A Sudden Blacklist Shakes Investor Confidence

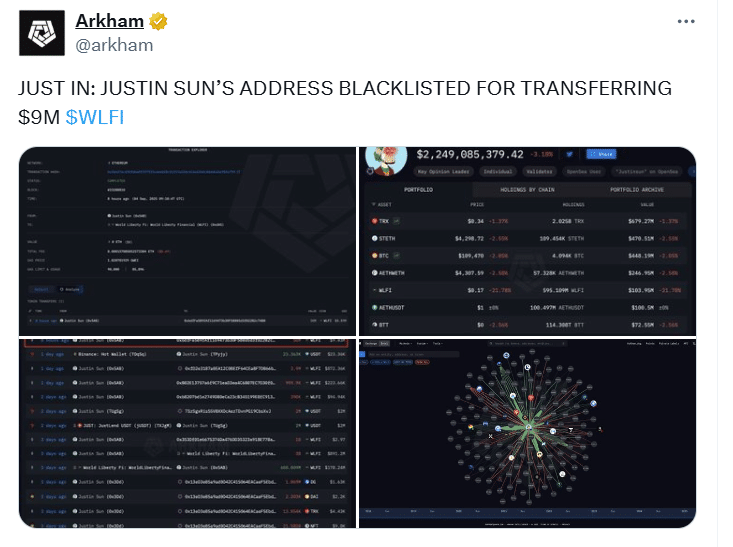

The Justin Sun wallet blacklist has become the latest flashpoint in the cryptocurrency market, with World Liberty Financial freezing more than $9 million in WLFI tokens tied to the entrepreneur.

The freeze, which was verified after the transfer of approximately 60 million WLFI to exchanges, caused severe price drops and prompted concerns about governance, transparency, and centralization in token projects.

Traders responded quickly as WLFI lost up to 42% of its value in hours. Blockchain data revealed that Sun’s wallet contains over 595 million unlocked tokens, as well as billions of vested holdings, which are now essentially out of circulation.

The extraordinary action is one of the most prominent freezes of an investment wallet in recent cryptocurrency history.

Details of the freeze and the immediate fallout

The Justin Sun wallet blacklist was established after $9 million in WLFI tokens were transferred to HTX, an exchange with which Sun is intimately involved. This prompted an automated protocol action, resulting in the freezing of both unlocked and locked tokens connected to Sun’s holdings, which totaled almost three billion WLFI.

Sun defended his conduct on the social networking site X, claiming that the transfer was “merely part of a technical test” rather than an effort to sell shares. He also asked World Liberty Financial to “act with transparency and respect the rights of early backers.” Despite his promises, investors remained cautious, citing time and magnitude as reasons for worry.

The token’s value fell even lower as the story spread, with some experts portraying the incident as a stress test for WLFI’s trustworthiness in its early market phase.

Governance Issues and Centralization Debate

The Justin Sun wallet blacklist has sparked controversy about the concentration of power inside the WLFI’s governing structure. Critics believe that the power to freeze wallets goes against the spirit of decentralization, but advocates argue that such restrictions are vital to avoid manipulation.

According to observers, the WLFI accused connected wallets of seeking to distort token stability during the shaky early phases. By blacklisting Sun’s addresses, the initiative sent a powerful message about compliance and monitoring, but at the expense of traders’ confidence.

One market expert said of X, “When a project can freeze billions of tokens, it stops being about decentralization and starts being about governance by decree.”

Market Impact and Investor Response

The Justin Sun wallet blacklist had an immediate and devastating effect. WLFI’s market valuation fell by billions, trading volumes increased, and volatility had ripple effects among related tokens. According to reports, losses ranged from 16 percent to more than 50 percent in different trading pairings, depending on the platform.

Investors expressed fear that the moratorium would inhibit institutional involvement. The episode has been comparable to previous controversy over governance tokens in which centralized control conflicted with community aspirations.

Meanwhile, Sun’s defenders emphasized his track record of developing big blockchain ecosystems, arguing that punitive action against one of the sector’s most recognizable individuals risked alienating the exact community that WLFI need for success.

The Road Ahead for WLFI

The Justin Sun wallet blacklist puts World Liberty Financial at a crossroads. On the one hand, its aggressive behavior displays a tight attention to internal compliance procedures. On the other side, it risks portraying WLFI as a project susceptible to heavy-handed supervision, weakening the very decentralization that entices cryptocurrency investors.

For Sun, the episode might mark the beginning of a new chapter in his turbulent career. While he has denied wrongdoing, the result of continuing discussions with WLFI will decide whether his frozen possessions are kept locked or recovered under new terms.

Conclusion

The Justin Sun wallet blacklist highlights the tricky balance between security and decentralization in current cryptocurrency initiatives. While World Liberty Financial’s prompt move demonstrates its commitment to stability.

It also raises serious issues about central authority in a purportedly decentralized economy. For investors and traders, the experience serves as a reminder that governance mechanisms are just as important as technology for determining the long-term legitimacy of a coin.

Glossary of Key Terms

Governance: Rules and decision-making processes that guide blockchain projects.

Liquidity: The ease of buying and selling an asset without impacting its price.

Market Capitalization: The total value of a cryptocurrency, calculated as price multiplied by circulating supply.

Volatility: The degree of variation in an asset’s price over a short period.

Wallet: A digital tool used to store, send, and receive cryptocurrency.

FAQs for Justin Sun wallet blacklist

1. What triggered the Justin Sun wallet blacklist?

It was triggered by the transfer of $9 million worth of WLFI tokens to an exchange.

2. How many tokens were frozen?

Over 595 million unlocked tokens and more than 2.4 billion vested tokens tied to Sun were frozen.

3. Did Justin Sun respond to the blacklist?

Yes. He stated the transfers were part of a technical test and urged WLFI to respect investor rights.

4. How did the market react?

WLFI prices plunged, with reports showing losses of up to 42 percent within hours of the announcement.