This article was first published on Deythere.

- Why the Holidays Make Crypto Users Easier Targets

- The Holiday Scam Menu Has Expanded

- The Psychology of the Click Is the Real Attack Surface

- Key Indicators That a Crypto Offer Is a Trap

- Practical Protection That Fits Real Life

- When Something Goes Wrong, Time Matters More Than Pride

- Conclusion

- Frequently Asked Questions

Every holiday season brings the same rhythm as people shop late, travel more, click quickly, and juggle family plans with end-of-year deadlines. Scammers love that rhythm because it creates the perfect cover for sloppy checks and rushed decisions, especially in crypto where a single bad link can end with funds moving out in minutes and never coming back.

This year’s seasonal playbook looks familiar on the surface, but it is getting sharper. Instead of crude spam emails, many traps now mimic real brands, real customer support chats, and even real app listings. The language feels polished. The urgency feels believable. The goal stays the same: get access to a seed phrase, trick a user into signing a malicious transaction, or push funds into an address that looks “official” for just long enough to steal them.

Why the Holidays Make Crypto Users Easier Targets

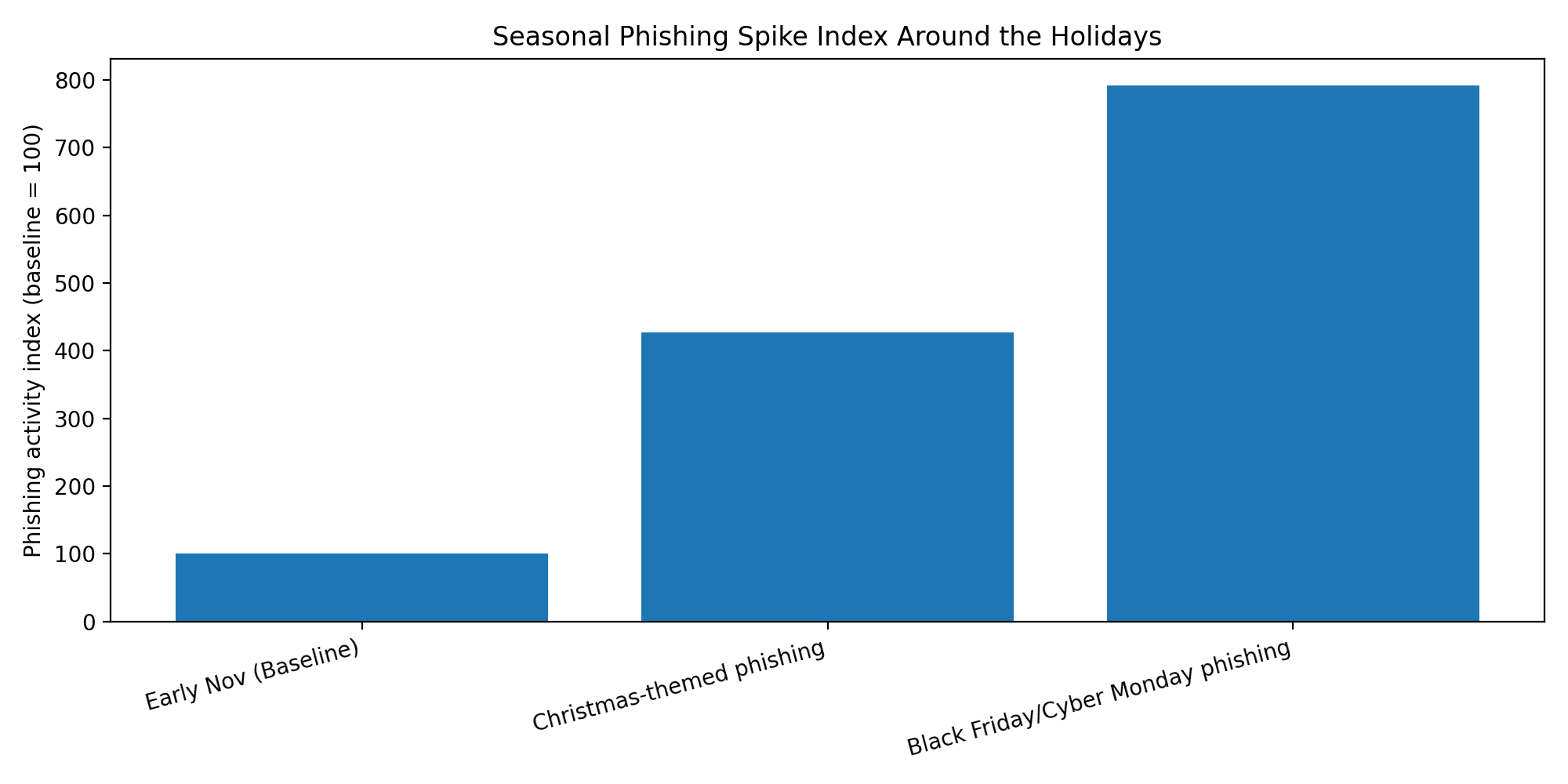

The most profitable scams rarely win because they are clever. They win because they arrive at the right moment. During the holidays, attention gets split into small pieces, and scammers build traps that fit that reality. A fake “security alert” feels plausible when travel logins spike. A “limited-time airdrop” feels tempting when everyone is hunting deals. A “support agent” feels comforting when a user is already anxious about missing a payment or losing access.

Crypto also has a structural weakness that scammers exploit: many transactions are irreversible, and self-custody puts responsibility directly on the holder. That design is powerful when used well, but it becomes unforgiving when a person is pushed into speed over caution.

The Holiday Scam Menu Has Expanded

The classic holiday phishing message still performs, but it has evolved into a full ecosystem of lookalike pages and impersonation workflows. A user receives a festive promo or a security warning, clicks a familiar-looking link, signs in, and hands credentials to an attacker. From there, the attacker often moves laterally, draining exchange balances, requesting password resets, or targeting connected email accounts.

Fake wallet apps and cloned wallet sites remain a major threat because they aim at the most valuable secret in crypto: the seed phrase. These traps often pretend to be “recovery tools” or “faster versions” of popular apps. Once a seed phrase is entered, the attacker can rebuild the wallet elsewhere and sweep assets quickly.

