This article was first published on Deythere.

- Latest Tether Gold Purchase Details

- Tether Gold Hoard vs. Central Bank Reserves

- Why Tether is Buying Gold: Implications and Use Cases

- Expert Take: Tether’s Gold Strategy Explained

- Regulatory Context: The GENIUS Act, and Stablecoin Rules

- Conclusion

- Frequently Asked Questions About Tether Buying Gold

- How much gold does Tether have?

- What is Tether doing with all that gold?

- What does Tether buying gold have to do with central banks?

- Is Tether legally permitted to hold gold under U.S. law?

- Could Tether buying gold sway the price of gold?

- Glossary

In Q3 2025, Tether -the company behind the USDT stablecoin reportedly purchased 26 tonnes of gold in one quarter, a larger amount than any single central bank that reported during Q3.

Tether’s total gold reserves were, as of the end of that quarter, around 116tonnes (roughly $14billion). Tether’s gold pile is now as large in comparison to those of nations like Greece, South Korea or Hungary.

Latest Tether Gold Purchase Details

Tether’s Purchase of Gold: 26 tons last Q3 2025, more than any single central bank bought in the same timeframe.

Total Holdings: 116 tons by Sep 2025, equivalent to the mid-sized central banks. Bloomberg reports 80 tons by mid-2025.

Market Relevance: Analysts note that Tether’s buying represented 2% of the total market size and 12% of Q3 central bank purchases, exerting supply pressure on the market and effecting prices.

Diverse Buyers: Beyond Central banks, private buyers, including sovereign funds, corporations, and stablecoin issuers like Tether, are piling into gold.

Why is Tether buying gold, comparing the company’s actions to central bank buying, and what does it mean for the market and stablecoins?

Tether Gold Hoard vs. Central Bank Reserves

Central banks in total bought 220 tonnes of gold (a 28% increase from Q2’s accumulated buying) in Q3 2025.

However, Tether’s purchase of 26 tonnes in that quarter alone was larger than the acquisition of any single central bank. By the close of September 2025, Tether’s 116-ton reserve had ranked it among the top-30 holders of gold in the world.

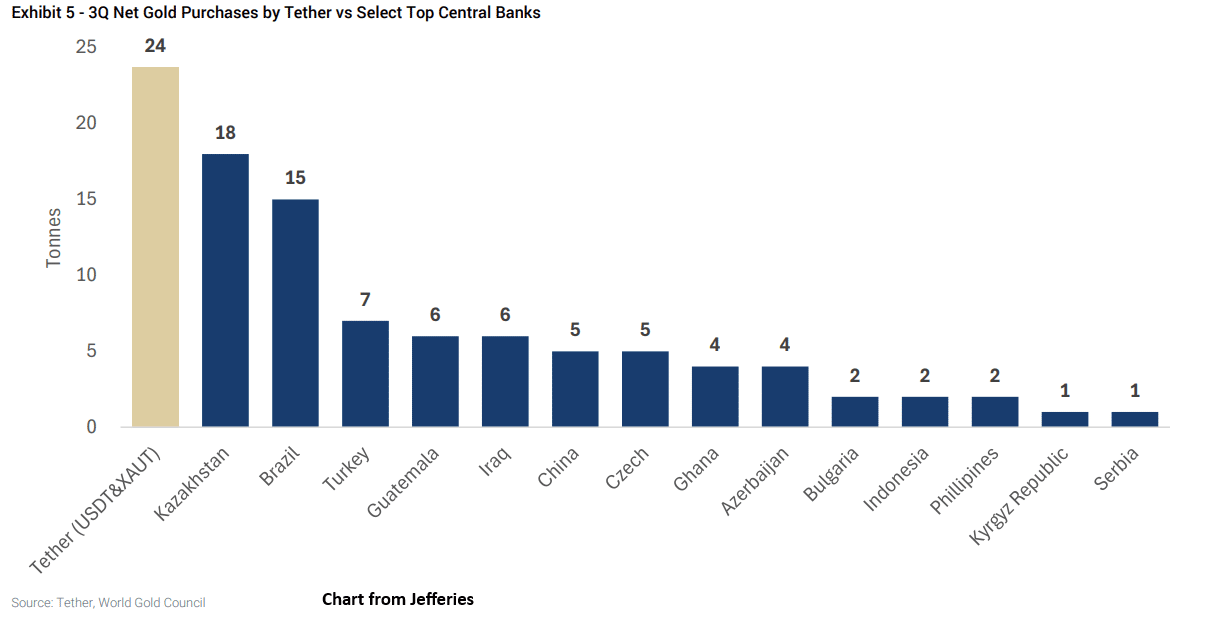

For context, here’s how Tether’s Q3 buying and overall holdings did in comparison to a few major central banks:

| Entity | Q3 2025 Gold Purchase (tonnes) | Total Reserves (tonnes) |

| Tether (stablecoin issuer) | 26 | 116 |

| Kazakhstan (central bank) | 18 | 324 |

| Brazil (central bank) | 15 | 145 |

| Turkey (central bank) | 7 | 641 |

| Guatemala (central bank) | 6 | 13 |

Those numbers reinforce what’s already been observed that Tether’s quarterly buying this year rivaled or exceeded mid-tier central banks (such as Kazakhstan and Brazil), while even outpacing some large ones in the period.

Tether’s 116 ton (Sept 2025), is close to both Greece’s official 112t and Korea’s 104t but miles away from top holders like the US or IMF.

To put it simply, a non-state actor (Tether) now has more gold in reserves than most nations.

Why Tether is Buying Gold: Implications and Use Cases

The idea of Tether buying gold may sound odd for a stablecoin issuer, but the company pitches it as part of its reserve diversification and stability strategy.

Tether CEO says they ‘continue to invest part of their reserves into safe assets like Bitcoin, Gold, and Land”.

Tether stresses that these purchases are made using company profit and not the USTD deposit reserves.

In other words, Tether uses its balance sheet similarly to how a mini central bank operates. It holds cash and Treasuries as well as noncash assets (gold, Bitcoin, loans) to help shore up its reserve portfolio.

As one report states, Tether’s gold procurement is based on profits and provides diversification, risk management and backing for USDT.

Use Cases

Stablecoin reserves: Tether issues its own USDT stablecoin. It needs to back that with assets. Most reserves are held in cash or Treasuries, but Tether has intentionally invested some in gold. This serves as an additional reserve layer, since gold has its own value.

Gold-backed token (XAUT): Tether also issues a gold-backed token that is directly 1-for-1 reserved by physical gold. Official attestation indicates that for every XAUT in circulation, there is 1 ounce of gold (as of Q1 2025, it was about 7.7t).

Inflation hedge: The company is using global economic uncertainty and fears of inflation as reasons to invest. Its Q1 attestation cited increased take-up of inflation-resistant assets. Tokenized gold (XAUT) provides a means for individuals to hold gold in a digital form, according to Tether.

Earning yield: Like a bank, Tether is in effect trying to earn interest on its reserves. It can make a profit on rising prices by purchasing gold or assets related to gold. Sources report that Tether has purchased shares in gold mining and royalty companies as part of its strategy.)

Notably, Tether has its modes and is influenced by central bank-type logic (store of value, liquidity) but also mirrors crypto trends. Stablecoin issuers, sovereign funds, corporates and tech firms are all players in gold markets, say analysts.

For Tether, the purchase of gold is a private business decision, risk management and investment strategy that had nothing to do with government monetary policy.

Its filings make it clear that gold is just one of many reserve assets. As of Q3 2025, about 7% of Tether’s consolidated reserves were in gold, with the remainder in cash and treasuries and other securities.

Expert Take: Tether’s Gold Strategy Explained

Industry experts view Tether’s gold-buying spree as a sign of changing dynamics. The investment bank Jefferies observes that Tether is the largest holder of gold outside central banks.

Based on Jefferies analysis, Tether’s gold purchases in Q3 (26t) represented close to 2% of global gold demand and around 12% of known central bank buying that quarter.

Tether was, in other words, a major marginal buyer by itself.

Jefferies warned that ““Tether gold demand is likely to have tightened supply in the short term and influenced sentiment”, which could send potential inflows into the metal.

Jefferies also observes Tether’s bullish goal. Investors have the impression that Tether plans to purchase another 100 tons of gold in 2025. As Tether’s upcoming profits are reported to be in the $15 billion+ range, analysts say that it could easily reach this goal.

Analysts have described an ideological connection between gold and crypto: both are treated as hedges against “currency debasement.” Mike Dolan writes that oversupplied fiat currencies drive demand for assets with finite supply, making “gold and crypto ecosystems” complementary stores of value.

Simply put, if investors are worried about inflation or policy risks, they might pour funds into gold through well-known crypto conduits like Tether.

Still, analysts warn against reading too much into the move. It’s not an indication that Tether is insolvent, or anticipating some kind of market crash.

As one analysis reads, private companies buy gold for any number of strategic reasons, which means such purchases alone does not indicate liquidity problems or a risk of insolvency.

