Crypto was supposed to be the antidote to old-school banking risk. No middlemen, no closed doors, no waiting for permission. Yet a harsh reality keeps surfacing: even the strongest encryption cannot protect someone who is being threatened in the real world. That is the uncomfortable truth behind a fast-growing category of crime known as crypto wrench attacks.

- The Anatomy of a Crypto Wrench Attack

- Why Crypto Wrench Attacks Are Getting More Attention

- The Market Cycle Effect: Higher Prices, Higher Incentives

- What Makes These Crimes So Difficult to Prevent

- Smart Storage Habits That Change the Outcome

- The Bigger Shift: Crypto Security Is Now Physical Too

- Conclusion

- Frequently Asked Questions

Unlike typical hacks that rely on malware or clever phishing pages, these incidents are physical and direct. A criminal does not need to beat a blockchain or crack an algorithm. All they need is access to the person holding the keys, plus enough pressure to force compliance.

In many cases, a phone is unlocked, a wallet is opened, and a transfer is approved in seconds. The funds move, the trail goes cold, and the victim is left dealing with more than just financial loss. As digital assets become more mainstream, crypto wrench attacks are turning what used to be “online risk” into something far more personal.

The Anatomy of a Crypto Wrench Attack

A wrench attack is a forced crypto theft where the attacker uses intimidation, violence, or kidnapping to obtain wallet access. The name comes from a simple idea in security culture: if someone cannot break your encryption, they may “break” you instead. That might sound dramatic, but the mechanics are painfully straightforward.

Most victims are targeted because criminals believe the payout will be instant. The attacker typically aims for hot wallets on mobile devices, exchange accounts, or any setup where funds can be moved quickly with a passcode, Face ID, or a simple approval. This is why crypto wrench attacks do not resemble long technical operations. They are quick, opportunistic, and designed for speed.

What makes it even more dangerous is that the attacker does not need deep knowledge of blockchain technology. They only need a basic understanding of how to force a transfer and disappear before help arrives.

Why Crypto Wrench Attacks Are Getting More Attention

There is a reason these crimes are being talked about more in 2026. Crypto adoption is broader than ever, and so is the pool of potential targets. At the same time, the lines between online identity and offline location have become thinner, sometimes dangerously thin.

Many investors unintentionally advertise their exposure. They show portfolio wins, share trading stories, or publicly celebrate meme coin gains. Even without revealing exact balances, patterns form. When someone appears confident online, posts regularly in crypto groups, or has a public-facing role in the industry, criminals may assume there is money nearby.

Data exposure adds another layer. Personal details can leak from old databases, social apps, or support-related incidents, making it easier to match a name to an address. In that environment, crypto wrench attacks become less random and more deliberate.

The Market Cycle Effect: Higher Prices, Higher Incentives

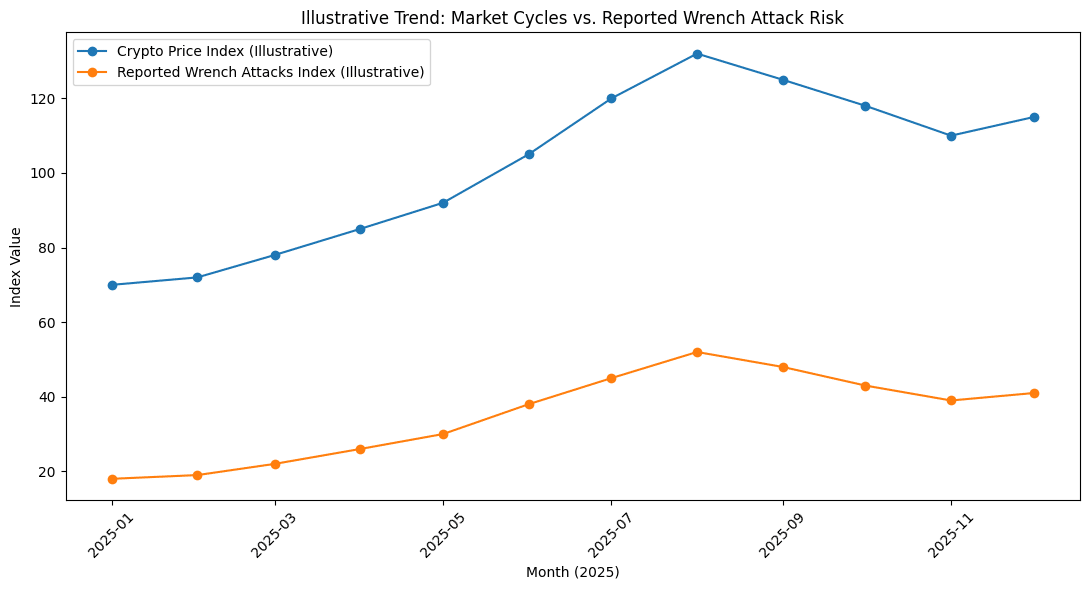

A rising market does not just attract new investors. It can also attract predators.

