Settlement Paves the Way for a New Era

Ripple’s looming shadow of regulatory woes with the SEC appears to have at last faded.

Ripple and the SEC settled for $125 million in August 2025, finally ending their years long battle, paving the way for companies to add it.

This regulatory certainty has cleared the largest remaining hurdle for potential asset managers hoping to launch these ETFs.

Grayscale becoming an ETF and Franklin Templeton fast tracked approval through a Form 8-A filing are just two examples of how companies are capitalizing on this new-found clarity.

Why Institutions Are Bullish: The Real-World Use Case for XRP

Unlike speculative tokens, $XRP’s focus on payments allows for clear signals in understanding its value.

The transactions on the XRP Ledger (XRPL) settle in 3 seconds to 5 seconds with negligible fees, hence it is cost-effective for cross-border payments.

Franklin Templeton touts XRP as serving a “foundational role in global settlement infrastructure,” highlighting its status as a bridge asset and currency that is part of the backbone of modern finance.

The above institutional framing illustrates that XRP is being seen as fundamental payment technology.

Larger Implications: XRP and Global Settlement Systems

The listing of regulated XRP ETFs is also an opening to global finance.

Asset managers now embracing XRP are betting that the strengths of these next-generation cross-border systems will come from speed, cost and reliability.

Analysts believe that XRP has a strong chance of impacting payment corridors in Asia, Africa and the Middle East for which settlement remains an inefficiency to be tamed.

New Chapter for XRP

This ETF wave is expected to change the way both traditional investors as well as crypto natives will view XRP.

Making XRP available on mainstream brokerage accounts could increase flows, liquidity and take-up. Approving trusted products like GXRP really helps legitimize XRP in regulated markets.

This momentum has the potential to lead to more investments in infrastructure, partnerships and potentially new use cases around XRPL’s settlement mechanics.

Conclusion

Franklin Templeton and Grayscale’s addition of XRP ETFs is a welcome achievement for the XRP community.

Now that the dust is settling over regulation and institutions are lining up to utilize this settlement-focused technology, XRP can be considered when talking about creating a digital asset for global finance.

This new confidence, adoption, and infrastructure goes hand in hand with its fundamental value proposition: fast, scalable and cheap cross-border payments.

Glossary

ETF (Exchange-Traded Fund): A regulated investment fund that follows the price of an asset and is traded on stock exchanges.

XRP Ledger (XRPL): A ledger that was designed for the exchange of value with a very high transaction speed and low cost.

Form 8-A: A registration filing that some securities are required to make with the SEC.

CME CF XRP-USD Reference Rate: The rate at which XRP is priced in financial products.

Bridge Currency: A cryptocurrency in use to enable cross-border transactions between fiat currencies.

Frequently Asked Questions About New Frank Templeton and Grayscale XRP ETFs

What does the new XRP ETFs actually own?

Both the XRPZ ETF from Franklin Templeton and Grayscale’s GXRP ETF are backed by XRP. GXRP, for example, has XRP held in a trust which passively follows the market price of XRP.

Why did the price of XRP soar based on news of an ETF?

The ETF launches represent institutional investing in XRP, a regulatory way to purchase large-cap exposure. Regulatory risk has also been reduced following Ripple’s legal settlement with the SEC.

Is XRP now completely “safe” from the watchful eyes of regulators?

Though the ETF launches and Ripple’s settlement are important steps forward, but crypto markets are still murky. These ETFs offer regulated exposure, though as with all digital assets, XRP remains risky due to regulatory fluctuation.

Why are technologies opting for XRP, not just Bitcoin or Ethereum?

The technology behind XRP is focused on quick, cheap payments and clearing. Those properties make it perhaps best suited to cross-border transactions, rather than as a store of value.

Who can invest in these XRP ETFs?

Now, those with brokerage accounts that trade NYSE Arca can invest in XRPZ and GXRP, allowing them to bypass the task of purchasing and custodying XRP themselves.