Giveaway scams also heat up around this time, and they come dressed as charity drives, influencer campaigns, and brand-sponsored rewards. The tell is usually the same: the promise of receiving more than what is sent, often paired with a countdown timer or a claim that spots are limited. The money moves only one way.

Then there are the slower scams that do not feel like scams at first. Romance-driven fraud and “pig butchering” operations rely on trust, not speed. The scammer builds a relationship over weeks, introduces a “safe” investment platform, and guides deposits step by step. Around the holidays, loneliness and stress can make people more receptive to a supportive stranger, which is exactly why this pattern keeps repeating.

A newer and nastier angle is app-based malware that searches for recovery phrases stored in photos, screenshots, or notes. Some infected apps have reportedly used optical character recognition to scan images for wallet words, which turns a simple screenshot into a silent liability. That one detail changes the security conversation, because it means the risk is not only what a user types, but also what a user stores.

The Psychology of the Click Is the Real Attack Surface

Most crypto theft begins as a feeling. Fear of missing out. Fear of losing access. Fear of being too late. Scammers lean on emotional triggers because emotions shorten the decision path. A holiday-themed message that says “account locked” or “suspicious login” pushes the mind toward immediate action, not careful verification.

They also borrow credibility. A scam may use a familiar logo, a real executive’s name, or a fake verification badge. It may copy the tone of a legitimate support team. That borrowed credibility is meant to remove friction, so the victim does not pause long enough to ask the boring questions that stop scams cold.

Key Indicators That a Crypto Offer Is a Trap

A safe rule in crypto is that legitimate systems rarely demand secrecy, haste, or private keys. When a message pressures speed, it deserves suspicion. When it asks for a seed phrase, it deserves rejection.

On the market side, scam tokens and fake presales also leave clues. A token that has extreme early concentration among a few wallets, sudden bursts of volume from fresh addresses, or liquidity that can be removed without warning deserves caution. If the contract is unverified, upgradeable in ways that allow privileged changes, or linked to a flood of bot activity, the risk rises. None of these signals guarantee fraud, but together they paint a pattern that often shows up before a rug pull.

