This article was first published on Deythere.

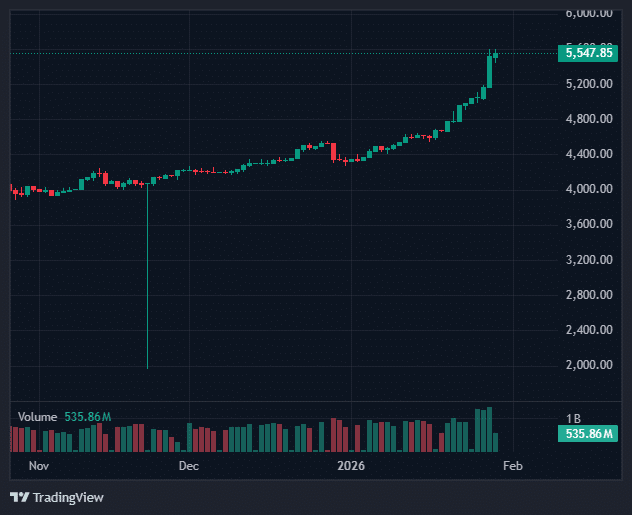

The gold price has surged to a historic $5,500, catching the attention of investors who sense rising stress beneath global markets. This jump is not just about numbers on a screen. It reflects a broader mood shift where safety matters more than speed.

According to the source, this rally comes amid lingering inflation fears and weakening confidence in fiat systems. Escalating geopolitical tensions and fragile political relationships have added pressure, leaving investors less focused on chasing returns and more intent on protecting value.

A Record Level That Redefined Market Psychology

Crossing $5,500 pushed the gold price into a new psychological zone. Analysts often note that record highs appear when uncertainty outweighs optimism. Recent market data support that view, showing strong inflows into bullion-backed instruments during periods of rising risk.

Independent market research linked here explains how prolonged inflation pressure, rising sovereign debt, and political instability are reshaping long-term asset allocation. This environment has helped gold reclaim its role as a financial anchor.

Central Banks Move Quietly but Decisively

One of the strongest drivers behind the gold price surge comes from central banks. Over the past year, reserve managers have steadily increased holdings to reduce reliance on major currencies, especially the U.S. dollar. A detailed reserve study linked here highlights how this trend has accelerated among emerging economies.

This institutional behavior sends a clear signal. When monetary authorities prioritize stability, markets listen. Retail investors have followed the same path, increasing exposure to gold through physical holdings and exchange-backed products.

Crypto Volatility Adds Fuel to the Shift

There’s a shift in the air of digital asset markets that is reflected by the gold price rally. Although still imaginative and rapid-moving, in recent times the otherwise endless volatility of crypto has given investors a rude awakening about risk assets. Thus, during times of doubt, financial capital often flows into those assets that have a long track record for safety.

For blockchain developers and crypto analysts, this contrast offers insight. Gold does not compete with technology. It complements portfolios when confidence in financial systems begins to waver.

Inflation, Rates, and the Narrow Path Forward

Inflation continues to test policymakers worldwide. At the same time, interest rates sit in a fragile balance between growth and control. This tension supports the gold price, as real yields remain under pressure.

Economic data indicate that when inflation-adjusted returns weaken, non-yield-bearing assets look good. Gold stands to benefit from this dynamic in particular because policy clarity still seems elusive across all large economies.

What Comes Next for the Gold Market

Some analysts are warning that short- term pullbacks may follow such rapid gains, but the overall picture of gold is optimistic for the year ahead and beyond. A solid foundation is provided by the structural demand from central banks, large retail investors and cautious individuals.

Market historians often point out that gold rallies tied to uncertainty tend to last longer than those driven by speculation. Current conditions suggest this move fits that pattern.

Conclusion

At $5,500, the gold price reflects more than market enthusiasm. It mirrors global concern, political strain, and a renewed search for reliability. For crypto enthusiasts, financial students, and analysts, the lesson is clear. When trust fades, value gravitates toward assets that have endured every cycle.

Glossary of Key Terms

Safe-haven asset refers to investments that retain value during uncertainty.

Inflation hedge describes assets that protect purchasing power over time.

Central bank reserves are assets held to support national currencies.

Real yield means returns adjusted for inflation.

FAQs About Gold Price

Why did gold reach $5,500?

Inflation fears, geopolitical risk, and central bank demand pushed prices higher.

Are central banks still buying gold?

Yes, many continue to increase reserves to diversify currency exposure.

Does this affect crypto markets?

It highlights a shift toward stability amid volatility.

Can prices correct from here?

Short-term pullbacks are possible, but long-term demand remains strong.