This article was first published on Deythere.

- End of $50 Gas: Record Throughput Meets Tiny Fees

- Fusaka Upgrade: Staying Ahead of the Curve

- Layer-2 Networks and Mainnet Harmony

- Ethereum Outpaces Competition on Cost and Usage

- Network Effects and Usage Signals

- Conclusion

- Glossary

- Frequently Asked Questions About Ethereum Gas Fees

- Why did Ethereum gas fees fall so much?

- How high is Ethereum usage at this moment?

- Are Ethereum fees really $0.01?

- What upgrades enabled this change?

- References

Years after high fees priced out everyday users, Ethereum has achieved a noteworthy change in how its network operates transactions. 2026 has seen a combination of protocol upgrades, enhanced data availability, and the adoption of Layer-2 protocols, leading to low gas prices as transaction volumes reach all-time highs.

This Ethereum gas revolution is a progression for the network from a congested, costly platform to one that can amply serve global mainstream use and complex decentralized finance (DeFi) activity.

End of $50 Gas: Record Throughput Meets Tiny Fees

For most of its existence, Ethereum’s demand had come with a cost; high gas fees that soared during times of high use like the bull market in 2021 and the NFT boom in 2024, when even simple transactions could run at least $50.

That period priced Ethereum out of reach for average users and restricted participation to people willing to pay high costs.

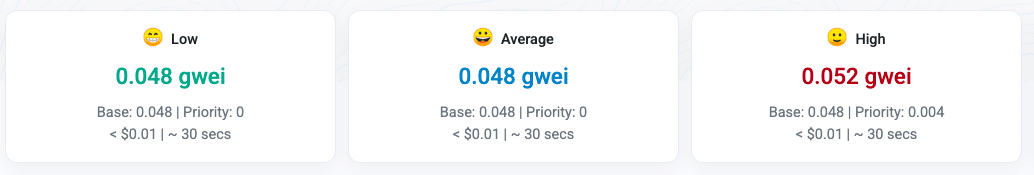

As of this January 2026, the situation has changed. Ethereum’s average gas fees now range below pennies, with costs as low as around $0.01.

This collapse in fees has happened without a drop in activity. In contrast, Ethereum’s seven-day moving average for daily transactions is approaching 2.5 million per day, almost double the level of a year ago and even above previous peaks during its boom.com periods.

Fusaka Upgrade: Staying Ahead of the Curve

One of the main contributors of this Ethereum gas fee drop is a series of network upgrades coming together in the Fusaka hard fork, which activated on December 3, 2025.

Fusaka’s main innovation is the introduction of a mechanism called Peer Data Availability Sampling (PeerDAS), which enables Ethereum validators to test smaller samples of rollup data instead of downloading the complete rollup data set. This enhances throughput and makes Layer-2 rollups more cost-effective.

By increasing blob capacity by about 8×, Ethereum now accommodates a vastly greater amount of Layer-2 throughput while reducing gas demand on the main chain.

PeerDAS has been perceived by developers and analysts as the first substantive sharding solution on Ethereum, helping to achieve long sought-after scalability.

Ethereum’s blob capacity has continued to expand in subsequent Blob Parameter Only (BPO) forks, pushing target and maximum blobs per block upward.

This growth also further decreases onchain data fees for Layer-2 networks, resulting in lower gas fees available to users.

The Fusaka upgrade also initiated a new twice-a-year-upgrade cycle focused on improving backend efficiencies and increasing data availability without frequent disruptive hard forks.

Layer-2 Networks and Mainnet Harmony

Another important piece of the Ethereum gas fee evolution is the increasing use of Layer-2 rollups; projects like Arbitrum, Base and Optimism.

These scaling-layers batch thousands of transactions outside of the chain and only post summaries to the Ethereum mainnet. Layer-2 usage has exploded without having to clog the main chain, as Fusaka and similar upgrades have raised blob capacity and lowered data costs.

Stablecoin transfers are already a big share of overall activity, composing 35-40 percent of all transactions on Ethereum according to recent data.

In the fourth quarter of 2025, developers launched over 8.7 million smart contracts on Ethereum, another record suggesting widespread interest to build out on the base layer rather than offload activity elsewhere.

This synergy of mainnet upgrades and Layer-2 ecosystems is characteristic of Ethereum in this stage, where inexpensive settlement and high throughput are compatible.

Ethereum Outpaces Competition on Cost and Usage

Typically, other blockchains like Solana have been preferred for cheaper transactions and faster finality. However, this fee gap mostly disappears in 2026, with Ethereum providing effectively lower costs without relinquishing its high assurances of security and decentralization.

Market models indicate Ethereum gas at almost near-zero even as throughput increases and with Solana and others suffering occasional performance fluctuations.

Meanwhile, Ethereum’s transaction volumes and active address counts also continue to grow.

That’s not to say Solana and others are now faded, but it eliminates the reason why users were previously enthusiastic about fleeing Ethereum.

Network Effects and Usage Signals

Ethereum recently processed 2.6 million transactions in a single day with fees near $0.01, showing that the network can handle high demand without rediscovering congestion problems of the past.

Network participating metrics have been affected as well by the high volume/low fee combination. Ethereum’s active addresses already exceed some top Layer-2 networks, and ecosystem developer activity remains strong.

Upgrades like Pectra introduced earlier in 2025 had served to expand blob capacity, while Fusaka increased the efficiency of data verification on this basis.

The next follow-up update, Glamsterdam, is currently scheduled for the first half of 2026 and targets boosting transaction throughput even more while also keeping fees low.

Conclusion

Ethereum’s gas in 2026 is a change in how the world’s biggest smart-contract blockchain works. By integrating significant protocol upgrades, such as the Fusaka hard fork and its PeerDAS implementation, trading-wide Layer-2-like solutions, and doubling the blob size capacity, Ethereum has made low fees and high usage to coexist.

Transactions that previously cost tens of dollars now are down mere cents, allowing everyday individuals to engage with the network without hurdles.

This transformation is no fad driven by speculation or temporary price action. It spells out the structural changes made in the core protocol and surrounding ecosystem that place Ethereum as a sound, scalable settlement layer able to handle mass adoption while being secure and censorship-resistant.

Glossary

Gas fee: The amount a user pays to submit a transaction on Ethereum; it dropped drastically after scaling improvements.

Fusaka upgrade: a protocol hard fork activated on December 3, 2025, that enforces PeerDAS and increases data capacity.

PeerDAS: Peer Data Availability Sampling, a solution that enhances data availability efficiency for rollups and scales better.

Layer-2 rollups: Layer-2s built off of Ethereum’s mainnet that batch transactions on-chain and settle them back onto the main chain to save money and cut down congestion.

Blob capacity: Ethereum data storage units used by rollups; rising of blob capacity equals cheaper and more transactions.

Frequently Asked Questions About Ethereum Gas Fees

Why did Ethereum gas fees fall so much?

Fees fell due to improvements in protocols (notably Fusaka and PeerDAS), which increased data capacity, as well as made Layer-2 rollups vastly more efficient, even as network activity hit all-time highs.

How high is Ethereum usage at this moment?

Seven-day average daily transactions approached almost 2.5 million, a record high and active addresses grew more than large Layer-2 networks.

Are Ethereum fees really $0.01?

According to data from Etherscan, typical fees are been well below $0.15, and in some swap cases can be close to $0.04 or less.

What upgrades enabled this change?

Highlights are Fusaka (PeerDAS), Pectra, raising blob capacity by BPO forks which combined have raised throughput and reduced costs.