This article was first published on Deythere.

- Stablecoin Inflows: Aptos Beats Ethereum and Solana

- Poor Fundamental Flows In The Face Of Higher Liquidity

- Upgrades and Scaling: Speed Is There, but Demand Isn’t High Enough

- Price Formation: Selling Pressure and Sentiment

- Implications for $APT Investors and Network

- Conclusion

- Glossary

- Frequently Asked Questions About Aptos Stablecoin Inflows

- Why does Aptos have so much stablecoin inflows on it’s platform?

- Why is $APT’s price dropping when liquidity is high?

- Is Aptos’s technology that fast?

- What should investors watch to understand Aptos’s future?

- References

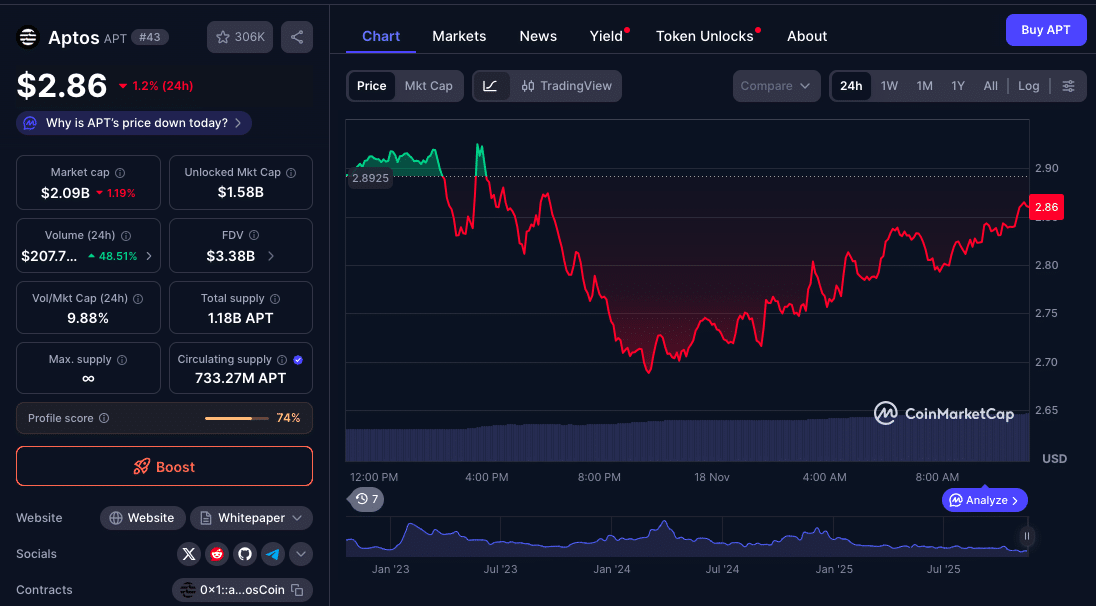

Aptos (APT) is making headlines as its stablecoin supply has skyrocketed, even eclipsing Ethereum’s 24-hour inflows, indicating notable on-chain liquidity. But yet, the price of $APT is falling.

Experts say it is a disparity between an expanding stablecoin supply and weak fundamentals (DEX volume, throughput, sustained demand) that has led to this reality.

Stablecoin Inflows: Aptos Beats Ethereum and Solana

Aptos has experienced a massive stablecoin inflow, surpassing chains like Ethereum and Solana. Just recently, onchain information showed Aptos accumulated $528 million in stablecoins over a single day. It had also been reported, as far back as the end of October, that inflows had touched $545 million in a single 24-hours.

This Aptos stablecoin inflows surge is enough to put Aptos among the more active chains in regard to stablecoin activity, suggesting capital rotation into its ecosystem.

Its growth has enthused hopeful that it could develop into an important liquidity hub; however, this hasn’t been enough to strengthen APT’s price.

Poor Fundamental Flows In The Face Of Higher Liquidity

While stablecoins are flooding in, Aptos’ underlying use metrics aren’t keeping up. According to DeFiLlama, Aptos Total Value Locked (TVL) stands at about $525.7 million.

