This article was first published on Deythere.

World Liberty Financial is capturing fresh attention after introducing a lending market that could shift how digital assets move through on-chain systems. The launch has sparked interest among analysts, developers, and students tracking the future of digital finance.

According to the source, the project sees lending tools as an essential step toward building a broader ecosystem that blends crypto efficiency with traditional financial structure. The update arrives at a time when many investors are seeking stable ground in the digital economy.

Market watchers believe this move highlights a growing effort to align real-world financial rules with the speed of blockchain. As stablecoins and lending platforms compete for relevance, this development stands out for its long-term vision rather than short-term hype.

A New Lending Layer Built for Practical Use

The newly launched World Liberty Markets places World Liberty Financial at the center of on-chain lending. Instead of building its own protocol, WLFI relies on Dolomite’s established liquidity system, known for fast execution and flexible collateral options.

Independent research shows that platforms using proven liquidity layers often see stronger user engagement because of their stability and predictable performance. This structure also supports greater activity around USD1, WLFI’s dollar-pegged stablecoin. Users can supply USD1 to earn yield or use it as collateral, keeping the token active across the ecosystem.

Analysts noted that stablecoins with real on-chain utility tend to retain users for longer than those used only for trading. WLFI’s new lending market aligns well with this trend as the project works to grow USD1’s long-term role in its ecosystem.

Governance Shifts and Real-World Asset Ambitions

As the ecosystem grows, World Liberty Financial plans to let governance participants guide future additions. Token holders will propose new collateral types, adjust risk settings, and help shape the platform’s incentives. This structure enables WLFI to evolve with market conditions, keeping the system flexible as new financial models emerge.

The USD1 Points Program adds another dimension by rewarding users who supply USD1 within the lending market. While participation terms may change, the program aims to boost stablecoin activity and reinforce productive usage rather than passive holding.

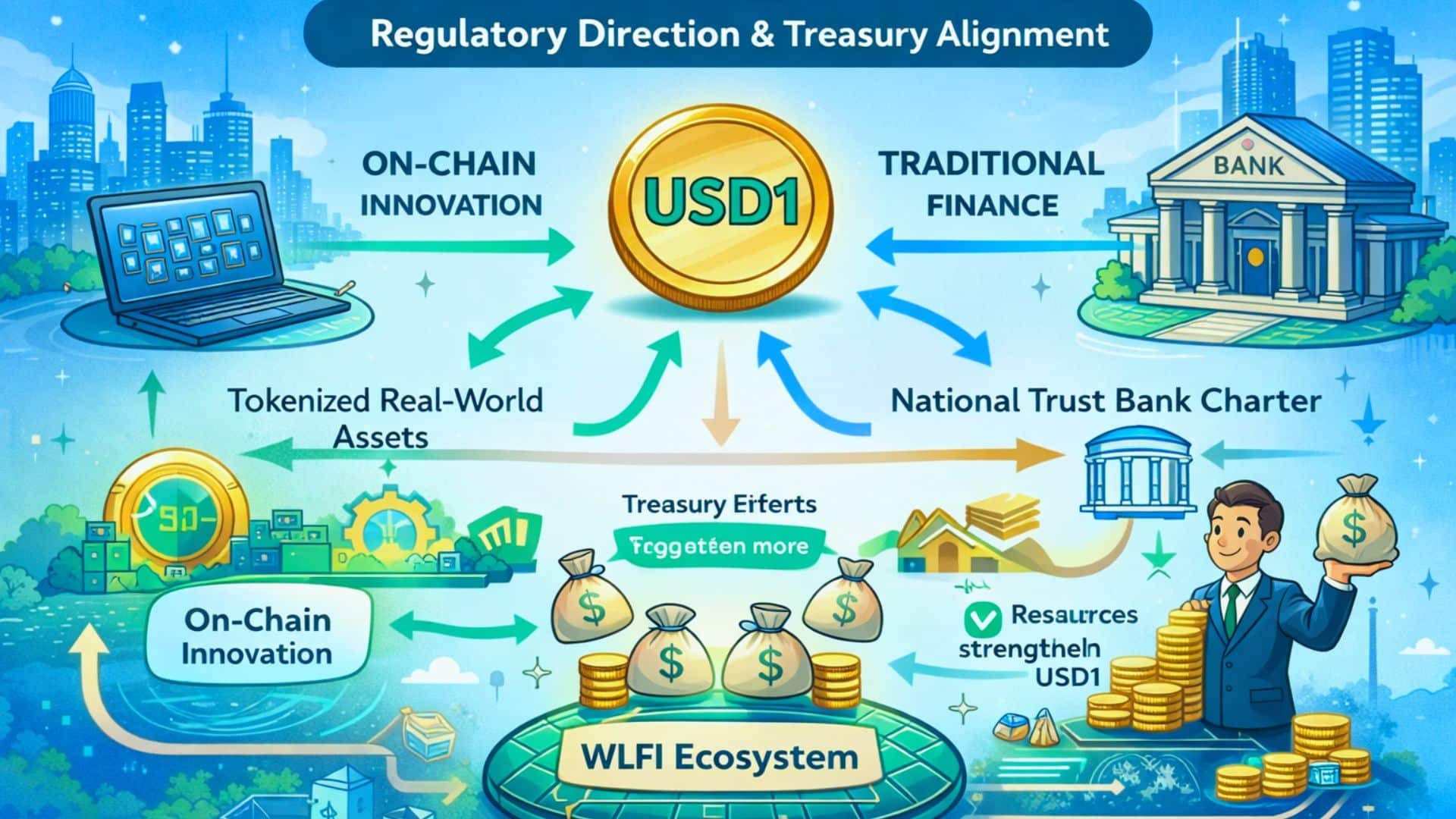

Regulatory Direction and Treasury Alignment

WLFI’s plans reach beyond crypto-native assets, with a long-term focus on tokenized real-world assets now drawing interest from institutions seeking faster, programmable financial tools. This direction positions World Liberty Financial between on-chain innovation and traditional finance.

The team is also pursuing a national trust bank charter, which would place USD1 issuance and custody under federal oversight. Analysts see this as a strong move toward regulatory alignment and broader market legitimacy.

Treasury efforts follow the same path, shifting resources toward programs that strengthen USD1 adoption. It reflects a clear strategy centered on making the stablecoin the core of WLFI’s evolving ecosystem.

Conclusion

The launch of World Liberty Markets marks a meaningful shift in how World Liberty Financial plans to merge blockchain systems with real-world financial principles. As WLFI expands its toolkit, it may help shape the next chapter of on-chain lending, stablecoin utility, and tokenized assets.

The coming years will reveal whether this model sets a new standard, but the early signals point to an ecosystem built for long-term relevance rather than short-term speculation.

Glossary of Key Terms

Stablecoin: A digital token designed to maintain a steady value.

Collateral: Assets locked to secure a loan.

Liquidity Layer: Technology that supports smooth trading and lending.

RWA: A real-world asset represented as a digital token.

FAQs About World Liberty Financial

What is the World Liberty Markets platform?

It is a lending system that lets users supply or borrow assets using Dolomite’s liquidity engine.

Why is USD1 central to the new market?

USD1 can earn yield and serve as collateral, increasing its utility across the ecosystem.

How does WLFI governance work?

Token holders can vote on collateral types, incentives, and market adjustments.

Why seek a trust bank charter?

It helps bring stablecoin issuance and custody under direct federal oversight.