Regulatory Context: The GENIUS Act, and Stablecoin Rules

Tether gold buying also presents regulators with questions. In July 2025, the US enacted the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) laying out a new method of governing stablecoins.

The GENIUS Act, for its part, demands 100% reserve backing by liquid assets (such as dollars or Treasuries). This is commonly understood to exclude gold, or other illiquid commodities. In effect, the new law bans redeemable stablecoin issuers from holding gold in reserve.

Tether however continues to accumulate gold, and the reasons behind that are being scrutinized.

Tether’s Q3 buying “appears to conflict with the US GENIUS Act”, according to Trakx.

Following the disclosure of these purchases, reports claim S&P Global downgraded Tether’s credit stability rating to “weak (5)” from “constrained (4)”, blaming high-risk assets among its reserves (gold was included).

Tether has revealed plans for a future “GENIUS-compliant” stablecoin (USAT) that will not be backed by gold, but in the meantime its gold holdings are significant.

All in all, when it comes to compliance, Tether’s gold buys appear to be defying soon-to-be law. That suggests Tether is willing to take the regulatory risk that comes with holding so much gold for now, gambling that its business model and desired position in the market enable it.

Conclusion

Tether gold buying seem to be a purposeful move by the stablecoin issuer that has trumped many an official buyer and mirrors market trends.

Tether’s massive gold purchases of 26 tonnes in Q3 2025 and around 116 in total, set it as one of the largest non-sovereign holders.

Analysts point this to Tether’s interest in reducing reserve concentration and offering a digital gold product which is being touted as a store-of-value due to the global economic uncertainty.

Reports from experts point out that Tether’s demand for gold has in fact been substantial enough to impact the supply and sentiment of the market.

Finally, Tether buying gold implies that investors are looking for safe havens across the entirety of crypto and traditional finance.

Frequently Asked Questions About Tether Buying Gold

How much gold does Tether have?

According to the latest data, Tether had around 116 tonnes of gold reserves by the close of Q3 2025. It had reported about 80 tons by mid-2025, so Tether’s sum has increased. This consists of approximately 104 tonnes supporting the USDT reserves, and a further 12 tonnes behind its gold token XAUT.

What is Tether doing with all that gold?

Tether says the purchases are funded from company profits and are aimed at diversifying its reserves. Analysts note that Tether’s purchase of gold is more strategic (to back its gold token and to build reserves) rather than forced by financial stress.

What does Tether buying gold have to do with central banks?

Tether was buying 26 tonnes in Q3 2025, more than any central bank did individually that quarter. In total central banks added 220 tonnes in the quarter. Tether’s holding of 116 tonnes is roughly equivalent to the gold reserves held by nations like Greece or South Korea. Analysts estimate that Tether’s buying accounted for around 12% of central bank demand in the third quarter.

Is Tether legally permitted to hold gold under U.S. law?

According to the new U.S. law (the GENIUS Act, from July 2025), stablecoin reserves should hold assets in full backing that are sufficiently liquid, such as dollars or even Treasuries. Gold is not liquid in this sense, so compliance issuers can’t use gold as backing. Tether has said it would issue a fresh stablecoin (USAT), in order to correct the imbalance by not using gold. For now, Tether’s gold holdings surpass what the new rules allow for regulated stablecoins.

Could Tether buying gold sway the price of gold?

Yes. The Tether purchases were large enough to tighten the short-term supply and affect sentiment, said analysts at Jefferies. Some 2% of global gold demand and 12% of central bank demand in that quarter came from Tether. This added demand contributed to higher gold prices in 2025.

Glossary

Tether (USDT): The world’s biggest stablecoin, a digital token linked to the value of the United States dollar on a 1:1 basis. Issued by Tether Ltd.

Stablecoin: A cryptocurrency that is designed to have a stable value, often by being pegged to reserves (such as fiat currency or commodities).

Gold Reserves: The physical gold that is owned by central banks or institutes. Gold is considered a “safe haven” asset that maintains its value.

XAUT (Tether Gold): Tether’s representation of gold. Every XAUT is allegedly 100% backed by the equivalent of one ounce of physical gold, which can be redeemed at the request of any holder.

Reserve Attestation: Independent verification of a stablecoin issuer’s reserve assets and liabilities on a certain date. Tether publishes these quarterly.

GENIUS Act: U.S. law (2025) that establishes stablecoin regulations. It calls for 100% reserve backing with liquid assets (dollars or Treasuries) and excludes backing by a commodity, such as gold.