This article was first published on Deythere.

Small-cap crypto is ending 2025 in a tough spot as a broad benchmark of smaller digital assets has dropped to its lowest level since 2020, undercutting the idea that a market-wide alt season is waiting right around the corner today.

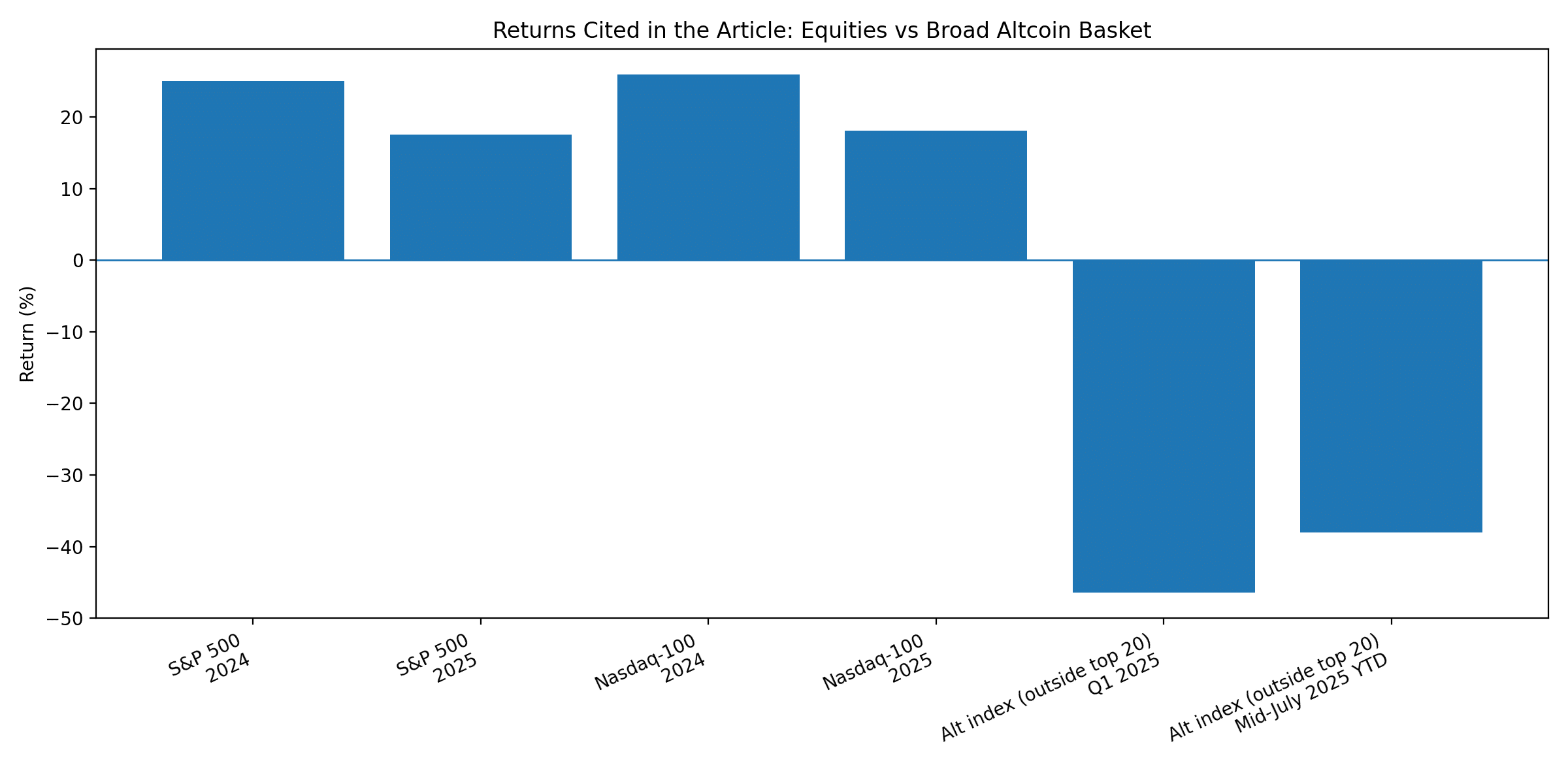

The contrast with traditional risk assets is striking. In 2024, the S&P 500 gained about 25%, then added roughly 17.5% in 2025. The Nasdaq-100 rose about 25.9% in 2024 and around 18.1% in 2025. Over that same stretch, a widely followed basket of altcoins outside the largest names suffered severe losses, including a -46.4% quarter in early 2025 and a decline near -38% by mid-July. It suggests spillover into smaller tokens has been weak, and the usual alt season sequence has been unreliable.

Alt season: Why the Old Playbook Is Stalling

Past cycles often showed a clear wave: Bitcoin first, then large altcoins, then mid caps, then smaller names. That rotation needs improving liquidity. In 2025, liquidity has been selective and it has clustered at the top.

Trading activity has gravitated toward a short list of large altcoins with deep order books. That leaves many smaller tokens with wider spreads and less consistent price discovery. Even when the broader market looks active, the action can be concentrated. One data snapshot put about 64% of alt trading volume in the top 10 alts. That is not a recipe for a broad alt season. It is a recipe for a narrow rally.

Another warning sign is correlation. One comparison showed correlation near 0.9 between a large-cap crypto index and a broader alt index, yet the broader group still lagged badly. High correlation with poor returns often means traders are buying beta, but avoiding the lowest liquidity names when it matters.

The Indicators Professionals Track

Market breadth matters as breadth is the share of tokens participating in a move. A healthy alt season usually features more tokens setting higher highs and holding them, not just brief spikes followed by drift.

Relative strength offers a reality check. Small caps need to outperform majors over weeks, not just jump in a single session. Rising open interest without steady spot volume often points to positioning risk, not organic accumulation.

Stablecoin flows are another practical signal. Net inflows suggest new buying power. Flat or falling inflows can turn rallies into pullbacks. Bitcoin dominance remains a simple proxy for preference: when dominance stays firm, capital is favoring the largest asset, and any alt season tends to compress into a few leaders.

What This Means for 2026

The long tail is not doomed, but it is not getting a free ride either. Supply dynamics, unlock schedules, and fragmented liquidity can keep pressure on smaller tokens even when headlines sound optimistic. For the next alt season to feel real, the market likely needs stronger breadth, steadier spot demand beyond the top names, and healthier liquidity in mid and small caps.

Conclusion

A 4-year low in small-cap benchmarks is a reminder that narratives are not catalysts. Until breadth improves and spot demand widens, the market is likely to treat alt season as a test, not a promise.

Frequently Asked Questions

Does a 4-year low rule out an alt season? No. It signals that conditions are not yet supportive for broad participation.

What confirms an alt season? Rising breadth, improving small-cap relative strength, and spot volume that expands beyond the top names.

Is correlation enough to assume a rebound? No. A 0.9 correlation can still mask large performance gaps.

Is this investment advice? This analysis is not investment advice and is for informational purposes only.

Glossary of Key Terms

Breadth: How widely a move is shared across tokens.

Bitcoin dominance: Bitcoin share of total crypto market value.

Funding rate: A periodic fee that reflects leverage and positioning in perpetual futures.

Open interest: The value of active derivatives contracts, used to track leverage risk.

Reference

For advertising inquiries, please email . [email protected] or Telegram