Decentralized exchange platforms are changing how people trade cryptocurrency by allowing peer-to-peer transactions without traditional middlemen. They let users trade directly, keep full control of their funds, and participate in new blockchains, making them a key part of decentralized finance.

- What Is a Decentralized Exchange and How Did It Begin?

- How Does a Decentralized Exchange Work?

- What Are the Advantages of Using a Decentralized Exchange?

- What Are the Risks and Drawbacks of a Decentralized Exchange?

- How Are Decentralized Exchanges Evolving?

- How Do Decentralized Exchanges Compare With Centralized Exchanges?

- Conclusion

- Glossary

- Frequently Asked Questions About Decentralized Exchange

These exchanges offer opportunities like earning rewards and joining liquidity pools, but they also come with challenges. Users face complex interfaces, higher transaction costs, and the risk of scam tokens. Understanding both the benefits and risks of DEXs is essential for anyone navigating today’s crypto market.

What Is a Decentralized Exchange and How Did It Begin?

A decentralized exchange is a platform where people can trade cryptocurrency directly with each other. There’s no bank, broker, or company controlling the trades or holding your funds. Everything runs through smart contracts on a blockchain, so when you trade, the assets move straight from your wallet to the other person’s wallet.

DEXs trace their origins to the early days of Ethereum, where the first attempts at peer-to-peer crypto trading highlighted the limitations of centralized methods. Before the advent of automated market makers, early DEXs suffered from slow transaction times, limited liquidity, and higher costs compared to centralized counterparts.

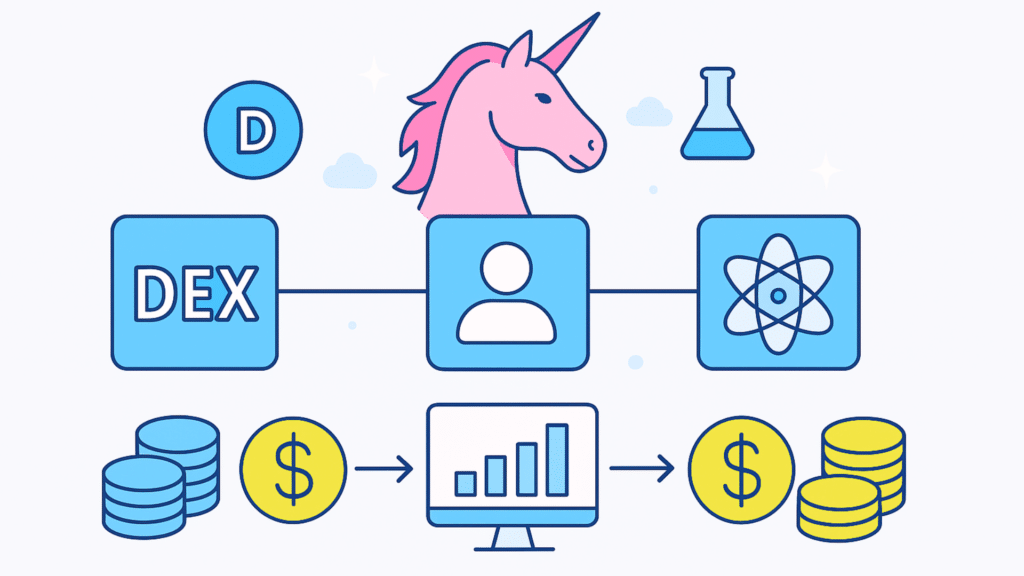

Uniswap, launched in 2018, changed the landscape by introducing the first functional automated market maker, or AMM. This innovation enabled the creation of liquidity pools, allowing users to provide funds for trading pairs and earn a share of the trading fees generated.

Before AMMs, decentralized exchanges often struggled because they tried to replicate the order book system of centralized exchanges. This approach required low-latency computation and partial centralization, resulting in poor performance and user dissatisfaction.

With the introduction of AMMs, decentralized exchanges could algorithmically price assets based on liquidity pool balances, allowing trades to occur without direct matching of buyers and sellers. As a result, decentralized exchanges have grown into foundational components of DeFi ecosystems.

How Does a Decentralized Exchange Work?

A decentralized exchange works by using smart contracts to carry out trades automatically. Each trading pair has a liquidity pool, which is filled by users depositing equal amounts of both tokens. When a trade happens, the AMM algorithm updates the pool’s balances to match the swap while keeping a set formula in place.

People who add funds to liquidity pools earn a share of trading fees, which encourages them to keep the pools full. Every transaction is recorded on the blockchain, making it transparent while keeping identities private.

What Are the Advantages of Using a Decentralized Exchange?

Decentralized exchanges, or DEXs, make it easier for people to trade crypto without going through a middleman. One of the main benefits is that new tokens show up much faster. On regular exchanges, getting a new coin listed can take weeks or even months, but on a DEX, traders can buy and sell almost any token right away.

