This article was first published on Deythere.

- Support Levels Hit But Bitcoin Liquidity Remains Low

- On-Chain Stress and Loss-Holding Supply

- Flows on Exchanges Show How Holders Are Behaving, Not Selling Pressure

- What Traders and Analysts Are Watching

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin Liquidity

- What Can be expected from Bitcoin’s price based on limited liquidity?

- Why do analysts focus on the realized profit/loss ratio?

- Does low exchange inflow mean the selling pressure is off?

- Can Bitcoin’s rallies run without better liquidity?

- References

Bitcoin’s price rebound in recent days has drawn market attention, but it is not yet certain whether the rally will last if market liquidity fails to return. New on-chain data indicates that although bulls have defended key support, short-term recovery remains a possibility, this won’t happen until infusions of liquidity into the Bitcoin markets increase.

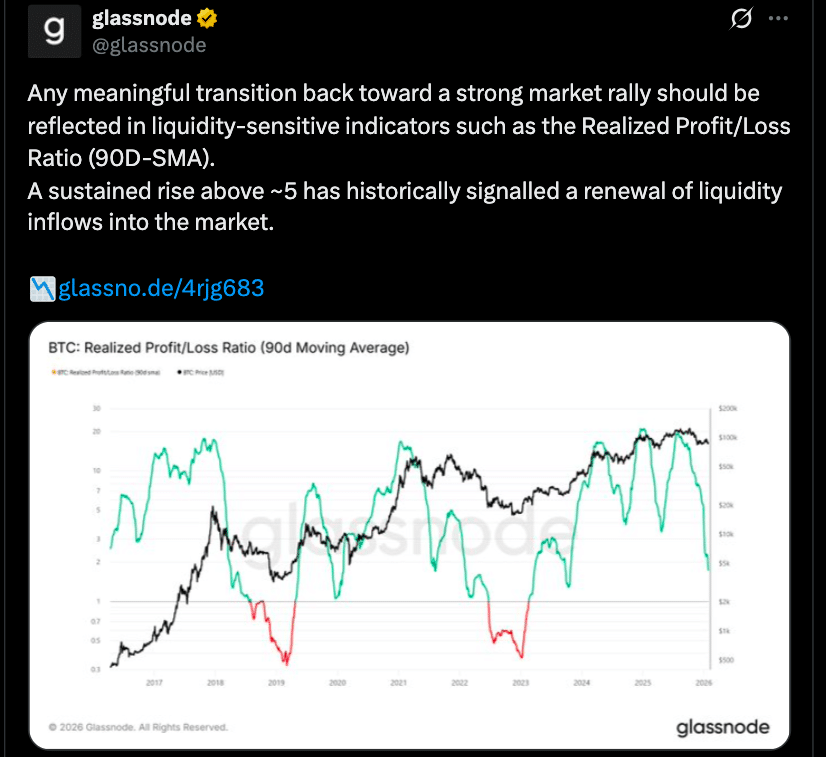

Analysts have referred to the 90-day realized profit/loss ratio, exchange flow activity and similar metrics as those that will define if a sustained breakout is feasible. Bitcoin has no upside beyond those signals until and unless it sees meaningful inflows.

Support Levels Hit But Bitcoin Liquidity Remains Low

The bulls succeeded in defending the price in a crucial support zone before it fell into worse territory below $80,700 to $83,400.

Recent action in the futures market indicates traders could be looking for a test of near-term liquidity around $93,500. But that alone isn’t sufficient for the market to confirm a transition into a multi-week or multi-month uptrend, according to Glassnode.

An important liquidity measure, the 90-day realized profit/loss ratio, needs to surpass some certain defined levels for a reconfirmation of flow of capital back into Bitcoin.

This ratio monitors the extent to which coins are being spent at gains or losses over a three month period, and has accurately indicated previous liquidity expansions in the past when it remained above five.

Liquidity is more than just a short-term price driver. If more new buyers don’t come into the market and push capital back into Bitcoin, breakouts can be short-lived because there’s not enough bid-side momentum to keep prices pushing higher beyond local resistance areas.

On-Chain Stress and Loss-Holding Supply

Another context for the liquidity problem is the percentage of BTC HODLers who are holding their coins at a loss?

According to data, over 22% of the circulating $BTC supply is at a loss, i.e., held at a lower price than the current value of those coins when they were last moved. In past cycles, this was an area where many investors would offload their bags during a relief rally to break even.

With a big number of holders underwater, price corrections can be more fierce, and support breaks more meaningful as all those holders adjust their behavior when important technical roads are crossed.

Past drawdowns have featured high supply stress at such periods: In early 2022 and mid-2018, realized losses escalated, selling pressure lower.

While the exact scenario is different today, the market has to manage a far greater tolerance for volatility than in times where profit holders run the show.

