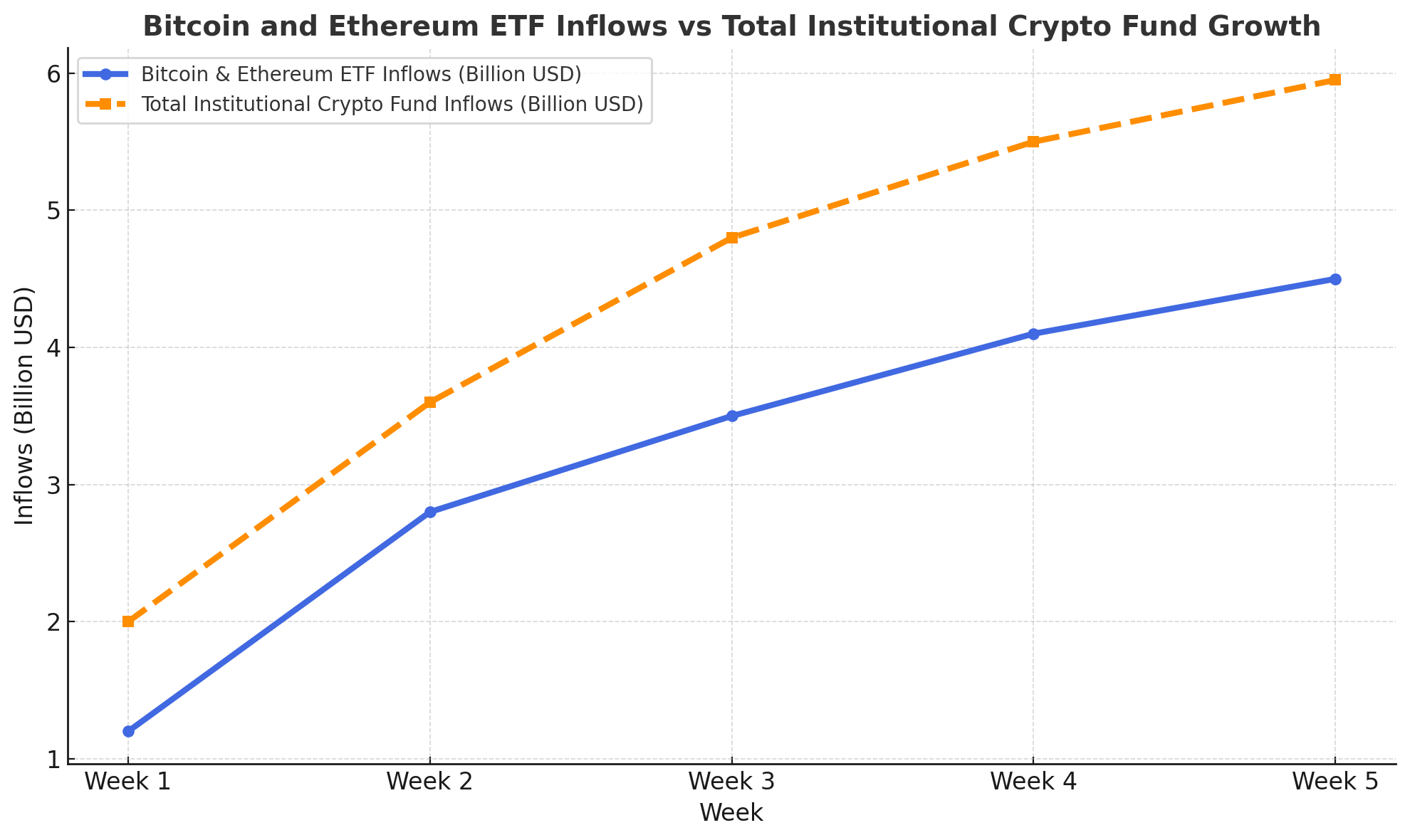

Bitcoin and Ethereum ETFs just logged their strongest week on record, pulling in a staggering $4.5 billion in fresh capital. The milestone has reignited optimism across the digital-asset landscape, suggesting that institutional demand for crypto exposure is accelerating once again.

According to fund flow data, Bitcoin ETFs captured roughly $3.24 billion, while Ethereum ETFs added about $1.3 billion, marking one of the largest collective surges since these products debuted. The renewed inflows have arrived alongside improving macro conditions, cooling inflation, and growing conviction that crypto assets are regaining legitimacy in diversified portfolios.

