This article was first published on Deythere.

- Application Revenue Reaches a New High

- User Activity and Network Throughput Intensify

- Trading Infrastructure Drives Volume Growth

- Retail Speculation and Low Fees Usage

- Conclusion

- Glossary

- Frequently Asked Questions About Solana App Revenue

- What does Solana app revenue show?

- Was this revenue due to $SOL’s price increasing?

- Why was trading volume so high in 2025?

- How did low fees factor into Solana’s growth?

- References

Solana’s blockchain economy had a blockbuster year in 2025, despite its native token closing far below prior all-time highs. Data from the network indicated that apps developed on Solana generated nearly $2.4 billion in revenue, active usage reached an all-time high and trading activity surged to record levels.

The dichotomy of token volatility and ecosystem growth was a recurring motif for Solana in 2025. SOL had a wild ride and ended the year well below its Q1 high, but application revenue, transaction throughput and user participation all hit records.

Application Revenue Reaches a New High

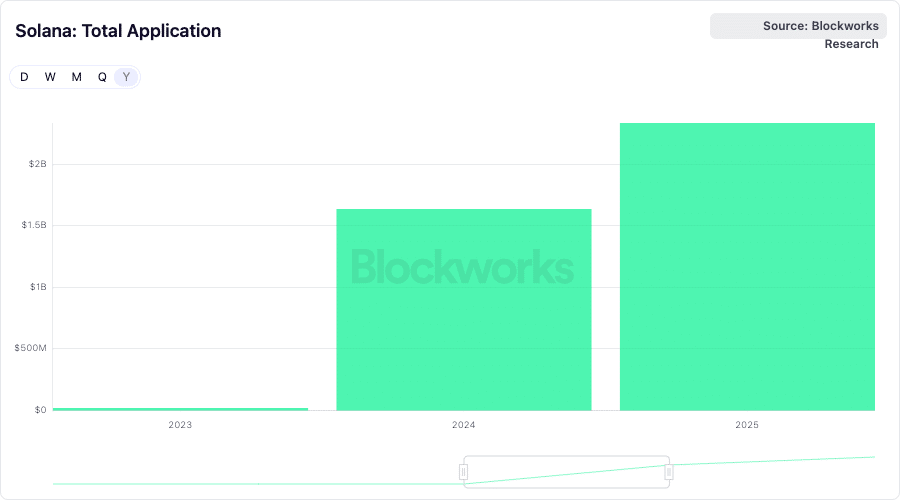

Revenue obtained through activities of applications developed on Solana reached roughly $2.39 billion in 2025, posting an increase of 46% from the previous year and the highest all-time record for the network.

The growth was not limited to any one sector or platform, according to the Solana Foundation. Instead, proceeds were spread across decentralized applications serving different functions from trading infrastructure to consumer-focused platforms.

Seven applications had at least $100 million in annual revenue, including Pump. fun, AxiomExchange, MeteoraAG, Raydium, JupiterExchange, tradewithPhoton and bullx_io.

Beyond these top platforms, smaller apps together generated over $500 million in revenue, suggesting that revenue growth was widespread and not limited to a handful of giants. This distribution indicates that neither developer activity nor user demand are concentrating, but spreading out over the applications.

Network wise, total revenue surged briskly. The measurement of total network revenue was $1.4 billion in 2025, with an increase that was 48-fold after a 2 year period . This growth illustrates continued demand for blockspace and services despite the changing market value of $SOL throughout the year.

User Activity and Network Throughput Intensify

Solana’s financial growth was reflected in its increasing usage throughout the network. In 2025, Solana processed 33 billion non-vote transactions, representing a growth of 28% from the previous year.

When vote trades are included, the overall volume of transactions rose to 116 billion. On average, the blockchain handled more than 1,000 non-vote transactions per second, showcasing its readiness for high-frequency activity.

Daily active wallets, at 3.2 million on average, represented a year-over-year increase of 50 percent and a new high for the network. All together, 725 million new wallets had at least one transaction over the course of the year.

While wallet addresses do not directly equate to individual users, the scale of participation indicates heavy engagement across applications, automated systems, and trading platforms operating on Solana.

The sustained level of activity highlights how low transaction costs and high throughput accommodate both retail and automated use cases.

These circumstances gave way for the network to grow sustainably without scenario of backlog or rising fees even at its busiest times.