Flows on Exchanges Show How Holders Are Behaving, Not Selling Pressure

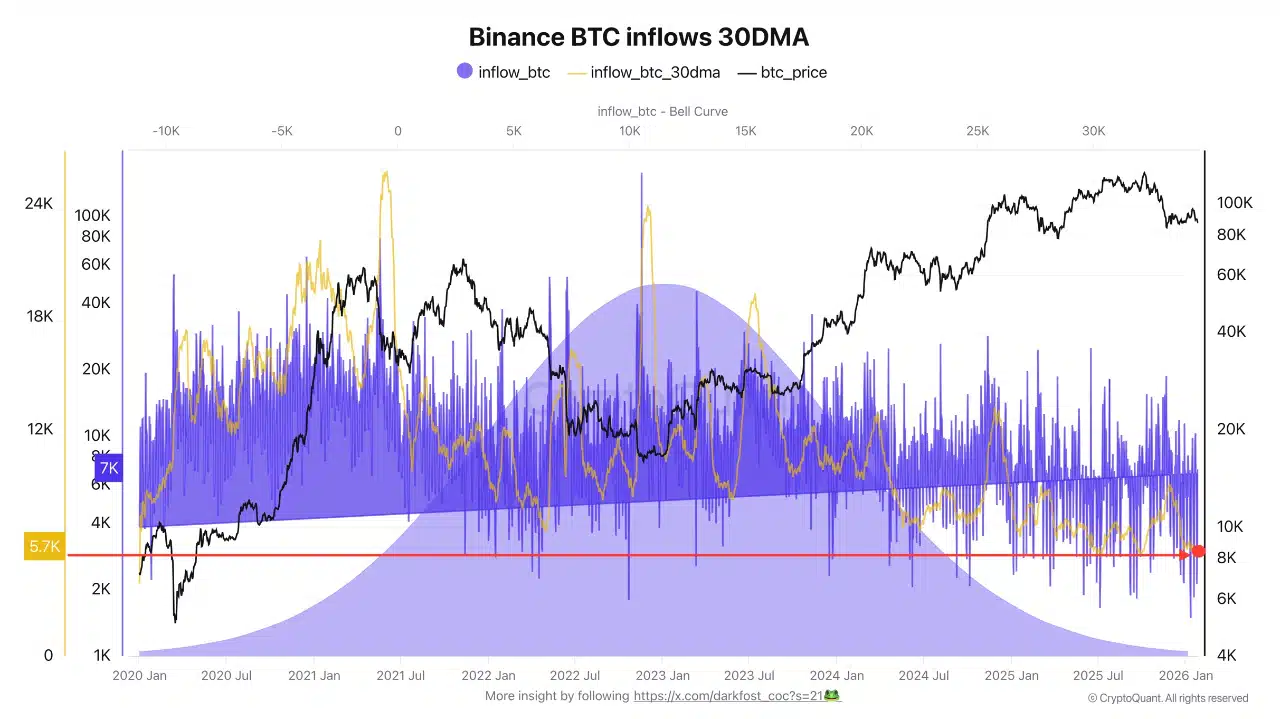

A clearer picture is provided by exchange flow data around liquidity. When Bitcoin inflows into major exchanges like Binance are high, it typically means holders are looking to sell and take profits (or cut losses).

However, data at present indicates that the monthly BTC inflow into Binane is near those levels not seen since last year. On average, only about 5,700 BTC flooding in per month, which is way lesser than the long-term monthly average of 12k BTC, suggesting not much pressure to sell while showing that holders are not putting capital back into the market with any fast pace.

Crypto analyst Darkfost characterized this low level of exchange inflows as “a rather positive signal” and noted that in spite of consolidation and macro risk, it appeared investors are favoring hodling their BTC. Although it limits the immediate downside risk, but it also does not alleviate the necessity for further substantial liquidity, in case of a sustainable

What Traders and Analysts Are Watching

The path to a sustained rally this 2026 is increasingly cast around liquidity signals rather than price only. On-chain data and metrics that are particularly responsive to capital rotation or real gains/losses may be viewed as early signals for more profound trend changes.

If the cryptocurrency begins holding above these levels, it could indicate that BTC is moving from short-term recovery phases to a more sustained strength.

In the meantime, analysts believe the current price action is structurally weak. While Bitcoin has not shown broad capitulation or rapid sell-offs, price action continues to be influenced by low liquidity ranges that keep rallies restricted in dimension.

This cycle of supported pace of outflows outracing deep inflows might continue until sustained breadth in capital rotations or broader market participation comes back.

Conclusion

Bitcoin’s price action so far points to a market that can defend key support levels and bounce for short-term gains, but liquidity in Bitcoin markets is still the major bottleneck to larger, longer rallies.

Amidst supply being lost, record low exchange inflows and on-chain metrics not showing clear signs of strong bid side participation, analysts are reluctant to call the strength of breakouts currently.

Until key liquidity thresholds on realized profit/loss metrics and deeper market participation return, Bitcoin’s price moves may continue to swing within defined ranges rather than sustain extended uptrends.

Glossary

Bitcoin market liquidity: the amount of capital available to purchase and sell Bitcoin without causing considerable changes in its price. It is driven by on-chain flows, exchange inventories and institutional involvement.

Realized profit/loss ratio (90-day SMA): measures the relationship between spending at profit versus loss (over a 3 month period), and is historically associated with an increase in liquidity inflows.

Exchange inflows: refer to Bitcoin sent into centralized exchanges, often covering selling intentions.

Support zone: A level where a stock finds support for its recent decline.

Frequently Asked Questions About Bitcoin Liquidity

What Can be expected from Bitcoin’s price based on limited liquidity?

When liquidity is limited, there are not enough buyers stepping up with their “bid side” capital to sustain the larger price moves. Even if Bitcoin does experience some kind of bump, prices will not be able to trend or move higher without constant capital flowing into the space.

Why do analysts focus on the realized profit/loss ratio?

This measure helps identify whether holders are selling at a profit or a loss. Sustained values above certain marks have usually ended in more severe rallies.

Does low exchange inflow mean the selling pressure is off?

Exchange inflows being low imply that holders are not actively selling through exchanges, but it also does not mean there is strong buying demand.

Can Bitcoin’s rallies run without better liquidity?

Short-term rallies can happen, but sustained and broad breakouts generally need the deeper liquidity or more active buying from different sectors of the market.

References

Cointelegraph

Cryptoquant

Blockchain News