This article was first published on Deythere.

UK crypto ETPs continue to capture interest as retail investors step into regulated digital asset markets for the first time. The shift arrives at a moment when confidence, clarity, and structured access matter more than hype. The story signals a steady change in how financial markets treat blockchain-based assets.

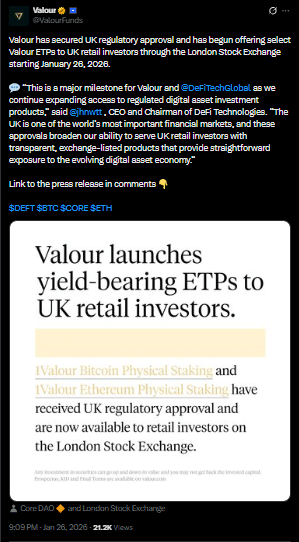

According to the source, Valour received approval from the Financial Conduct Authority to launch its Bitcoin and Ethereum physical staking ETPs for retail buyers on the London Stock Exchange. The approval marks a long-awaited opening for everyday investors who previously faced strict limits on exposure to digital assets.

A Regulatory Shift that Repositions UK Crypto ETPs

The UK lifted its retail ban on crypto ETPs in October 2025, allowing products backed by actual Bitcoin and Ethereum to enter public trading channels. The updated rules require full physical backing, cold-storage custody, and transparent risk labeling. UK crypto ETPs now operate under conditions designed to protect inexperienced buyers while still offering access to top digital assets.

Valour moved quickly by preparing staking ETPs that add blockchain rewards directly into the asset value. This design gives investors a chance to earn staking yield without having to manage technical steps. A market update shared through an economic research platform highlights how regulated access can attract users who avoided crypto due to security and custody concerns.

Valour Positions Itself as a Front-Runner in a Competitive Field

Valour has become a central name in the ongoing expansion of digital asset products across Europe. Its Bitcoin and Ethereum staking ETPs began trading on January 26, 2026. The products rely on physically held coins, a structure many analysts see as safer during market uncertainty.

The company also introduced a Solana-based product in Brazil, signaling its interest in expanding beyond the UK. A recent trend report from a global digital asset tracker noted that crypto ETPs saw more than $1 billion in outflows following weaker expectations for interest rate cuts.

Even so, major firms continued adding digital asset offerings. This balance of caution and long-term optimism reflects the mixed mood shaping UK crypto ETPs today.

Why UK Crypto ETPs Arrive at an Important Economic Moment

Retail access comes at a time when many investors want regulated exposure without the hurdles of crypto wallets or private keys. UK crypto ETPs allow users to participate through familiar brokerage accounts while relying on regulated custodians.

These products, however, are not covered under the Financial Services Compensation Scheme, which places responsibility on buyers to understand market and issuer risks. The UK has moved toward deeper regulation across the sector.

Ripple recently received approval to operate as an Electronic Money Institution, a move that strengthens oversight of blockchain payments. Studies from financial policy groups suggest a comprehensive regulatory blueprint for digital assets may be finalized by 2027, shaping how companies like Valour build future products.

Conclusion

Valour’s approval, and the release of UK crypto ETPs for private investors are not just the launch of a new kind of product. They represent a change in how mainstream finance come to assimilate digital assets.

As the UK forms the long physique of its commonplace regulatory network, these first steps may affect the way in which millions come to use blockchain-based markets in later years. The gate is open and the path is now up to the future landscape of regulated crypto investing alone to take.

Glossary of Key Terms

Crypto ETP: A market-traded product offering exposure to digital assets.

Staking Yield: A reward gained by supporting blockchain validation.

Cold Storage: Offline safeguarding of crypto for stronger security.

Custodian: A regulated entity responsible for holding assets.

FAQs About UK Crypto ETPs

Are UK crypto ETPs safe for new investors?

They follow strict rules but still carry market and issuer risks.

Why is FCA approval critical?

It ensures that the products meet security and transparency standards.

Do staking ETPs pay rewards?

Yes, staking yields are added to the asset value.

Can more crypto assets be added later?

Yes, once the UK finalizes wider regulatory rules.