Trading Infrastructure Drives Volume Growth

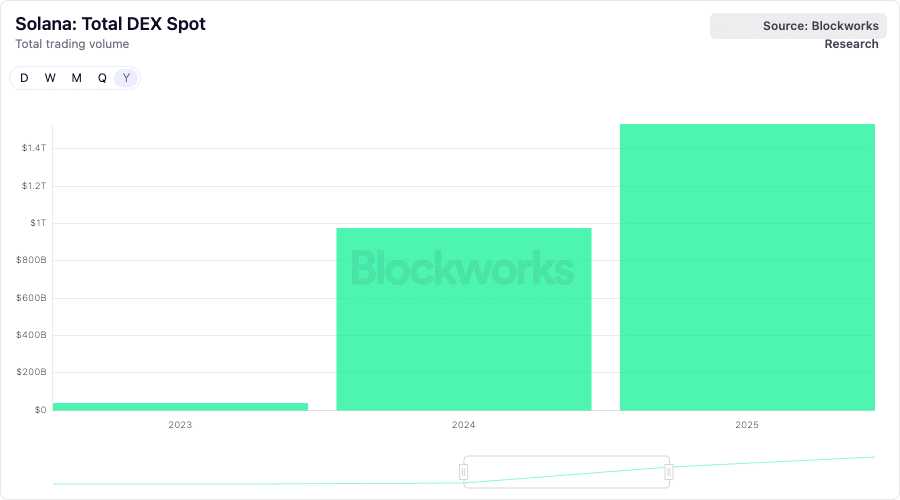

Trading activity emerged as the strongest growth driver on Solana in 2025. The volume of DEX reached $1.5T, which is 57% higher than a year ago, and an absolute ATH for the network.

Liquidity grew deeper as volumes increased, with SOL stablecoin trading reaching $782 billion, double last year’s figure.

Volume was heavily concentrated at a handful of large exchanges, each processing more than $10 billion in trading over the year.

Raydium took the lead with $347 billion in volume, followed by orca_so, humidifi, SolFiAMM and MeteoraAG. These together built a decentralized on-chain trading ecosystem of Solana.

A significant change was made in the routing of trades. These numbers tell a story of more specialized and efficient trading, with proprietary automated market makers owning 54% of aggregator volume, up from 19%.

Trading pairs of SOL also became more diversified: with SOL used in 42% of trades and USDC accounting for 30%, highlighting the growing role of stablecoins alongside the native asset.

There was also activity from new categories. Automated AI agents represented $31 billion in trading volume and tokenized real-world assets clocked near $600 million.

Project tokens like JUP and RAY recorded a combined $86 billion in volume indicating the enduring demand for ecosystem-native assets.

Retail Speculation and Low Fees Usage

Retail speculation is still driving much of the activity on Solana, especially in meme coins trading and among token launch platforms. Meme coin trading volume hit $482 billion in 2025.

While slightly below the figure in the prior year, the two-year increase by a factor of 80 showed that the segment took on an unusually significant role since 2023.

The launchpads had been key to much of this. Six platforms each enabled over $1 billion in trading volume, and combined launchpad revenue doubled to $762 million.

Pump.fun stood out as the most influential retail application, simplifying token creation to the point where users could deploy new assets within seconds.

This access produced over-the-top volume. Users created 11.6 million new tokens during the year, over twice as many as in 2024.

However, only 105K tokens made it out of their initial launch phase, translating to a success rate below 1%.

Low transaction costs enabled this. Average transaction fees dropped to $0.017, median fees to just over one-tenth of a cent. One of the reasons is that this cost was expended for high-frequency trading, automated agents, and large-scale experimentation without the profit getting eaten away.

Conclusion

Solana 2025 performance represents a blockchain ecosystem being steered by use rather than token price exclusively.

Though $SOL was extremely volatile, application revenue, user numbers and trading volume marked all-time highs. Low fees, massive scalability and varied application demand helped the network to be capable of everything from retail speculation to institutional investing.

The launch of spot Solana ETFs, increased stablecoin adoption and the growing popularity of tokenized assets also reinforced this pattern.

Taken together, these advances indicate an ecosystem that is thriving financially even as market prices fluctuate.

Glossary

Solana app revenue: Overall revenue from applications built on the Solana blockchain.

Decentralized exchange: A type of blockchain-based platform that enables users to trade assets without intermediaries.

Stablecoin: A cryptocurrency that is meant to hold the real-world value of a currency like the U.S. dollar.

Launchpad: A tool for users to develop and release new tokens.

Transaction fee: The price you pay to make a transaction on a blockchain network.

Frequently Asked Questions About Solana App Revenue

What does Solana app revenue show?

It is representative of how much revenue the applications on the network generate from user interaction, regardless of token price.

Was this revenue due to $SOL’s price increasing?

Revenue increased despite heavy volatility in the price of $SOL.

Why was trading volume so high in 2025?

A spike in volume was propelled by increased DEX activity, automated trading systems and memecoin speculation.

How did low fees factor into Solana’s growth?

Low transaction costs allowed for high-frequency trading, as well as easily creating tokens en masse and automated activity.