This gives everyone a fair chance to discover new projects early. DEXs are also great for privacy since they don’t ask for personal information. All you need is a wallet, so you can trade freely even if you live somewhere with strict financial rules.

Anyone with internet access can join, no matter where they are. People who add funds to liquidity pools can also earn a share of the trading fees, which means they can make money without constantly trading. Some platforms even give extra rewards like bonus tokens for helping provide liquidity.

Because of all this, DEXs appeal to both casual traders and big investors who want more control and freedom over their crypto.

What Are the Risks and Drawbacks of a Decentralized Exchange?

Despite their benefits, decentralized exchanges still carry some risks. The user interface can be confusing, especially for newcomers. Using a DEX requires understanding wallets, gas fees, and how AMMs function. Errors like sending tokens to the wrong address cannot be reversed, and customer support is usually very limited or absent.

Another issue is impermanent loss, which happens when the value of assets in a liquidity pool changes relative to each other. Liquidity providers may see their holdings drop temporarily, particularly during times of high market volatility. Smart contracts, even when audited, are not completely safe from bugs or exploits.

Any weaknesses in the code can be taken advantage of, potentially causing serious financial losses for users. Users of decentralized exchanges often struggle to identify which tokens are reliable. Because the barrier to listing a token is low, scam projects can appear alongside legitimate ones. Doing proper research is critical.

Traders should study white papers, follow developer activity, and check independent audits before committing funds to any project. Transaction fees also present a challenge. On Ethereum, which hosts the most active decentralized exchanges, network congestion can push gas fees high, making smaller trades costly.

While layer-2 networks such as Optimism and Polygon offer relief, users must still factor these fees into their trading plans.

How Are Decentralized Exchanges Evolving?

The ecosystem of decentralized exchanges is growing quickly. Developers focus on making them faster, cheaper, and easier to use. Layer-2 solutions, like rollups and sidechains, let transactions happen off the main blockchain while staying secure and decentralized. This helps DEX trading be faster and more cost-efficient.

Decentralized exchange platforms now offer more than token swaps. Users can stake, lend, or do yield farming to earn rewards. Governance tokens let the community vote on changes, keeping the platform decentralized. Decentralized exchanges, or DEXs, are changing how people use money online.

Unlike banks, they don’t ask for lots of details or set limits, so anyone with a wallet and internet can trade or invest. This helps people in countries where banking is hard or too costly.

Some DEXs now link different blockchains, letting people trade coins that couldn’t be traded before. This makes the crypto world more connected, helps money move faster, and gives users more ways to use their crypto.

How Do Decentralized Exchanges Compare With Centralized Exchanges?

Centralized exchanges (CEXs) keep your money and handle trades for you. They usually offer a limited selection of tokens. They’re easy to use, provide customer support, and let you buy crypto with regular money. But they come with risks like hacking, mismanagement, or government rules.

Decentralized exchanges (DEXs) work differently. You keep control of your money, and trades are run automatically through smart contracts. You get access to more tokens and lower risk from the exchange itself. The trade-off is that you must manage your own wallet, pay fees, and deal with a more complicated interface.

Both centralized and decentralized exchanges serve important functions, but the key distinction lies in control, transparency, and accessibility. While CEXs prioritize convenience and compliance, DEXs emphasize autonomy and peer-to-peer trading.

Conclusion

Decentralized exchanges are more than just places to trade. They let people trade directly, keep control of their money, and join the growing world of decentralized finance. As more people use them, these platforms can offer new tools, make trading easier, and give access to more digital assets.

Using a DEX isn’t always simple. People need to know how to manage their wallets and handle some complexity. Still, the benefits like privacy, freedom over your funds, and the chance to take part in new token projects make them worth exploring. For those willing to learn, DEXs provide access to global markets while keeping control in the user’s hands.

Glossary

Automated Market Maker: A system that sets token prices automatically in a liquidity pool.

Governance Token: A token that lets holders vote on platform decisions.

Decentralized Finance: Financial services on blockchain without banks.

Layer-2 Solution: A blockchain add-on that makes transactions faster and cheaper.

Liquidity Pool: A user-funded pool that enables token trading and earns fees

Frequently Asked Questions About Decentralized Exchange

How do decentralized exchanges work?

They let you trade crypto straight from your own wallet. Smart contracts handle the swap automatically, so there’s no middleman.

What are the main advantages of using a DEX?

You get more privacy, early access to new tokens. And you can earn a bit by adding funds to liquidity pools. Anyone in the world can use DEX.

What are the risks of trading on a DEX?

They can be confusing at first. Fees may be high, and some tokens can be scams. Smart contract bugs and impermanent loss are also possible.

How is a DEX different from a centralized exchange?

With a DEX you stay in control of your money. Trades happen directly on-chain, not through a company.

How are DEXs evolving in 2025?

They’re getting faster, cheaper, and easier to use. With Layer-2 upgrades, cross-chain swaps, and more earning options.

Sources