Institutions Re-Enter the Arena

For much of the year, large investors were cautious, some even trimmed exposure amid market volatility and regulatory uncertainty. That stance has clearly changed. This latest capital surge into Bitcoin and Ethereum ETFs represents what analysts call a “vote of confidence” in crypto as a maturing asset class.

One portfolio strategist posted on X that “we’re watching a rotation from cash into digital ETFs, the move is tactical, but it’s also structural.”

The data support that claim. Bitcoin’s dominance remains solid, but Ethereum’s inflow strength shows growing appreciation for its staking-based yield and broader DeFi ecosystem. Many funds are now treating ETH as a complement, not a competitor, to Bitcoin within their crypto baskets.

Macro Winds Fuel the Flow

The timing of these inflows is not random. Investors are adjusting to a new economic reality, interest rates that are likely to fall, a softer U.S. dollar, and fading returns in traditional bonds. Against that backdrop, the risk-reward profile of Bitcoin and Ethereum ETFs has turned appealing once again.

Bitcoin recently pierced $125,000, while Ethereum traded near $3,900, both buoyed by optimism surrounding regulatory clarity and mainstream adoption. The move echoes early 2021, when institutional buyers drove sustained rallies in both assets.

However, this time is different: instead of direct purchases or unregulated funds, the capital is arriving through fully compliant, exchange-traded products. That evolution underscores how far the crypto industry has come in aligning with traditional finance.

Ethereum ETFs Find Their Moment

For Ethereum, this momentum represents more than price recovery; it’s about utility and yield. Staking now sits at the heart of its appeal. Roughly 30 % of the total ETH supply is staked, and with annualized yields hovering around 3 %, ETF issuers are exploring ways to channel a portion of that reward into fund performance.

When Bitcoin and Ethereum ETFs both generate returns, one through appreciation and the other through yield, the pair becomes a natural hedge. As one DeFi researcher wrote on X, “Bitcoin gives institutional portfolios digital scarcity; Ethereum adds digital productivity.”

It’s a narrative Wall Street understands well: growth plus income. That dual character could make ETH-based products the quiet outperformers of 2025.

Ripple Effects on Market Structure

Beyond the inflows themselves, this trend is reshaping the crypto market structure. Data shows a parallel spike in on-chain withdrawals, meaning large holders are moving coins off exchanges for long-term custody. Historically, such moves align with accumulation phases and reduced selling pressure.

Liquidity conditions also improved, with tighter spreads across major exchanges and a rise in institutional order flow. If Bitcoin and Ethereum ETFs continue attracting billions, they could absorb a significant portion of daily spot liquidity, effectively making ETF pricing a new benchmark for the broader crypto market.

Conclusion

The $4.5 billion weekly inflow into Bitcoin and Ethereum ETFs is more than a headline figure, it’s a signal that the institutional thaw has ended. Big money isn’t just dipping toes; it’s diving back into regulated crypto exposure with conviction.

With macro sentiment shifting, staking yields rising, and ETFs delivering accessibility without custody headaches, the bridge between traditional finance and digital assets is now firmly built. If this trajectory holds, the next chapter for crypto could be defined not by retail hype, but by institutional strategy.

Frequently Asked Questions

1. Why did Bitcoin and Ethereum ETFs see record inflows?

Institutional investors returned to crypto as inflation cooled, rates eased, and ETF structures offered regulated exposure.

2. How much money entered these ETFs in total?

Combined inflows reached about $4.5 billion, $3.24 billion into Bitcoin ETFs and $1.3 billion into Ethereum ETFs.

3. What makes Ethereum ETFs unique compared to Bitcoin ETFs?

Ethereum ETFs can tap into staking yields, offering potential passive income alongside price performance.

4. Could this inflow trend continue?

If macro conditions stay favorable and regulation remains steady, analysts expect sustained ETF inflows through Q4 2025.

Glossary of Key Terms

ETF (Exchange-Traded Fund): A publicly traded investment fund tracking the value of assets like Bitcoin or Ethereum.

Staking: Locking crypto to help validate network transactions and earn rewards.

Institutional Inflows: Large-scale investments from hedge funds, asset managers, and corporations.

Liquidity: The ease of buying or selling an asset without major price swings.