Even social proof can be a warning. Comment sections filled with near-identical praise, accounts with thin histories, or aggressive replies to anyone asking basic questions are not signs of strength. They are often signs of coordination.

Practical Protection That Fits Real Life

The safest habits are the ones people can follow when tired. That is why the best defenses are simple routines, not complicated checklists.

Crypto users who hold assets long term tend to reduce risk by separating daily spending wallets from long-term storage, keeping larger balances in environments that are harder to access casually. Many also treat links as hostile by default, using saved bookmarks for critical services rather than clicking through messages. When account access matters, strong authentication and unique passwords remain essential, because credential reuse turns one compromise into several.

App hygiene matters too. If a device is loaded with random utilities, unofficial installers, and unknown keyboard apps, it becomes easier for malicious software to hide. The safest approach is to keep wallets and security tools minimal, update systems regularly, and avoid storing seed phrases in photos, cloud notes, or chat drafts. When a recovery phrase must exist, it is safer offline, protected from cameras and syncing.

When Something Goes Wrong, Time Matters More Than Pride

Victims often lose more money after the first hit because recovery scammers move in fast. They pretend to be investigators, compliance agents, or “ethical hackers,” then charge fees or request more access. A safer response is disciplined: document what happened, save transaction hashes, capture screenshots of messages and domains, and contact support only through official channels found independently, not through links in the suspicious message.

If an approval was signed on a wallet, revoking token approvals on the affected chain can limit further draining. If a centralized account was compromised, password resets and session resets become urgent, along with email security checks. The priority is containment, then reporting, then rebuilding with clean devices and fresh credentials.

Conclusion

Holiday crypto scams thrive on the same human truth every year: busy people cut corners, and scammers build traps that reward corner cutting. The tactics now look more professional, the fake apps look more real, and the emotional triggers are timed perfectly for end-of-year chaos. Still, the defense is not mysterious.

When crypto users slow down, verify sources, protect seed phrases like cash, and treat urgency as a warning sign, most scams lose their power. The goal is not paranoia, but discipline, because discipline is what keeps a festive season from turning into an expensive lesson.

Frequently Asked Questions

What is the single biggest red flag in crypto security?

The strongest red flag is any request for a seed phrase or private key. Legitimate wallet providers, support teams, and exchanges do not need that information, and anyone asking for it is effectively asking for full control of the wallet.

Are giveaways and airdrops always scams?

Not always, but many scam campaigns copy the language of real promotions. The danger rises when the offer requires sending funds first, signing unexpected permissions, or rushing through a countdown. Legitimate distributions do not require “sending to receive more” as a condition.

What should be done if a wallet signed a suspicious transaction?

The immediate priority is limiting damage. Assets can be moved to a fresh wallet created on a clean device, and token approvals can be revoked to reduce further draining. Evidence should be saved for reporting, because clear records can help exchanges or investigators identify patterns.

How can scam tokens be spotted before buying?

Risk rises when ownership is highly concentrated, when liquidity can be removed easily, when the contract is unverified or overly privileged, and when social engagement looks automated. None of these signals are perfect, but a cluster of them is often a warning.

Glossary of Key Terms

Seed phrase: A set of recovery words that can recreate a crypto wallet. Anyone with the phrase can control the wallet, which is why it should never be shared or stored casually online.

Private key: The cryptographic secret that authorizes spending from an address. It functions like the final permission layer, and exposure often results in irreversible loss.

Phishing: A fraud method that uses fake messages or websites to steal logins, codes, or sensitive wallet information by impersonating trusted services.

Malicious approval: A permission signed in a wallet that allows a third party contract to spend tokens. It can be exploited even without sharing a seed phrase.

Rug pull: A scam in which a token’s creators or insiders remove liquidity or abandon the project after attracting buyers, leaving holders unable to sell.

Impersonation scam: A fraud where the attacker pretends to be support staff, a public figure, or a trusted brand to convince victims to transfer funds or reveal secrets.

Optical character recognition (OCR) theft: A malware technique that scans images for readable text, such as recovery phrases stored in screenshots, then exfiltrates that data to attackers.