This article was first published on Deythere.

- What is the purpose of the CLARITY Act crypto bill?

- Why does Michaël van de Poppe view the delay as beneficial?

- How did Coinbase’s withdrawal impact the bill?

- What role did the White House play in the standoff?

- Why are stablecoins and DeFi at the center of the debate?

- How does Europe’s MiCA framework influence this discussion?

- Why does regulatory clarity still matter to the industry?

- Conclusion

- Glossary

- Frequently Asked Questions About CLARITY Act Crypto Bill

CLARITY Act crypto bill developments in the United States have reached an important stage, following the legislation’s stall in Congress. The pause followed Coinbase’s decision to withdraw its support for the bill.

Market analyst Michaël van de Poppe described the delay as constructive for the crypto industry. He said the bill, in its current form, could damage decentralized finance and broader digital asset markets rather than protect them.

What is the purpose of the CLARITY Act crypto bill?

The CLARITY Act crypto bill is designed to create a formal market structure for digital assets in the United States. Its primary objective is to define regulatory responsibilities, clarify oversight across crypto markets, and establish consistent rules for on-chain finance.

The bill has been a key priority for lawmakers aligned with the crypto industry, which has long pushed for regulatory clarity instead of an enforcement-driven policy approach. However, progress stalled after concerns emerged that the proposed framework extended beyond clarity and moved into restrictive regulatory control.

Why does Michaël van de Poppe view the delay as beneficial?

Van de Poppe said the stalling of the bill could ultimately protect crypto markets from overregulation. He warned that approving the CLARITY Act crypto bill in its current form would have harmed both crypto markets and decentralized finance protocols.

I think if the bill were approved in its current form, it would have had a very bad impact on the markets in general. So, now, all the parties are aligned to continue the discussion. It reminds me a lot of the Markets in Crypto Assets (MiCA) regulations in Europe.

He said the delay allows lawmakers and industry participants to reassess the framework more carefully.

How did Coinbase’s withdrawal impact the bill?

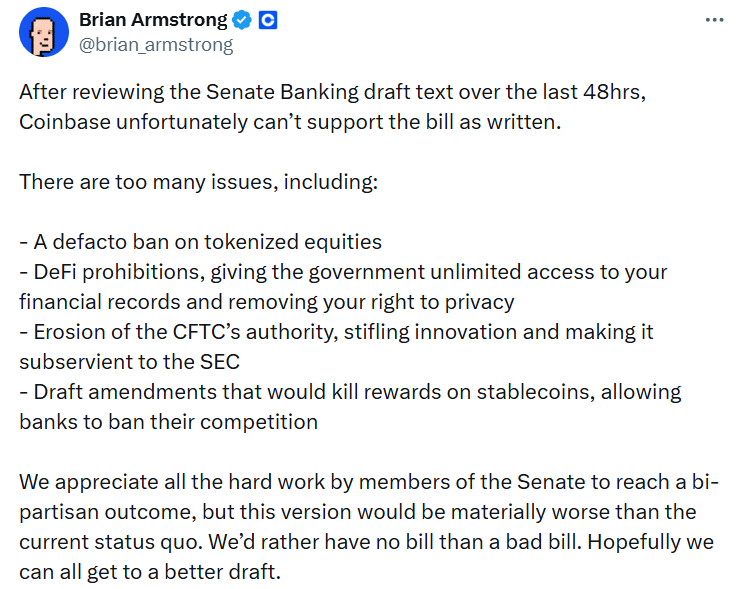

The legislative slowdown followed Coinbase’s decision to withdraw support for the CLARITY Act crypto bill. Coinbase CEO Brian Armstrong explained the exchange’s position after reviewing the Senate Banking draft.

Armstrong said the draft would be “materially worse than the current status quo” and pointed to concerns such as a “de facto ban” on tokenized stocks, expanded government access to DeFi user records, and rules that would prohibit yield-bearing stablecoins. He said Coinbase would rather see no bill than legislation that weakens innovation and user privacy.

What role did the White House play in the standoff?

