Updated on October 29, 2025

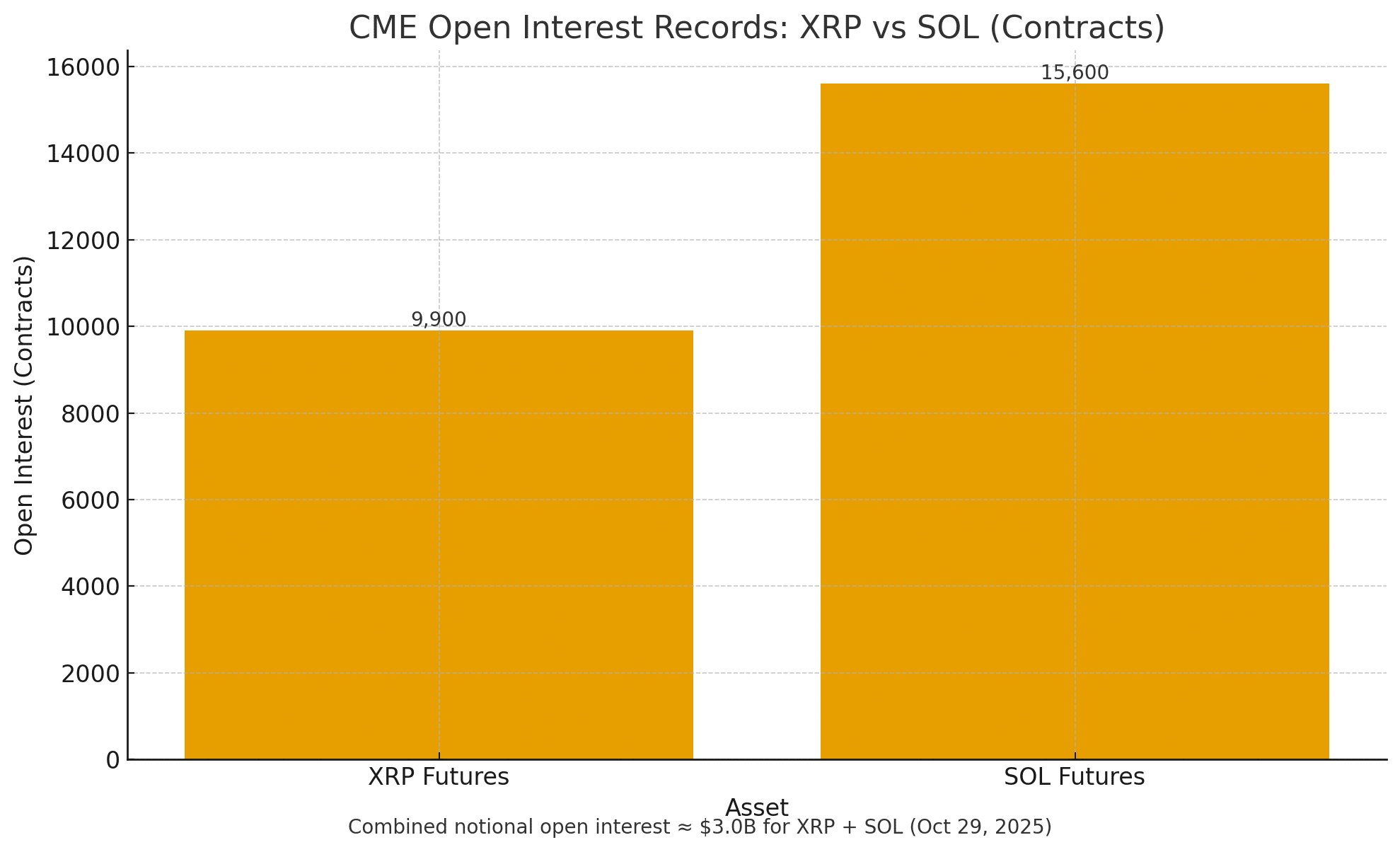

Open interest in CME-listed futures tied to XRP and Solana climbed to a record, with combined notional value of nearly three billion dollars. The totals included about 9,900 active XRP and micro XRP contracts and roughly 15,600 open positions across SOL standard and micro listings, according to exchange figures and market reporting. This milestone signals persistent demand for regulated exposure to leading altcoins.

CME crypto futures momentum shifts toward XRP and SOL

Why are these two contracts leading the pack? Both track transparent benchmarks and trade against liquid spot markets that anchor pricing. CME crypto futures have matured into the preferred venue for institutions that require regulated execution. CME introduced options linked to XRP and Solana this quarter after strong uptake in the futures, and options open interest across the complex set fresh highs in October.

The timeline is straightforward. Solana futures launched in March 2025 and drew steady interest. XRP futures listed in May 2025 and quickly gathered traction as liquidity improved and spreads tightened. By mid-October, analysts noted that average daily open interest across CME crypto futures had climbed, with more sophisticated flows entering the book. The latest highs extend that curve and show that altcoin risk can clear at scale on a regulated venue.

Open interest rises

The milestone arrived during a week shaped by interest rate speculation, thinner liquidity, and tactical de-risking. In that type of tape, new peaks in CME crypto futures indicate that hedgers remain active even when spot traders turn cautious. Rising open interest alongside mixed price action often reflects a tug of war between longs adding exposure and shorts protecting inventory. Depth rises either way, and price discovery improves.

Readers can track several indicators to judge whether this move has legs. Open interest reveals commitment from both sides of the market. Volume confirms conviction. The futures basis versus spot shows appetite for leverage and balance sheet. Funding in perpetual markets provides a similar read for offshore risk. Options skew and term structure reveal how traders price tail events. When these signals align with steady inflows, CME crypto futures tend to become a magnet for liquidity and tighter spreads.

A trust of traders

There is also an exchange-traded product angle. A deeper regulated futures market can support the case for spot vehicles that require reliable surveillance and credible price references. Earlier in 2025, CME added Solana futures and then brought XRP futures to market, steps that observers saw as building blocks for broader investment access. If open interest and turnover remain elevated, sponsors may find a stronger base to pursue new products that sit on top of CME crypto futures.

In short, fresh records in XRP and SOL open interest represent more than a headline. They point to a market where regulated participation is expanding, risk can be hedged with precision, and liquidity is thickening beyond bitcoin and ether. If the trend continues, CME crypto futures will become the daily yardstick for altcoin sentiment, not a sideshow to the main pairs. That is why CME crypto futures now sit at the center of many desks.

Conclusion: The new high for XRP and SOL shows how fast market structure is evolving. Institutions prefer clarity, robust benchmarks, and deep order books. CME crypto futures are delivering all three, and the data suggests that this story has room to run in coming months.

Frequently Asked Questions

What is open interest and why does it matter here

Open interest is the total number of outstanding futures contracts that have not been closed. Rising open interest alongside active trading often signals stronger participation and deeper liquidity, which improves price discovery for XRP and SOL.

Are these contracts physically settled or cash settled

CME lists cash settled products for these assets, allowing institutions to gain or hedge exposure without handling the underlying tokens directly.

Do record highs in OI imply a bullish price outlook

Not necessarily. Higher open interest can reflect both new long and new short positions. Direction depends on flows, basis, funding, and options skew, not just the headline OI.

Glossary of Long Key Terms

Average Daily Open Interest (ADOI)

The average number of open futures contracts outstanding across trading days in a given period. Higher ADOI indicates sustained positioning and liquidity across sessions.

Basis Trade at Index Close (BTIC)

A CME mechanism that lets participants execute futures at a price related to an official reference rate at the close, useful for aligning hedges with benchmark pricing.