This article was first published on Deythere.

Bitcoin and US dollar dynamics are no longer a theoretical debate. They now shape real market behavior. What started as a challenge to traditional money has evolved into a quiet force that influences fiscal discipline, inflation expectations, and investor trust.

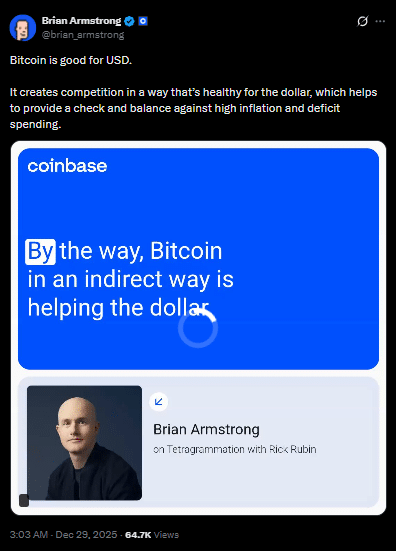

According to the source, senior leadership at a major US crypto exchange recently argued that Bitcoin plays an unusual role. It does not replace the dollar. Instead, it reacts when confidence weakens. Coinbase CEO Brian Armstrong has argued that Bitcoin helps preserve the US dollar’s global reserve status by discouraging excessive inflation and unsustainable fiscal policy.

That reaction alone sends signals to policymakers, markets, and global investors. At a time when reserve currency credibility depends on restraint, that signal matters.

How Bitcoin Pressures Policy Without Power

The relationship between Bitcoin and US dollar operates through choice, not authority. When inflation rises or debt expands too fast, investors seek protection. Bitcoin offers an exit. That option forces accountability by discouraging policies that could undermine confidence in the US economy and its currency.

Economic research shows reserve currencies lose status when inflation consistently outpaces growth. This pattern weakened past monetary systems. The same risk exists today. Market participants now monitor inflation, deficits, and capital flows in real time.

Bitcoin’s role is indirect but visible. When confidence dips, demand shifts. That movement becomes a warning light for monetary authorities.

Debt Growth Turns Markets Into Judges

America’s debt trajectory has sharpened this discussion. Public data shows the national debt approaching $38 trillion and rising by $1,000 per second. That pace raises long-term sustainability concerns. Armstrong’s argument suggests that the existence of Bitcoin makes markets less tolerant of unchecked debt expansion, reinforcing discipline that ultimately supports the dollar’s reserve role.

The Bitcoin and US dollar narrative intensified as institutional analysts described Bitcoin and gold as a form of protection against currency debasement. Those views aligned with rising uncertainty around fiscal expansion and monetary policy.

Market pricing reflects that concern. Bitcoin surged above $126,000 earlier this quarter before retracing to near $89,000. Despite volatility, demand held firm. This resilience suggests long-term conviction rather than speculative excess.

Verified market figures and historical pricing trends support this observation and remain publicly accessible through widely used crypto market data platforms, including this real-time dataset.

Strategic Bitcoin Reserves Meet Political Reality

Policy attention followed market momentum. The US administration authorized the creation of a Strategic Bitcoin Reserve. Supporters claimed it could help offset future debt risks.

However, disclosures show the reserve currently holds only seized Bitcoin. No active purchases have occurred. The Bitcoin and US dollar connection remains shaped by market behavior, not by direct state strategy.

Legislative proposals linked to the reserve remain in early stages. Analysts view the move as symbolic but notable. Bitcoin has entered policy discussions once reserved for gold.

Stablecoins Extend Dollar Power Faster Than Bitcoin

While Bitcoin draws attention, stablecoins quietly expand the US dollar across borders. Dollar-backed tokens now power payments, payrolls, and remittances in regions underserved by banks.

The Bitcoin and US dollar conversation increasingly includes stablecoins because they increase global demand for US debt instruments. Economic studies show this link strengthens dollar influence while shifting payment infrastructure to digital rails.

Recent regulatory frameworks passed in the US aim to control risks while supporting innovation. Market data shows the stablecoin sector exceeds $300 billion and continues growing. Government projections estimate that figure could reach $2 trillion by 2028, according to public financial outlooks published earlier this year.

These estimates are detailed in official treasury projections available here.

Conclusion

The relationship between Bitcoin and US dollar no longer fits a straightforward rivalry narrative. It functions as a feedback loop. Bitcoin responds to excess. The dollar adjusts under pressure. Markets enforce discipline faster than policy alone ever could.

For students, analysts, and developers, the takeaway is clear. Monetary trust now faces real-time stress tests. Capital moves instantly. Transparency replaces theory. That reality may define the next chapter of global finance.

Glossary of Key Terms

Bitcoin: A decentralized digital asset with a fixed supply used as a store of value.

US Dollar: The primary global reserve currency backed by US government debt.

Reserve Currency: A widely held currency used in global trade and finance.

Stablecoin: A digital token pegged to a fiat currency like the US dollar.

FAQs About Bitcoin And US Dollar

Does Bitcoin threaten the US dollar?

No. It pressures fiscal discipline rather than replacing it.

Why do investors hedge with Bitcoin?

It protects value during inflation and debt expansion.

Do stablecoins strengthen the dollar?

Yes. They expand digital dollar use worldwide.

Is Bitcoin part of US policy now?

It is discussed, but not yet formally integrated.