When asset prices climb, the value of the average wallet increases. Someone who bought early and stopped paying attention could be holding a fortune without realizing how visible that wealth has become. Even smaller balances can be worthwhile for criminals if they believe the transfer is easy and the risk is low.

This is why crypto wrench attacks often appear during periods of excitement. Bull markets encourage visibility. People talk more, share more, and move funds more frequently. That higher activity creates opportunities, especially when investors keep too much crypto in accessible wallets tied to their phones.

A phone, in this context, becomes a walking vault. It holds access to exchanges, self-custody wallets, and even stored passwords. That is a scary combination if the wrong person decides to take it.

What Makes These Crimes So Difficult to Prevent

There is no perfect defense against physical coercion, but there are strong ways to reduce the risk. The biggest issue is not the wallet software itself. It is the setup around it.

Most people prioritize convenience. They keep long-term holdings in the same wallet they use daily. They store backups in easy places. They rely on a single device for everything. That is exactly what crypto wrench attacks exploit.

Crypto security used to mean protecting private keys from hackers. Now it also means making sure your funds cannot be emptied instantly, even if someone forces you to open the app. If it is easy for you, it is easy for them.

Smart Storage Habits That Change the Outcome

The most effective strategy is reducing what can be taken immediately. That starts with separating funds into layers.

A small “spending” wallet can stay on a mobile device. Larger holdings should be moved to cold storage or a setup that requires more than a quick approval. Multi-signature wallets, hardware devices, and time-delayed withdrawals make theft harder because they reduce speed, and speed is the whole point of these attacks.

Privacy also matters. People who keep their crypto life quiet are naturally harder to target. Public bragging, visible lifestyle signals, and predictable routines do the opposite.

In real-world terms, crypto wrench attacks resemble a thief choosing between two houses: one with an open gate and one with strong locks and cameras. Criminals pick the easy route.

The Bigger Shift: Crypto Security Is Now Physical Too

Self-custody gives investors freedom, but it also shifts responsibility onto them. That responsibility is no longer just digital. It is about operational discipline, personal awareness, and lowering exposure. In 2026, a serious investor thinks about security the same way someone thinks about cash management. Carrying $200 is normal. Carrying $200,000 in a backpack and telling everyone about it is a different story.

That comparison captures why crypto wrench attacks are so unsettling. They bring crypto back into real-world danger zones, where social behavior and physical habits matter as much as passwords.

Conclusion

Crypto has created new ways to store and move value, but it has also created new ways to steal it. Crypto wrench attacks are a reminder that technology cannot fully remove human vulnerability. The safest investors are not the ones with the fanciest apps. They are the ones who reduce visibility, structure wallets intelligently, and avoid keeping large sums within instant reach. In a market built on speed, safety often comes from slowing down and building friction into access. That friction can be the difference between a scare and a disaster.

Frequently Asked Questions

What is a crypto wrench attack?

It is a physical threat or assault used to force access to a crypto wallet and approve transfers.

Why are crypto wrench attacks rising?

More adoption, higher prices, and personal data exposure make targets easier to identify and worth pursuing.

Are hot wallets dangerous?

Hot wallets are convenient, but they increase risk because funds can be moved instantly under pressure.

Can stolen crypto be traced?

Transactions can often be tracked on-chain, but recovery is difficult if funds are rapidly moved or swapped.

What is the safest storage option?

Cold storage and multi-step security setups reduce the chance of instant theft.

Glossary of Key Terms

Cold storage: Offline storage method for crypto assets that reduces exposure to immediate theft.

Hot wallet: Internet-connected wallet used for frequent transactions and easy access.

Seed phrase: A recovery phrase that grants full control of a wallet if exposed.

Multi-signature wallet: A wallet that requires multiple approvals before funds can be moved.

Operational security (OpSec): Personal practices that reduce the risk of being identified, tracked, or targeted.

Source