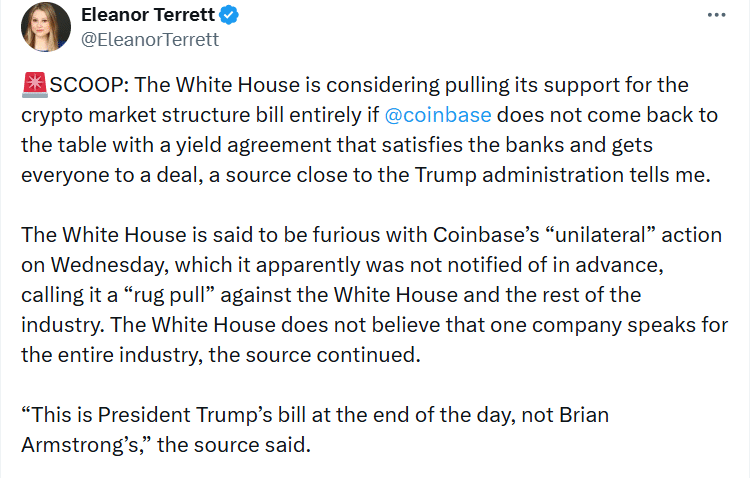

Independent reporter Eleanor Terrett reported that the White House threatened to withdraw support for the CLARITY Act crypto bill following Coinbase’s decision to pull its backing. The report cited frustration within the administration, describing the move as unilateral by the exchange.

Armstrong later denied the report and said discussions with policymakers were ongoing. He added that the White House had been “super constructive” during the negotiations.

Why are stablecoins and DeFi at the center of the debate?

One of the most debated aspects of the CLARITY Act crypto bill is how it addresses decentralized finance and stablecoins. Armstrong said draft amendments could remove rewards on stablecoins, which could allow banks to limit competition.

Venture capitalist Nic Carter shared similar concerns and said banning stablecoin yield would significantly set back the stablecoin market for many years. These objections reflect wider fears that the bill could weaken user privacy and slow innovation in decentralized finance.

How does Europe’s MiCA framework influence this discussion?

Van de Poppe compared the U.S. legislative process to the European Union’s Markets in Crypto-Assets framework. MiCA went through multiple rounds of negotiation and revision before it was passed into law.

Van de Poppe said this step-by-step process helped improve the final regulation. He added that the CLARITY Act crypto bill may now be entering a similar phase, where continued discussions could result in a more balanced outcome.

Why does regulatory clarity still matter to the industry?

Even though some people have criticized the draft, industry leaders still support creating a clear market structure law. They believe strong and transparent rules are important for the crypto industry’s long-term growth.

Institutional investors also prefer clear regulations before getting involved. The main debate around the CLARITY Act crypto bill is about how these rules will be applied, not about rejecting regulation itself.

Conclusion

CLARITY Act crypto bill discussions are not over, even as the legislation remains stalled in Congress. Van de Poppe said all parties are now aligned to continue talks, pointing to Europe’s MiCA framework, which improved after several rounds of revision before adoption.

He noted that the pause around the CLARITY Act crypto bill could benefit the crypto industry by allowing unresolved issues tied to DeFi and stablecoins to be addressed. The delay, he said, may give Congress the time needed to draft clearer rules without weakening decentralization, innovation, or market integrity.

Glossary

Crypto Market Structure: Rules that explain how crypto markets work and are regulated.

Stablecoin Yield: Earnings made from holding or using stablecoins.

Tokenized Stocks: Company shares turned into digital tokens on a blockchain.

MiCA: The EU’s law for regulating crypto assets.

On-Chain Finance: Financial transactions done on a blockchain with smart contracts.

Frequently Asked Questions About CLARITY Act Crypto Bill

Why did the CLARITY Act crypto bill stall in Congress?

The bill stalled as Coinbase withdrew its support. And raised concerns about its impact.

Why does van de Poppe support the delay?

He believes the delay prevents harmful rules that could hurt crypto and DeFi.

What problems did Coinbase see in the bill?

Coinbase said the bill could ban tokenized stocks, limit privacy. And even block stablecoin rewards.

Why are stablecoins part of the debate?

The bill may stop stablecoin rewards. Which could reduce competition and innovation.

How is Europe’s MiCA law related to this issue?

Europe’s MiCA law also took time to finalize. Showing slow talks can improve rules.