In the meantime, on-chain volume dynamics are also showing a mixed bag. While Aptos stablecoin inflow has been booming, decentralized exchange (DEX) use isn’t growing an equivalent amount, suggesting perhaps some of those inflows are passive.

That is, with money flowing in but going not necessarily into active trading or productive DeFi use.

Upgrades and Scaling: Speed Is There, but Demand Isn’t High Enough

For Aptos especially, a big strength is in engineering; after the AIP-131 (velociraptür) block time improved to 94 ms, an easy 40% gain. This is supported by Aptos Foundation’s data reporting 870,000 inputs and successful deployments in the last six months.

Under the hood, it now features very-high theoretical throughput of up to 160,000 theoretical transactions per second (TPS). But in the real world (44.91 TPS), it suggests that increased capacity has not yet been used to its potential, and actual demand and usage have not maxed out the available capacity.

This discrepancy of excellent technology and sub-par on-chain economics contributes to why $APT’s price isn’t topping the chart relative to how much liquidity is subsequently being provided.

Price Formation: Selling Pressure and Sentiment

$APT’s price is under pressure. The token has already been hit by over a 10% drop in early November and it has broken HODL support levels around 3$. This is weak buyer demand according to on-chain traders and analysts, despite inflows and on-chain usage.

A portion of the inflows however seem to be coming from stablecoins themselves so liquidity may not currently be turning into long-term APT accumulation, or use.

In short, it may be that capital is simply circulating through Aptos without generating lasting value, a kind of “liquidity illusion.”

Implications for $APT Investors and Network

The divergence of stablecoin inflows and price has some big takeaways for investors:

Liquidity is not equal to Price Support. High Aptos stablecoin inflows don’t necessarily equate to upside price pressure unless that capital is deployed productively.

Though Aptos’s throughput is an incredible weapon, but if the demand for DeFi and DEX activity doesn’t scale up with it, it’s being left on the table.

Developers might find this an attractive window, fast, low-fee chain with heavy capital buy-in but depressed token valuation.

Metrics such as TVL, DEX volume, block times and active addresses will be more indicative of long-term health than inflows alone.

Conclusion

There is no question that Aptos stablecoin inflows are impressive and in certain respects greater than those of giants like Ethereum. But the $APT price is dropping because that liquidity isn’t leading to sustained usage or value capture on the network.

There have been technological upgrades that most definitely speed up the process, but basic operations haven’t kept pace.

For investors, and also developers, the question that remains is whether Aptos network has what it takes to convert its on-chain capital into real value-creating activity or if this recent solid run was just skin deep.

Glossary

Aptos (APT): Layer-1 blockchain with focus on high throughput, low fees, using the Move language.

Inflows of Stablecoins: The quantity of stablecoins (such as USDT, USDC) entering an ecosystem/blockchain over time.

Total Value Locked (TVL): Total value of assets that is locked in DeFi protocols on a blockchain.

Block Time: The average time it takes for the network to generate a new block of transactions.

Throughput (TPS): Transactions per second, number of transactions a blockchain can process.

DEX Volume: Volume traded on decentralized exchanges powered by a blockchain, showing user activity.

Frequently Asked Questions About Aptos Stablecoin Inflows

Why does Aptos have so much stablecoin inflows on it’s platform?

Stablecoin flows are on the rise with a robust on-chain and enterprise’ move of capital into Aptos, cementing it as the network of choice for stable value transfer.

Why is $APT’s price dropping when liquidity is high?

Because much of the inflow may not be converting into long-term usage, liquidity is growing, but DEX usage, TVL, and demand aren’t rising at the same pace.

Is Aptos’s technology that fast?

Yes, after the AIP-131 upgrade, Aptos block time dropped to 94ms and can actually facilitate extremely high theoretical TPS but in practice it is lower.

What should investors watch to understand Aptos’s future?

Key on-chain metrics: Aptos stablecoin inflows, TVL, DEX volume, daily active addresses and transaction throughput.