Bitcoin fell to $74,680 during a fast downturn that also triggered a heavy wave of liquidations in leveraged positions. When liquidations dominate the tape, price can drop faster than underlying conviction changes, because forced selling is not the same as a slow, discretionary exit. That is why the $75,000 area is being treated as a candidate base and why the Bitcoin price bottom 2026 discussion returned so quickly.

Why Bitcoin price bottom 2026 analysis starts with derivatives plumbing

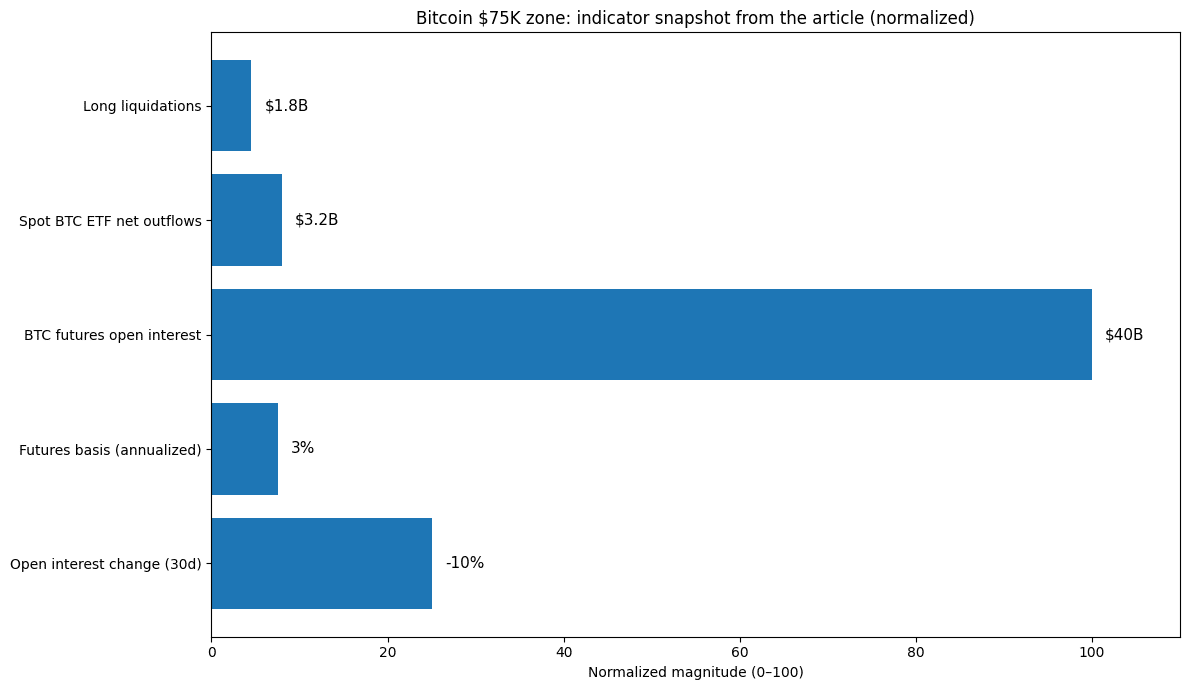

A deeper breakdown usually shows up first in derivatives as Futures can trade at a discount to spot, funding can stay negative, and traders pay up for protection. In this episode, the signals looked more restrained. The futures basis sat around 3%, which is below a healthy bull range but does not look like panic pricing.

Open interest adds another layer as a sharp dip paired with shrinking open interest often indicates that leverage has been flushed out, leaving a cleaner market. Providers still showed sizable outstanding exposure even after recent reductions, pointing to de-risking rather than a stampede into aggressive shorts. For anyone testing the Bitcoin price bottom 2026 claim, that matters because it suggests the market took damage, but did not fracture.

ETF flows look large until the denominator is considered

Spot Bitcoin ETFs have recorded net outflows of about $3.2 billion since January 16. The headline sounds severe, but context softens the interpretation. Framed against total ETF assets, the outflow has been described as under 3%, which fits rotation and rebalancing more than a broad abandonment of exposure.

This is where the Bitcoin price bottom 2026 thesis can either strengthen or weaken. If outflows fade as volatility cools, it supports the idea that the market just went through a positioning reset. If outflows persist alongside thinning liquidity, the support narrative becomes harder to defend.

Macro signals were tense, but not an all-out panic

Even during risk jitters, broader markets did not behave like they were in a full flight to safety. The US 2-year yield stayed around the mid 3.5% range, suggesting bond demand did not surge in an extreme way. US equities also finished February 2 close to record highs, which is not the usual backdrop for a sustained unwind across risk assets. That relative steadiness is another reason the Bitcoin price bottom 2026 argument has gained traction near $75,000.

A jump in yields, persistent ETF selling, or another leverage build-up can still turn a stable range into a trap. For now, the Bitcoin price bottom in 2026 remains a thesis, not a fact.

Conclusion

The market has assembled a plausible case for $75,000 functioning as a meaningful support zone, but labeling it as a confirmed Bitcoin price bottom 2026 is still premature. Derivatives stayed orderly, ETF outflows look smaller in context than the headline suggests, and macro markets did not fully crack.

What turns a bounce into a floor is follow-through. Buyers need to show up on spot, volatility needs to compress, and liquidations need to slow into routine levels rather than cascading events. If those conditions hold, the Bitcoin price bottom 2026 narrative gains credibility. If they fail, $75,000 becomes just another stop on the way down, and the same data points will be re-read with harsher eyes.

Frequently Asked Questions

Which indicators most often confirm a Bitcoin price bottom 2026 call?

Futures basis, open interest, liquidation intensity, and spot ETF net flows tend to lead because they reveal leverage and real demand.

Do liquidations make a bottom more likely?

Liquidations can accelerate selling and clear leverage, which sometimes allows price to stabilize once forced closures slow.

Can ETF outflows reverse without a major rally?

Yes. Flows often shift when volatility drops and arbitrage pressure eases, even if price only ranges.

Glossary of key terms

Futures basis is the premium or discount of futures versus spot, often annualized.

Open interest is the value of outstanding derivatives contracts.

Liquidation is a forced closure of a leveraged position when margin falls below requirements.

Spot ETF flows are net creations and redemptions that indicate buying or selling pressure.

References